INTRODUCTION

Economies around the world are

witnessing changes in the energy

landscape with the advent of new

technologies, rising customer

expectations and changing

regulatory regimes. Advanced

technologies such as smart meters,

smart grids, sensing devices along

with communication networks and

data management systems have

significantly impacted the

management and operation of

the energy sector.

Smart technologies are making

the energy system more flexible,

reliable, environmentally

sustainable and affordable. These

digital trends are supporting

greater control, real-time

optimization of consumption,

production and interaction with

customers. Moreover, smart technologies are making the

system more efficient by creating

new services for customers.

The convergence of the latest

technology systems with legacy

systems has also led to the

emergence of new cross-sectoral

partnerships to deliver the

necessary infrastructure and

develop innovative business

models. However, an efficient

transition into the new technology

system requires active processes to

create policy, establish operational

and planning practices and

facilitate and manage requisite

changes. Some areas that require

special focus are: data security and

privacy, modern infrastructure for

enabling the new electricity system

and a dynamic workforce that can

handle technology and deliver a

new set of services.

This report looks at the current

scenario of the changing energy

landscape with the emergence of

one such technology – the

deployment of smart meters

in the utility industry. Smart

meters hold immense potential,

providing benefits across the value

chain – from network optimization

to improving retail operations and

enhancing customer support

services. This paper assesses the

case of the U.K. which has

committed to the deployment of

smart meters in households by

2020. Further, the report focuses

on how the future of utilities will

change with the use of data

generated from smart meters,

making businesses more efficient

and effective.

SMART METERING: CHANGING

TRENDS

Smart metering is a business

initiative to make the utility

industry smarter through intelligent

accounting of electricity

consumption. Smart meters have

the potential to benefit customers

by giving them the control of energy usage and reducing their

electricity bills through efficient

monitoring and improved usage

information. On the other hand,

suppliers are able to monitor and

balance supply and reduce

outages. It provides them with real-time data and helps them in

setting dynamic pricing and

providing better customer service.

Some of the benefits of smart

meters are listed in Exhibit 1.

The widespread application of smart meters is likely to make utilities data-driven, and improve the quality of the grid and further expand the potential use cases of data in the coming years. It will also help utilities create new types of services driven by data, analytics and digital technologies.

UK: TOWARDS BECOMING A SMART METER ECONOMY

As per the estimates by Ofgem1 (2017), domestic and non-domestic consumers spend around GBP 50 Billion on gas and electricity each year in the U.K. Over the span of 10 years starting 2006, the average annual energy consumption has fallen by about 20 percent, but the retail prices have increased by 46 percent for gas and 28 percent for electricity. These energy statistics reflect the changes that are being introduced through new regulations, technology and business models.

One such recent measure

introduced by the government has

been the implementation of smart

metering infrastructure from 2016

onwards. The government has

committed to offer 50 million

smart meters to all homes and

small businesses in the country

by the end of 2020. During this

period, approximately 30 million

domestic properties and smaller

non-domestic sites in the U.K.

are expected to get smart gas

and electricity meters.

The Implementation of Smart Meter Program has Taken Place in Two Stages:

As per the classification by the

Department for Business, Energy

and Industrial Strategy (BEIS), the

U.K. has (as of Q3 2018) 14 large

energy suppliers who have at least

250,000 domestic customers in

any fuel, and 63 small energy

suppliers supplying to less than

250,000 customers by the end of 2017. The energy suppliers are

responsible for planning and

installation of smart meters for

their customers as per their

suitability, and are required by law

to roll out smart meters across

households and small businesses

by 2020.

Expected Savings from

Smart Meters

As per the government published

'Impact Assessment' or

'Cost-Benefit Analysis' of the

program in 2016, by 2030,

the smart meter rollout would

deliver a net benefit of GBP

5.75 Billion, based on costs of

GBP 10.98 Billion, and a gross

benefit of GBP 16.73 Billion.

