The digital disruption has brought about a major transformation in the way customers communicate with organizations. Even if the company and its contact center are closed for the day, customers would still like to access the company through social media, mobile applications, web sites, and other digital channels. Companies acknowledge that they can no longer predict how and when their customers may reach them for customer service. In addition, there is a shift in the mode of communication from one-to-one conversations2 to many-to-many3 public interactions. Customers' inclination towards do-it-yourself channel options is also gaining traction. Consequently, the multichannel approach is being adopted by various companies across industries including the ones in the utility sector. Multichannel customer service aims at providing customers with different alternatives to connect with their utilities through an integrated network of channels. It includes traditional channels, such as phone, fax and direct mails; digital channels such as website, mobile applications and social media; and the always-on and always-available self service channels like frequently asked questions (FAQs), forums and interactive tools. Multichannel also includes the emerging digital technologies such as video and virtual assistants.

Customers are increasingly demanding more channel choices and this has a direct impact on their satisfaction with the utility service provider. As per the survey by the International Customer Management Institute (ICMI), a sizable number of companies accepted that emerging channels4 have a great impact on customer service experience and customer engagement, as shown in Exhibit 1 below. Nearly 40% of companies stated that emerging channels have a positive impact on quicker response time, and over 30% witnessed a significant increase in customer satisfaction (CSAT), first-contact-resolution (FCR), and customer loyaltyi.

Companies who have proactively deployed a multichannel (especially digital channel) strategy are realizing many benefits from this approach. Multichannel customer experience can potentially lead to lower customer complaints and operating costs and higher acquisition of new customers5.

As per the survey by the Institute of Customer Service, in the UK utility sector, customers who used a lesser number of channels (one or two) to interact with their utility providers were more satisfied as compared to customers who used three or more channelsii. Despite the availability of multiple channels, customers suffer from channel inertia due to which they do not have the necessary motivation for switching the medium of communication.

Lower satisfaction among customers in a multichannel engagement model was mainly driven by two factors

Most companies performed well in terms of increased FCR and lower average time to resolve an issue over voice channels, but strive to provide a similar level of services over digital channels, resulting in an inconsistent customer experience. Many companies are still unable to appropriately leverage digital channels to realize their business goals. As per the survey on customer experience across multiple communication channels, 40% of companies reported that digital channels were unable to meet their current business needsiii.

Moreover, customers increasingly prefer to be communicated with through their channel of choice and are willing to switch to competitors in the absence of such customer service options. The survey by ICMI highlighted the fact that, despite receiving good customer service, over 60% of consumers were still dissatisfied or somewhat satisfied as they were not offered their preferred channel of choice (Exhibit 3A). Over 93% of the customers said they would be more satisfied if they are offered their channel of choice and around half of them were willing to move to competitorsiv. (Exhibits 3B and 3C).

The inability of utilities to appropriately understand their customers' channel preferences also holds them back from realizing the benefits of a multichannel approach. There is a wide gap between customers' channel preferences and the channels leveraged by utilities to interact with them. To assess this disconnect, WNS DecisionPoint™ conducted a survey of over 60 energy utilities across the US, the UK and Australia and their customers. The extent of consonance and disparity between customers' preferred vs. available channel options is examined through a correlation derivation. A gap analysis by region (Exhibit 4) highlights a wide disparity indicating the inability of utilities to understand their customers' favored channels of interaction. In order to improve engagement with their customers, utilities must gain a more thorough understanding of customer segments, expectations and behaviors. With that data, they can embrace personalized communications and effective engagement strategies on the channels they prefer.

Further, the survey observed that, although utilities are focusing on multichannel customer service, they lack an understanding of the specific inherent capabilities of each channel. WNS DecisionPoint™ has categorized various types of customer interactions into four broad functions and examined which channel(s) customers prefer for each kind of interaction.

The survey exhibited customers' strong preference to interact through phone or email for non- recurring communication, such as to receive information about a new tariff or other services. On the other hand, website self service portal was the channel of choice for recurring communication such as to send meter readings and to know about billing and other details. This trend was stronger in the U.S and in the UK, while in Australia, customers prefer mobile self service channel for recurring communication (Exhibit 5).

