Financing deals in the FinTech industry have grown by leaps and bounds in the last five years, with 2017 registering record growth in Venture Capital (VC)-backed financing deals.

The year 2016 was the only year when VC-backed FinTech didn't witness growth. Primary reason for this was the lack of any notable mergers and acquisitions (M&A) and initial public offering (IPO) exits in the FinTech industry. Most FinTech startups were acquired to get an access to their advanced technology, and not because of their business success, implying that multiples were quite low. IPO exits were even worse only a few traditional payment and financial services companies went public, with no major startup in the list.

Europe witnessed an exponential growth in VC-backed FinTech funding between 2016 and 2017, with funding growing by over 120 percent. On the other hand, Asia witnessed an 11 percent fall in VC-backed FinTech funding from 2016 to 2017, falling for the first time in four years.

Deep Dive into Fintech Sectors: The Key Game Changers

While FinTech, as an industry, has grown exponentially, there are certain segments and sectors within the FinTech space that have dominated the expansion of the industry over the years and will continue to play an imperative role in the future proliferation of the industry. In the following pages, we assess the key FinTech verticals that are pre-eminent to the success of the industry.

E-Wallets

Ever since their inception, mobile wallets have garnered much attention, with questions around the value they deliver to their end-clients and their business results, in addition to their ability to compete with banks and payment systems. It is worth assessing the future direction e-wallets will take, as well as the key players that are shaping the segment.

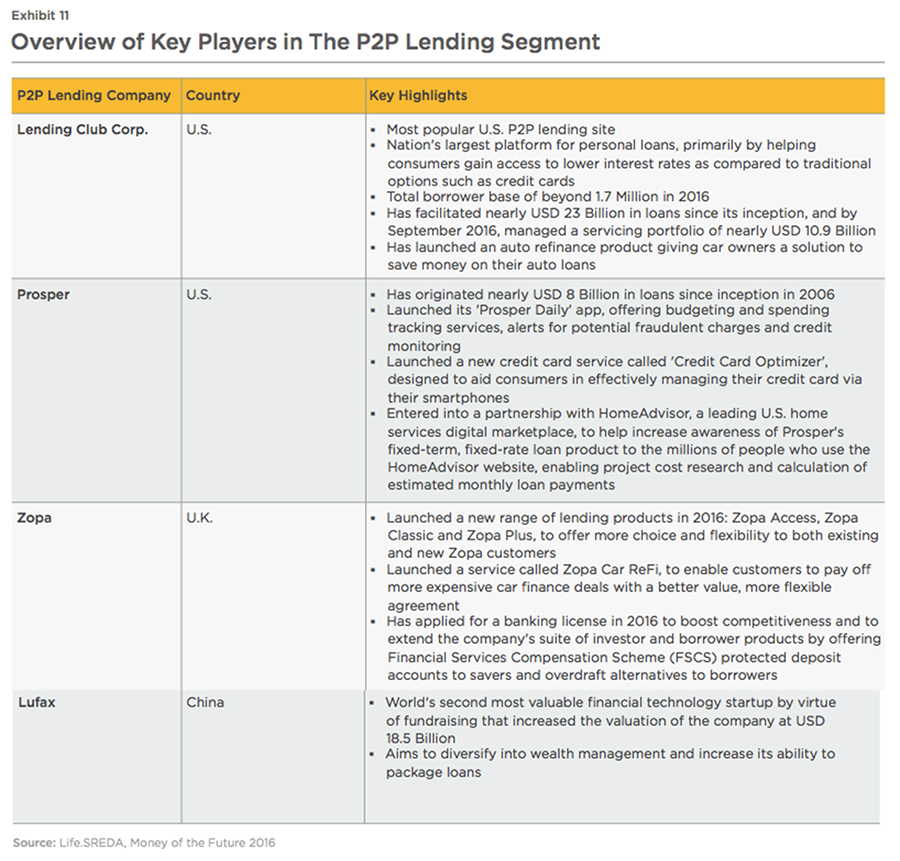

P2P Lending

Investors on alternate lending platforms are increasingly gaining prominence as large institutional investors and banks dominate this arena. Such platforms require a different level of reporting, transparency and business processes from the startups (higher expertise in securitization, rather than in financial innovation)xxii. P2P business models are required to be either very well targeted and differentiated, or be the best in risk management (via big data analytics), or have a unique selling proposition (specific conditions, e.g. regarding collateral, payouts, particular clients) or have the largest funds for loan origination.