Total Benefits: GBP 16.73 Billion

Total Costs: GBP 10.98 Billion

-

Meters – GBP 2,809 Million

-

In-Home Displays – GBP 551 Million

-

Installation – GBP 2,077 Million

-

Communication hubs - GBP 1,082 Million

-

Data and Communications Company services – GBP 2,044 Million

-

Supplier costs - GBP 1,001 Million

-

Other costs - GBP 1,418 Million

Implementation of Smart Meters: Current Status

According to the smart meter

quarterly report released by the

BEIS to end September 2018,

around 14.70 million smart and

advanced meters were installed

across the U.K. by large and small energy suppliers. Of this, 13.64

million (92 percent) were installed in

domestic properties and just over

one million in smaller non-domestic

sites. At present, 12.8 million smart

and advanced meters are operational. Around 11.67 million (91

percent) are operating in domestic

properties and a further one million

in smaller non-domestic sites.

Changing Scenario of Utilities

Until recently, the U.K. had only six

large suppliers of gas and electricity

– Centrica, EDF Energy, E.ON UK,

RWE NPower, SSE, and

ScottishPower. Each of them

generates electricity and retails both

electricity and gas. Centrica is also

involved in gas production. They

collectively supply most of U.K.'s

electricity and gas with a market

share of 78 percent and 77 percent

(2018) respectively.

Apart from the introduction of the

smart meter program, there have

been many other transformations that have changed the face of

energy system and networks in the

U.K. Ofgem focused on opening the

market to new suppliers. These big

suppliers faced stiff competition

from new players in the market.