WNS DecisionPoint™ further measured the level of association based on the correlation between the channel preference of customers and the channels offered by utilities for the above mentioned four functions. Depending on the correlation scores, the utilities are classified into four groups;

It has been observed that utilities which understand their customers' requirements and interact with them through their channels of choice have reported improved efficiency in support operations, increased customer satisfaction, and a renewed sense of customer engagement and loyalty to the brand. Analyses of financial performance of utilities in the above categories revealed that Optimizers significantly outperformed their peer group in most of the areas. Examining the trends in customer base and revenues in the last three years highlighted the poor performance in case of Resistors, who witnessed an average negative growth in revenue and a negligible growth in customers. Executors reported better growth in both the parameters compared to Explorers.

Currently, when utility sector is witnessing lower earnings and declining customer satisfaction scores (CSAT) scores, Optimizers not only overtook their peers in terms of EBITDA (Earnings before interest, tax, and depreciation) growth but are also gaining customers' confidence as witnessed by their CSAT scores that far exceed the industry average (Exhibit 7).

How Are Optimizers Leading The Omnichannel Race?

Optimizers differentiate themselves from other utility players through their ability to understand customer needs, offer services through their customers' preferred channels, and provide seamless customer experience.

Optimizers Invest In Tools And Techniques To Predict Customers' Current And Future Needs

The accelerated progress in customer experience in other sectors such as banking, retail and telecom are forcing utilities to better anticipate customers' requirements and offer more relevant and tailored custom solutions. Consequently, utilities are also investing heavily in customer analytics. U.S. utilities are expected to spend USD 1 billion by 2018 on customer analytics tools and technologiesv. Customer analytics

solutions, notably advanced applications benefitting both customers and utilities, are likely to witness significant growth during the period 2017-20.

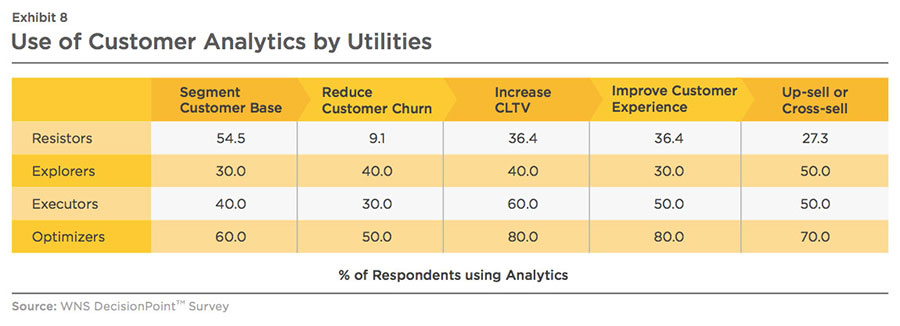

WNS DecisionPoint™ survey observed that most Optimizers demonstrate higher adoption of customer analytics techniques compared to Executors, Explorers or Resistors, as shown in the graph below. Customer analytics

techniques deployed by such utilities mainly have the following intentions:

- Segment customer base

- Reduce customer churn

- Increase customer lifetime value (CLTV)7

- Improve customer experience

- Up-sell or cross-sell

Segment customer base - Many Optimizers and Executors have deployed statistical techniques such as clustering and predictive modelling to generate insights about future behaviors of customers. Based on analytics- driven insights, Optimizers and Executors are able to create better-targeted demand response programs, adjust billing strategies, design marketing campaigns, and determine pricing strategy that maximizes revenue and profitability. They are also using predictive analytics to anticipate and quantify impact of promotional incentives and to optimize their outreach campaigns. By leveraging big data generated by smart meters and other intelligent electronic devices in distribution and transmission grids and communications networks, these utilities are able to perform multi-factor segmentation of their customers based on past behavior, demographics, and energy usage, among others. However, utilities in Resistors category and few Explorers still follow traditional customer segmentation techniques based on customer income levels and strive to have better customer insights to address their current and future needs.