P2P lending has firmly established itself in 3 countries U.S., Great Britain and Chinaxxiii. The Chinese market is the biggest because of the large population and lower availability of traditional sources of credit, but is highly uncertain because of a number of issues. Firstly, there are approximately 2,000 P2P lending platforms in China, majority of which are poorly diversified in terms of products and invest too little in risk management, resulting in soaring bad loans. Secondly, the geographic isolation of these models makes them susceptible to overvaluation and corruption. All these projects are Chinese, work exclusively in China and have only Chinese investors. Opening these models to foreign investors will improve transparency and increase reliabilityxxiv.

Crowdfunding

Crowdfunding has emerged as one of the most talked about and popular FinTech models in recent years. The collaboration between crowdfunding platforms and big corporates is gaining momentum. Technology giants can now try new services and technologies in a more interactive manner, thereby expanding their base of innovation-friendly customers. The crowdfunding market has witnessed increasing consolidation over the years due to the abundance of players n the market. Also, many companies are using their own platforms to raise capital.

Many countries also support the growth and acceleration of crowdfunding companies. For example, Singapore, Malaysia, Hong Kong, Korea and Japan offer grants and co-investment programs for their startups. Banco Santander has partnered with Crowdfunder platform in providing startups with 50 percent financing

along with 50 percent from the crowdxxv.

Crowdinvesting

Real Estate crowdinvesting and increasing partnerships with stock exchanges are the key trends

gaining prominence in this segment. Stock exchanges offer crowdinvestors some pre-IPO

settlement and trading in technology stocks, which are very small-cap relative to the main board stocksxxvi.

Challenger Banks

Challenger banks are often seen as rivals to the traditional brick-and- mortar banks. However, this perception is gradually changing. Innovational solutions are built in the mobile-first model, in contrast to a branch-first modelxxvii. These banks also serve the new generation of technology- and mobile-savvy population, and not the existing clients of traditional banks, which fundamentally changes their brand positioning, language and perception. Also, the level of service is entirely different in terms of quality and channels of delivery. With challenger banks, one can ask a question via a messenger or web chat service and get an answer immediately.

Challenger banks are also complementary to various other FinTech verticals. E-wallets suffer from poor functionality (ApplePay, SamsungPay, AndroidPay) and difficulties with customer retention and scalability (AliPay, Paytm). Traditional banks (CapitalOne, MetroBank, SBI) use outdated technology and hence need a boost, in addition to being geographically limited. P2P lending platforms experience burgeoning customer- acquisition costs, and need continuously updated and advanced information with regard to a client's credit-worthiness to avoid credit risks. These areas offer potential opportunities for challenger banks to help other FinTech verticalsxxviii.

Most of the mobile-banking activity is concentrated in two segments the young, working class population (age group 18-19) and emerging marketsxxix. Geographically, challenger banks enjoy the largest demand in the U.K., U.S., Canada and Brazil. There is very little volume of challenger bank activity in Asia, which acts as an incentive for investors and banks in the region to look for solutions in Europe and the U.S. and implement them in Asia.

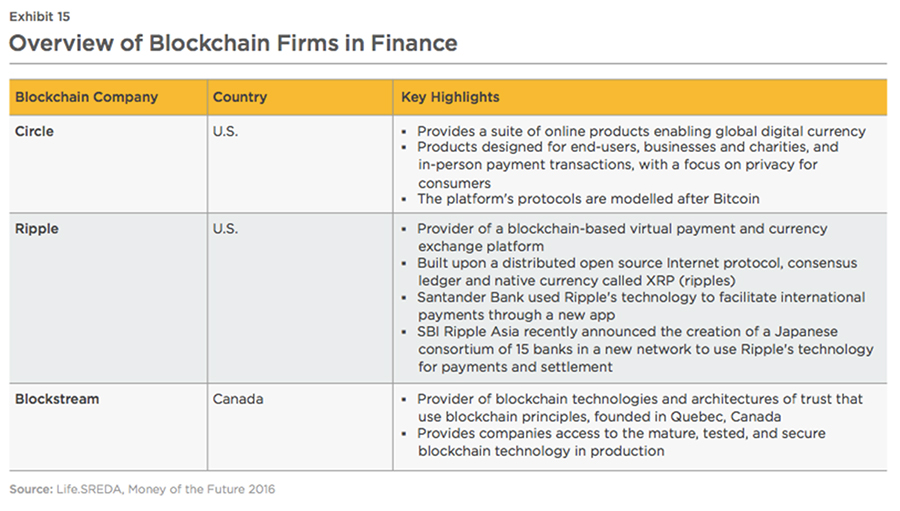

Blockchain

The Blockchain segment is highly fragmented and the wide array of implementation possibilities and technical complexity involved make it a challenging segment to dissect.