Around 60 active energy retailers

cut into their share with more

customer offerings, and increased

switching and engagement

opportunities. Intensified

competition has led to increase in

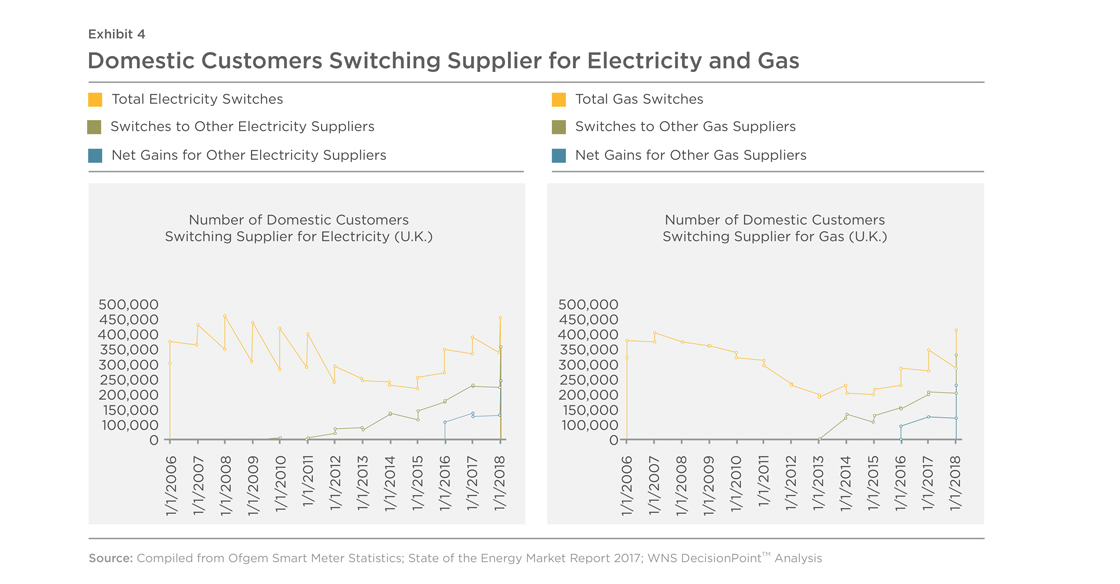

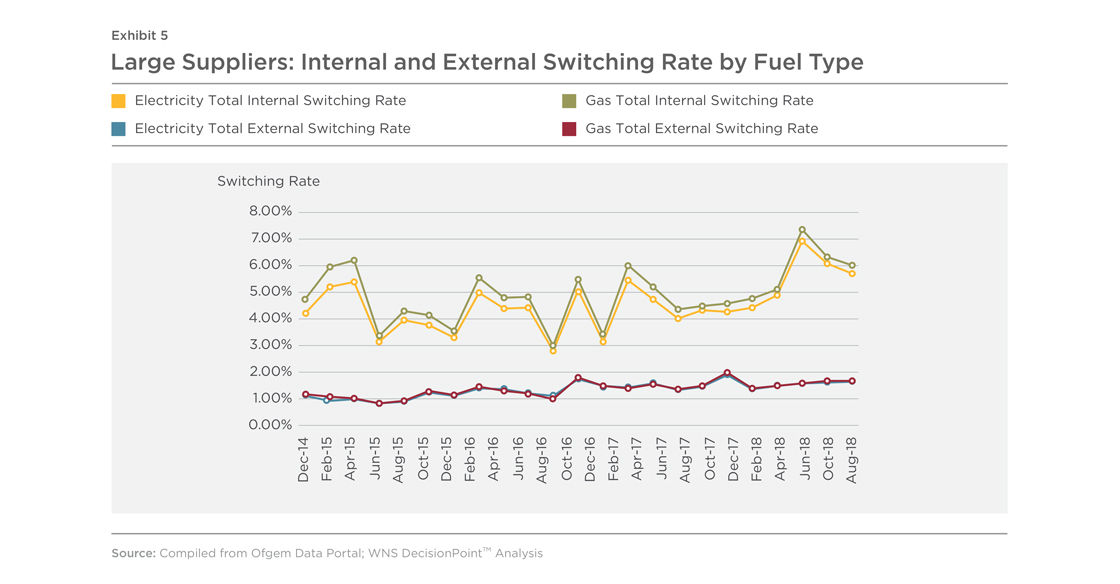

switching rate (Exibit 4). However,

the internal switching rates (i.e.

customer changing tariff, payment

method or account management with existing supplier) among the

six large suppliers have been

consistently higher than external

switching rates.

The supplier performance on

customer satisfaction in 2018

shows that, on average, customers

are getting better experience

from their suppliers than in 2016. As per the Ofgem survey2, overall

satisfaction with complaint handling

for domestic and small business

has improved significantly, from

27 percent in 2016 to 32 percent

in 2018.

In the coming years, all the major

players are likely to face increasing

competition with more innovative

tariffs and service offerings as the

smart meter program aims to

increase competition through an

engaged and better informed

consumer. However, despite

increasing competition, these

major players still capture a large

market share, and are

spearheading the smart meter

installation through early adoption

of technologies to enhance their

energy management services.

In addition, the entry of many

new players has led to problems

related to unsustainable business

models. Ofgem is working

towards developing more robust

models to ensure the quality of

customer services with reliable and

minimum standards.

As per the estimates in the 2016

report of the BEIS, supplier costs

savings will account for 49 percent

of the smart meter program's

entire GBP 16.7 Billion gross benefit figure.3 Benefits will also be

achieved in terms of energy savings (32 percent of total

benefits), carbon savings and air

quality benefits (8 percent), peak

load shifting (6 percent), and

network-related benefits

(5 percent). To comply with the

smart meter timelines, suppliers

have set individual annual targets

for installation of smart meters.

Monitored by Ofgem, if suppliers

fail to meet their roll-out targets,

they are held accountable for not

being able to meet the stated

targets and are charged fines of up

to 10 percent of their turnover for

non-compliance. A key challenge

for suppliers is securing installation

appointments with customers. For

this, new schemes, incentives and

other engagement approaches

have been proposed by suppliers.

Despite smart meters providing

benefits to the consumer and the

industry, the deployment of nearly

36 million smart meters by the end

of 2020 presents a challenge to

suppliers and is unlikely to be met.

Apart from the installation

deadlines, a few inadequacies have

been reported related to the functionality of smart meters after

the first set was installed. Some of

the meters are reported to be

operating in 'dumb' mode. In other

words, they stop communicating

with the supplier. In some areas,

due to poor mobile connectivity,

nearly 10 percent of smart meters

are not working. The National Audit

Office have also estimated that

70% of SMETS 1 “go dumb” due to

switching. Due to these reasons,

energy suppliers have proposed

installation of smart meters in

around 70 to 75 percent homes

and small businesses by 2020, accepted by Ofgem4. While smart

meters are an upgrade for the

energy ecosystem, consumers need

to be made aware about the

benefits of smart meter roll-out

and made part of the transition.

Overall, policies, customer behavior

and technology are moving the

economy towards a smarter

change. The benefits enabled by

smart meters are likely to be

realized in the long run, with data

playing a key role in every aspect

of decision-making for utilities and

consumers.