Reduce customer churn - With regulations promoting competition in the market, utilities are witnessing rising customer churn. Intensifying price competition and higher customer acquisition costs compel utilities to rethink their customer retention strategies. The critical component of any retention strategy is identifying

the most profitable customers the company wants to retain as well as the high-risk annual 'switcher' that it should not dedicate valuable resources to preserve. Utilities can leverage analytics to understand the specific needs of individual segments of customers that have the highest profit-improvement potential. Insights on their behavioral patterns will enable utilities to design tailored and cost-effective offerings such as price discounts, credit points for specified units of energy saved, and proactive service arrangements, among others.

The right customer analytics techniques and tools can accurately segment the customer base to highlight significant upsell and cross-sell opportunities, enhance customer experience, reduce customer churn and increase customer lifetime value.

Increase CLTV - 80% of Optimizers have deployed CLTV analytics to optimize their customer acquisition strategies. Utilities leverage Big Data and predictive analytics to target customers with the highest propensities to respond to specific product or service offers. Each customer is assessed based on demographics and other data such as the period of owning a home, age of their home, electrical and gas appliances they use at home, green energy preferences, time period with current energy supplier, and their response rate to similar offers. By mining this data set using predictive analytics, utilities are able to reduce the pool of consumers chosen for outreach which decreases the cost of a campaign and increases the probability of customer acquisition. Utilities that leveraged analytics also experienced 70% reduction in the time required to design new campaigns and generate a target customer list.

Improve customer experience - Most Optimizers have also deployed analytics to continuously improve customer experience. The ability to predict customer behavior and tendencies, and engage with customers more meaningfully, can help utilities personalize their services. For instance, utilities can proactively offer services such as alerts on higher energy usage, communicate new service plans to customers whose service contract nears the term- end or implement targeted marketing by rolling out new products and services to those most likely to enrol.

Up-sell or cross-sell - Optimizers have also implemented advanced predictive analytics to determine the probability to cross-sell/up- sell the right products to the right customers. Micro segmentation with next best product recommendation model enables utilities to precisely target customers with highest cross selling and up selling probability.

Optimizers Routinely Evaluate Customer Channel Preferences And Prioritize The Ones On Which To Focus Efforts And Resources

Apart from understanding customer's needs, Optimizers have also invested in learning the channel preferences of their customers, especially those of

Millennial. It is clear from Exhibit 9 that the older segment of respondents prefers verbal communication as compared to those under 45 who are far more likely to choose the E-mail or web self service communication mode.

Analytics-driven insights have enabled Optimizers to:

- Understand customers' experience journey and their channel preferences as per various interactions and by different customer groups (age, location - urban or rural, education, etc.)

- Identify triggers that influence channel hopping

- Determine which interaction needs drive their channel preference

Being able to deliver the right message at the right time using the right channel set Optimizers apart from competitors. As evident in Exhibit 10 below, Optimizers witness a good positive correlation (>50) for most interactions whereas almost all Resistors demonstrated a negative correlation for most interactions.

Optimizers Provide A Seamless Customer Experience

To understand the maturity of the omnichannel customer experience offered by these utilities, WNS classified utilities' customer engagement approach into three areas:

Multichannel

- Channel choices are offered to customers wherein utility companies use one channel for a single interaction

- The contact center processes in these utilities are disintegrated

- The context and contact history are lost when customers change channels

Multimodal

- Customers use more than one channel in the same interaction (for instance, the customer can update his/her account details on web self service platforms while interacting on the phone with customer service agent)

- Contact center is unable to generate a single and unified view of the customer as only few communication channels are integrated with the customer relationship management (CRM) system

Omnichannel

- Customers are able to use more than one channel over multiple connections, while the contact history and background of the initial inquiry are retained by the contact centers

- The technology, processes and services are integrated and utilities are able to create and leverage an accurate, comprehensive, up-to-date customer view for operational, marketing and analytical purposes

On examining utilities' contact center processes from customers' experience standpoint, it was seen that most Optimizers are offering an omnichannel experience to their customers as compared to peers (Exhibit 11).

A multichannel contact center provides utility service providers with a unique opportunity to gain a deeper-level understanding of their customers by accessing a plethora of external information on their activities and feedback. For example, companies can integrate social media information with their internal systems to enhance their view of customer behavioral data, which helps customer service agents personalize each interaction based on customers' needs and historical activity.