The most popular area, cryptocurrencies, is the most complex subject within Blockchain. There are over 150 cryptocurrencies, including 30 major ones, and 10 currencies with the largest number of transaction volumesxxx. They are mainly traded in China the four Chinese pools control 60 percent of the market. Cryptocurrencies are headlined by continuous emergence of tools such as high frequency trading and margin trading and index investment fundsxxxi. The other key areas of interest in Blockchain are healthcare, logistics, land registry, public and corporate document managementxxxii. Estonia, a global leader with regard to implementation of e-government services, is collaborating with Guardtime blockchain startup to create a unified base of medical records for people, which will be accessible to hospitals and insurance companiesxxxiii. Swedish authorities are collaborating with ChromaWay blockchain company to create a single registry of land plots on blockchain to make life easier for land sellers and buyers

as well as banks that use

land plots as collateral for loansxxxiv. While all areas in the financial sector, from payments to transfers, trade finance, stocks, collateral records, have registered significant activity in the Blockchain realm, the largest number of activities take place either in money transfers or establishment of new standards for the banking sector by regulators and associationsxxxv. A Singaporean startup, DaoPass, offers complete identification of customers through partner banks for Fintech startups, telcos, messengers and e-commerce players. Two American companies R3 consortium and Digital Asset Holdings are competing for the right to become the largest 'SWIFT' banks for the worldxxxvi.

Summary

While FinTech as a financial sector phenomenon is gathering pace worldwide, Latin America and Southeast Asia will see the strongest FinTech growth in terms of market volume in coming years, thanks to a relatively young population and increasing demand for robust mobile products. The year 2017 witnessed VC-backed FinTech deals in Latin America focused on the unbanked and underbanked demographics.

As more venture-backed Latin American FinTech startups crop up, the focus will continue to expand from lending and payments to wealth management and enterprise financexxxvii. Blurring lines between FinTech and commerce will enable innovation in the Southeast Asian and Latin American financial sectors.

Blockchain and cryptocurrencies will strengthen their position as the most popular segments within FinTech. As crypto speculation continues, more companies will look beyond their initial use cases to enable and expand investment and trading across platformsxxxviii. The coming years will also witness growth and collaboration between Challenger banks and traditional banks, e-wallets and P2P lending platforms, as these FinTech segments look to consolidate their market position across the globe. In this increased pace of FinTech market activities, it is the end-consumer who is set to benefit from the assortment of user-friendly features available

at his disposal.

References:

i. DTCC, FinTech and Financial Stability: Exploring how technological innovations could impact the safety and security of global markets, Oct 2017. Accessed on Feb 28, 2018.

ii. Ibid.

iii. Ibid.

iv. Bruegel, Capital Markets Union and the FinTech opportunity, Sept 2017. Accessed on Feb 27, 2018.

v. Ibid.

vi. DTCC, FinTech and Financial Stability: Exploring how technological innovations could impact the safety and Accessed on Feb 28, 2018.

vii. Ibid.

viii. Financial Stability Board, Financial Stability Implications from FinTech, June 2017. Accessed on Feb 28, 2018.

ix. Ibid.

x. Ibid.

xi. Ibid.

xii. There are three common and interrelated drivers of FinTech innovations.

xiii. Global Partnership for Financial Inclusion, German 2017 Priorities Paper, 2017. Accessed on March 5, 2018

xiv. Financial Stability Board, Financial Stability Implications from FinTech, June 2017. Accessed on Feb 28, 2018

xv. Ibid.

xvi. Ibid.

xvii. Cambridge Centre for Alternative Finance, The 3rd European Alternative Finance Industry Report, 2017. Accessed on March 1 2018

xviii. Ibid.

xix. Ibid.

xx. Ibid.

xxi. Ibid.

xxii. Life. SREDA, Money of the Future, 2017. Accessed on March 6, 2018

xxiii. Ibid.

xxiv. Ibid.

xxv. Ibid.

xxvi. Ibid.

xxvii. Ibid.

xxviii. Ibid.

xxix. Ibid.

xxx. Ibid.

xxxi. Ibid.

xxxii. Ibid.

xxxiii. Ibid.

xxxiv. Ibid.

xxxv. Ibid.

xxxvi. Ibid.

xxxvii. CB Insights, 2018. Accessed on March 7, 2018

xxxviii. Ibid.