PATH TOWARDS SMART FUTURE: BEYOND SMART METERS

The benefits of smart meters may

be realized in a phased manner and

may take some time to cover the

initial costs of installation and

infrastructure. Various studies have

shown that benefits to consumers

through reduction in energy

consumption and better

information on cost is driving

behavioral change and shift in

demand from peak time to off peak

time. The Department of BEIS

estimates that smart meters are

also expected to reduce the

demand on call centers for billing

issues, notching a savings of GBP 2.20 per meter per year and

another GBP 2.2 per year from

better debt management.

Managing and detecting theft will

also be easier for suppliers,

reducing it nearly by 10 percent

and resulting in benefits of GBP

0.29 per meter per annum for

electricity and GBP 0.36 per meter

per annum for gas. Apart from the

immediate benefits of smart

meters, the future of home energy

management will experience

changes with significant

opportunities related to

automation through analytics.

While utilities are currently

focusing on the effective

installation of smart meters, the

next phase for smart utilities is the

management of influx of data and

utilizing it to generate and

maximize benefits from these

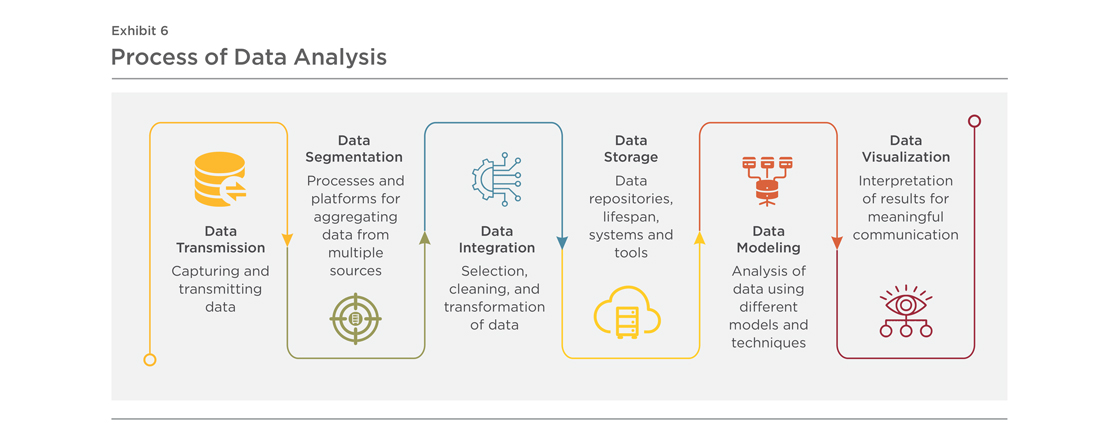

technologies. Data management

involves data capturing,

transferring, structuring, storing,

analyzing and visualizing

(Exhibit 6). To smoothen the

transition into new technologies,

utilities are acquiring players in the

analytics domain and gaining early

benefits from these technologies.

One of the key elements in the rollout

of smart meters is the

development of a centralized smart

metering communications

infrastructure. The metering

infrastructure will ensure that

suppliers, network operators and

consumers receive the necessary

information. In the U.K., this service

is being provided by the Data and

Communications Company (DCC),

a subsidiary of Capita PLC. The

DCC is required to develop a

national smart grid, maintain and

provide smart meter data to

network operators to support the

digitalization of the energy market.

The government and Ofgem are

also launching an Energy Data

Taskforce to use data more efficiently and propose

recommendations to the

stakeholders.

Data will be a critical asset for

businesses. Data-driven insights

will not only improve business

performance but also help

introduce new business models.

Data utilization involves mapping

business needs and requirements

against the various analytical

techniques and tools which will

provide the required output. In

order to realize operational,

financial, customer and strategic

benefits, utilities will have to

institutionalize analytics in business

processes, frameworks and

functions. It is also important to understand the inter-relationships

between business processes. For

instance, customer data could be

used for ramping up billing services

and payment plans, as well as for

improving customer interaction at

each touchpoint. Both require

different data and analysis based

on need – like text analytics for

customer satisfaction and

predictive analytics for payment

collection.

The process of integrating data

analysis with business objectives

comes with the challenge of setting

up methods for data storage,

understanding data complexity and

ensuring data security and privacy.