Although Executors lead Explorers and Resistors in terms of better understanding of customer preferences for specific channels, they still lag behind with Optimizers in fully integrating their customer support operations. Most Executors (80%), Explorers (90%),

and Resistors (91%) have very limited or no coordination among various channels resulting in the creation of multiple customer profiles and contact histories.

The customer data generated from various channels is isolated in disparate systems and used by individual processes in a siloed form. The disintegrated systems limit the ability of contact center to share customers' recent and historical data with other agents, thereby requiring customers to reiterate their contact purpose to every agent with every transfer. This slows down the interaction process and leads to an increase in average handle time (AHT) and adds to customers' displeasure. As a result, these utilities lag behind industry in customer satisfaction scores (Exhibit 7).

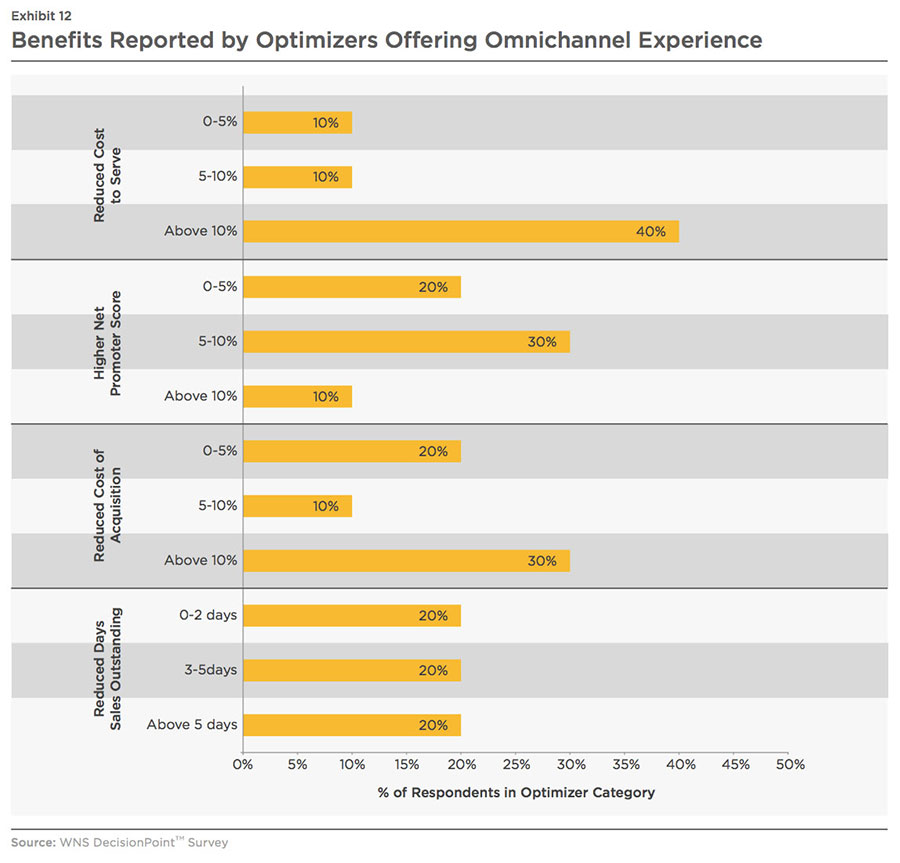

Most Optimizers provide omnichannel experience to their customers. These utilities have a centralized knowledgebase of customer details (such as customer's tariff plan, energy consumption patterns, location, meter readings, and payment details, among others) and are able to gain access to all customer intelligence, generated from any channel, on a single screen/ desktop. This enables them to promptly share customers' data and contact history with other agents when customers switch channels or get transferred to another department. Optimizers offering an omnichannel experience to their customers

also enjoy many other benefits (Exhibit 12).

Although utilities recognize the significance of the omnichannel strategy to boost customer experience, only 24% of utilities were able to deploy this approach, as per the WNS survey. Major challenges holding back Explorers and Resistors from initiating and executing this approach include lack of technology infrastructure to support a single view of the customer and siloed business operations.

Although, all utilities in the Resistor and Explorer categories offer multiple interaction channels, 55% of Resistors and 50% of Explorers still have disintegrated operations.

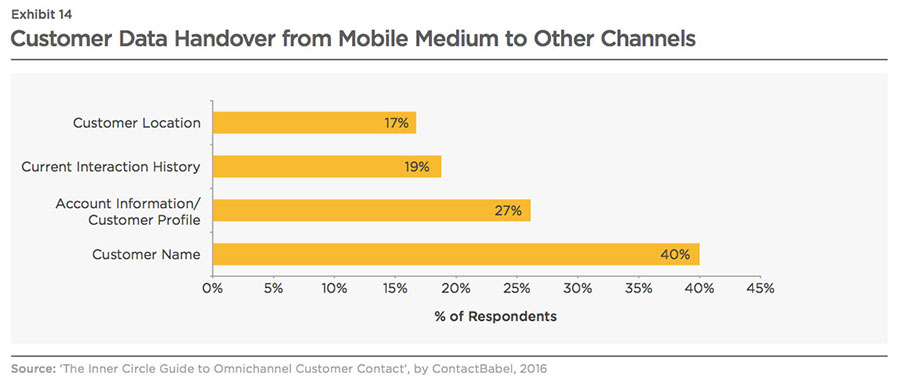

As depicted in the survey (Exhibit 14) by Contact Babel8., fragmented processes pass only standard customer data, most often the customer name, rather than key fields such as the contact history of the customer, his/her account details, or location details vi.

Most Resistors (~80%) and Explorers (~60%) also lack the ability to generate a single view of customers as investing in such technologies to develop a complete picture of customers' needs and opportunities is not considered a priority area. Moreover, lack of resources and capabilities further delay the adoption of such technologies.

While contact center agents of Executors lack the expertise to handle multiple channels, utilities in Optimizers category reported decentralized ownership of multichannel customer contact operations. For instance, functions such as telephone calls, emails, and live chats are documented as contact center services, whereas customer interaction through social media is often considered as a part of marketing, and self service operations is embedded within Information Technology (IT) function. Lack of centralized ownership of multichannel customer contact operations restrains utilities from maintaining consistent service across channels and also delays the transition to an omnichannel model.

Beginning The Shift From Multichannel Or Multi-Modal Customer Engagement To An Omnichannel Environment

Omnichannel customer engagement enables organizations to resolve customers' issues and cater to their needs in one contact regardless of the communication channel used by them. When the initial channel of interaction fails, the utility, through its omnichannel customer service solution, enables

customers to switch to an alternative/next preferred channel seamlessly without requiring them to repeat tasks they have already completed in the initial channel, such as a customer identity verification process. Building an omnichannel environment creates uniformity across all contact points,

and allows customers to benefit from cohesive, familiar experiences when dealing with the utility service provider. Moving from a multichannel to an omnichannel environment requires utility company to consider following key strategies.

Provide Multichannel Options

Allowing customers to select which communication they want to receive, when they receive it, how often they receive it, and through which communication channel

(e.g., text message, email or telephone) is the first step towards a holistic omnichannel customer experience. Consequently, mobile application additions and upgrades are the primary area of focus for most utilities over the next 24 months (Exhibit 15).

Identify Customer Preferences for Channels

Another factor bolstering the drug uptake is increasing Like the Optimizers, other utilities also need to figure out the channel preferences of their customers. They need to understand that leveraging multiple channels (voice, email, SMS messaging, and push notifications) of customer

engagement to communicate is not enough, as customers can have a disjointed experience if the various channels and associated systems do not communicate with each other. Leveraging the range of analytics solutions mentioned

above in Exhibit 8 will enable utility service providers to know the channel preferences of each customer segment and to deliver relevant and personalized content through the most appropriate channel.

Consistently Provide Unified and Integrated Customer-centric Experiences

Customers demand continuity across touch points to complete an interaction and consistency in services across channels. They can promptly figure out if service is better in one channel versus another and this triggers channel switching. Thus, utilities must

deploy integrated tools and processes that support uniform user interfaces across channels and also contribute greatly to ease and efficiency of customer journey. WNS DecisionPoint™ survey highlights that there is an increasing requirement for

multichannel/omnichannel analytics to get a 360 degree view of the customer journey in a single interaction and also to identify and improve any channel that failed to fulfill the interaction requirements.