Once the data processes are

identified and placed in the utility

chain system, businesses will

realize their value / potential and

ease in the decision-making

process. Combining various

analytical techniques will make the

system more intelligent and

efficient. Some energy suppliers

are already using analytics to

analyze consumer data to offer

better services. The big suppliers are at the forefront of adopting

such techniques and are

increasingly using data to forecast

demand and also improve

customer services.

Data-intensive technologies are

going to present opportunities

to uncover new customer patterns,

forecast demand better, prevent

fraud and loss, enhance services

and improve compliance.

The increasing focus on using

data efficiently with smart meter

analytics is going to be the

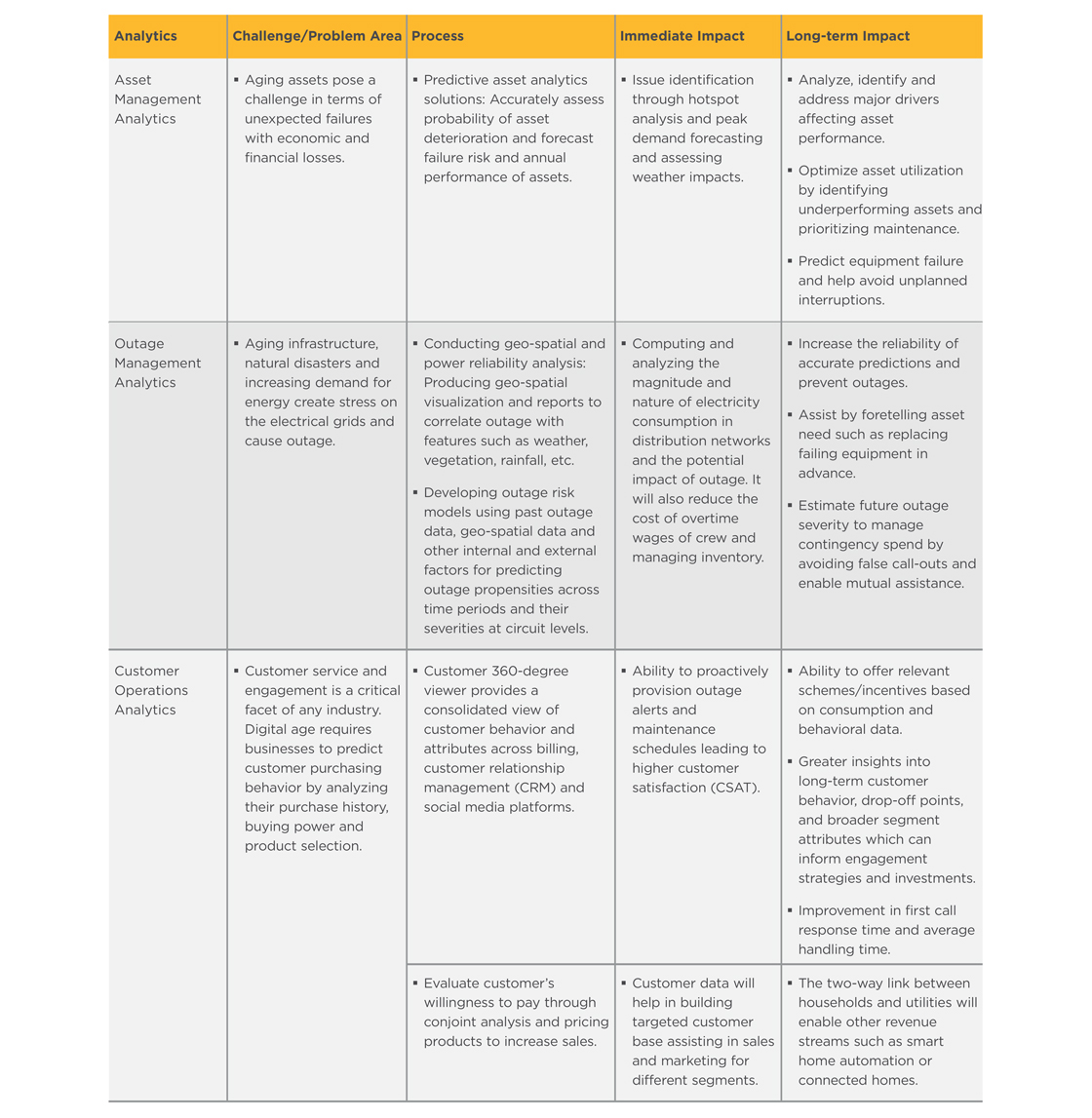