Further, to ensure a smooth transition towards an omnichannel customer experience, utilities must focus on building essential infrastructure, anticipate vital agent skill set gaps, and ensure close coordination between various departments that directly or indirectly interact with customers.

Develop Infrastructure Support

Saddled with legacy systems and siloed operations, the typical cost of customer operations remains high. To cope with the rapidly moving target of customer expectations, utilities should focus their immediate efforts on:

- Deploying omnichannel tools to engage with customers via the 'best-fit' channel for a particular type of interaction

- TAggregating engagement data by investing in an IT infrastructure that can serve as a central repository for all transactional and interaction data

- Providing a 360 view of customers wherein agents can view the full context of a customer's contact status, account history, and consumption pattern, irrespective of any channel

Anticipate Agents' Skill Sets

With the advent of digital channels, agents are further burdened with the responsibility to handle as many as 17 different contact channelsvii. Utilities should provide their contact center agents with an omnichannel CRM or similar infrastructure to enable them to promptly access product/service information on a single screen/desktop. Utilities are required to evaluate the gap in the skills they currently have within the contact center, what they require to support an omnichannel environment and how they can bridge the knowledge gap. Partnering with professionals that have expertise in omnichannel solutions is one of the ways to overcome the knowledge gap and accelerate the adoption of omnichannel customer experience.

Make Organization Ready for the Change

This not only includes technology to back the transition to an omnichannel support model but also aligning the entire organization towards the same goal. Omnichannel requires integration between various channels and coordination among the ownership and management of the various business processes (invoicing, demand response, bill generation, meter reading, among others) and departments (billing, payment, metering and sales) affected by customer interactions. Thus, to successfully execute omnichannel, utilities are required to have senior executive sponsorship, vested with the authority and responsibility to make changes to any and all appropriate business units.

Moving Forward To Optimize The Omnichannel Experience

Utilities should now look ahead to optimize customer-facing operations and increase accountability, while lowering

cost-to-serve and raising customer identified for each interaction satisfaction. Based on the WNS DecisionPoint™ survey, primary and

secondary channel choices were among different age groups.

Utilities should segment their customers based on multiple sub parameters including age, income level, location, usage pattern and payment history and should then assess the channel preference of

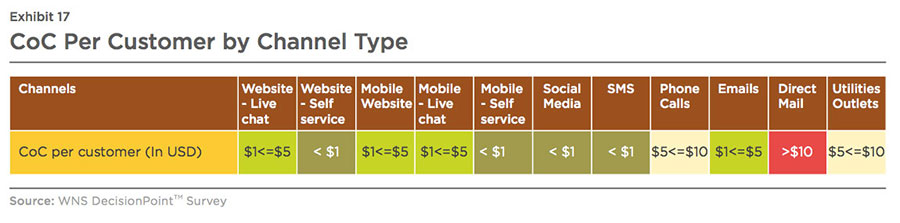

each group for each function and interaction type. However, for illustration purpose, we have segmented customers based on their age group only. Utilities should then measure, understand

and compare the costs associated with each channel. The range of cost of contact per customer (CoC) for each channel is depicted in the table below.

As seen in the above Exhibits (16 and 17), customers below 34 years mostly use low-cost digital channels such as mobile self service and social media as their primary interaction channels for recurring communication such as sending meter readings, obtaining records of past bills and payment history, as well as receiving

promotional offers. Channels such as SMS and web self service platforms are comparatively less preferred modes to interact with utilities for transactional and non- recurring communication. This group also considers email as an important channel of communication for almost all interactions.

Customers in the age group of 35- 44 years prefer low-cost digital channels such as web self service for transaction related and recurring communication and, to some extent, for non-recurring interactions. Customers in this age group also leverage low-cost digital channels such as mobile website and smartphone apps as their next preferred choices of communication to receive updates on outages and promotional offers.

Customers in the age group of 45-54 years prefer a mix of digital and traditional channels for varied types of customer service interactions. Costlier traditional channels are mostly preferred by customers aged 55 years and above for reaching out to the utility service provider including promotional offers which this age

group prefers to receive through direct mails.

Digital technologies can help utilities become more cost competitive by transitioning specific interactions from high-cost channels such as direct mail, phone calls and face-to-face interactions at utility outlets to primary or secondary preferred low cost digital channels. However, utilities need to fully comprehend the drivers for usage of a specific channel(s) for

various interactions. WNS DecisionPoint™ proposes a conceptual framework (Exhibit 19), that provides a theoretical understanding of Channel Determination Criteria (CDC). Each customer interaction is required to be assessed from the customer's perspective and rated as high, medium, or low on basis on three criteria; criticality, complexity, and sensitivity.

Each interaction of various

segments of customer needs to be quantified on a scale of 1 to 5 to generate a 'Channel Shift Probability Score' (CSP score). The CSP will enable utilities to assess

the probability for shifting a particular interaction(s) of specific customer segment(s). This framework will also enable utilities to develop an optimal strategy for a more effective and profitable

management of these interactions. Below is a hypothetical example to illustrate the value gained by a utility from switching a customer to the low-cost channels.

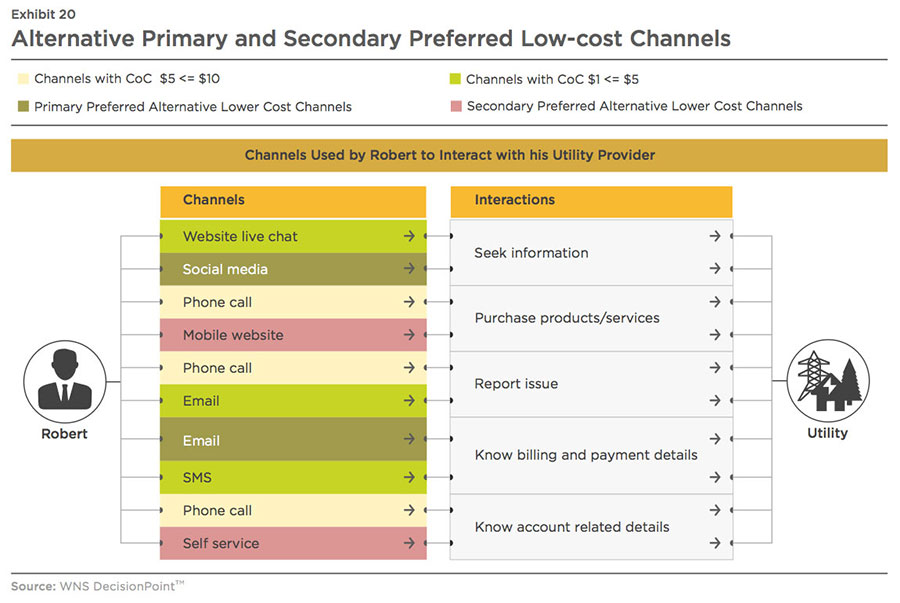

Illustration - Robert, a middle-aged (44-55 years) US resident, interacts with his electricity utility provider through various channels (Exhibit 19).

On analyzing the channel preferences of Robert for each interaction, it was found out that Robert mostly prefers to use low- cost channels to receive promotional offers, and also to complete transactions such as signing up for a new tariff plan. Robert also uses high-cost traditional channels for transacting with his utility provider and for recurring communication such as checking account balances. The utility should compare the channel preferences of Robert with those with similar demographic characteristics. This assessment enables companies to ascertain interactions where CoC can be reduced further. For instance,

in the above illustration, Robert's interactions for seeking information and knowing the details of historical bills and payments can be shifted to channels with CoC below $1. Exhibit 20 highlights the alternative channels of choice (both primary and secondary) by U.S. residents in the age bracket of 45-54 years and also the interactions which can be completed using the most cost effective touch point, thereby improving customer engagement and maximizing channel efficiency.

The next step is to determine the CSP score for each of the above interactions based on channel determination criteria with scores 2 or below 2 for each of three criteria are most amenable to be shifted to cost effective channels. Whereas, scores higher than 2 for each criteria indicate discomfort or reluctance of customers to shift. In the exhibit below, interactions marked in the red boxes are the ones that can be considered for channel shift.