potential area to explore. Some

of the potential areas of analytics

are customer analytics, grid

analytics, device analytics, work

and asset analytics and advanced

metering infrastructure analytics,

a few of which are discussed in the

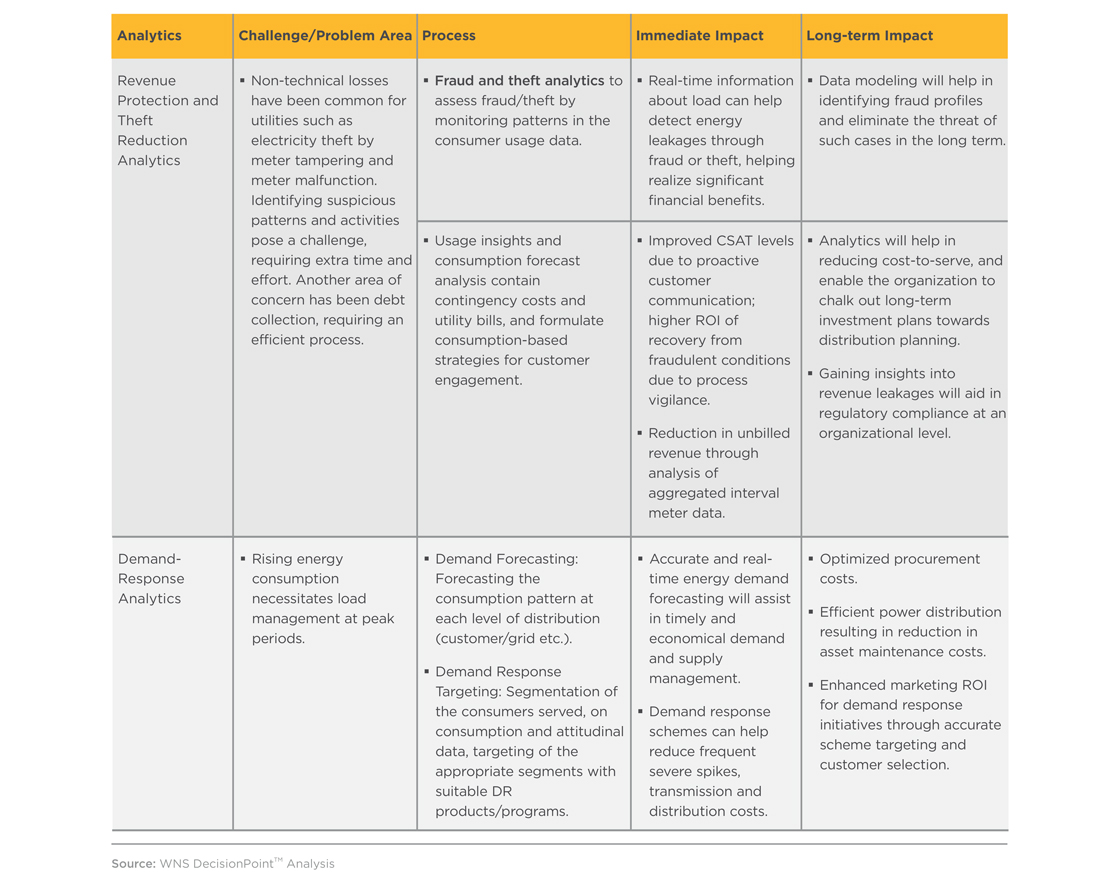

table below.

ANALYTICS IN SMART UTILITIES

The data-driven era will require

businesses to adapt to new skills

and technologies. This will enhance

business performance leading to

greater efficiency and increased

productivity. The utility industry is evolving and competing in an

environment of changing

government regulations, increased

competition and evolving

consumer demand. Smart utilities

will have to establish mature business processes and analytics.

Aligning their organizational goals

and priorities with the changing

data landscape will help forge a

way for a smart transformation.