Overview

Credit unions, while being a small contributor to the U.S. financial

services industry, hold significant importance for their members.

They have maintained a strong loan growth over the years, with

industry loans exceeding USD 1 Trillion in the second quarter of 2018.

The interest rate environment as dictated by the U.S. Federal

Reserve's (Fed) policies impact the growth and performance of

credit unions. There is a clear trend of increasing interest rates over

the last four revisions in 2018. With indicators pointing at a slower

growth in 2019, the Fed has already marked down its growth and

inflation projections. Recent policy briefings signal further rate rises

in the medium term.

Credit unions are feeling the impact of the rising rates. For example,

auto loans, constituting approximately 35 percent of their portfolio,

have witnessed a decline in the past year. Further, credit unions also

experienced a flat quarter-on-quarter yield on loans in 2017-2018.

Credit unions will need to re-assess their lending and investment

strategies in the current environment. They have to find ways to

continue lending while maintaining adequate liquidity. Building a

contingency plan for any short-term change is also recommended.

This WNS DecisionPointTM report analyzes the growth trajectory of

credit unions, in loans, assets and membership, across categories in

context of the interest rate policies. It also discusses the possible

options and approaches credit unions can take to deal with the

situation in the near future.

U.S. CREDIT UNIONS: WALKING THE TIGHTROPE

BALANCING GROWTH IN A RISING INTEREST RATE ENVIRONMENT

- As interest rates continue to

rise due to the U.S. Federal

Reserve's policy, consumer

lending is likely to experience

further slowdown in 2019

- Credit unions now have to

re-assess their lending and

investment strategies, while

maintaining liquidity

- A WNS DecisionPoint analysis

shows that if policymakers

allow credit unions more

opportunities to partner with

small businesses, it will have

far-reaching implications for

the industry

U.S. CREDIT UNIONS: WALKING THE

TIGHTROPE

BALANCING GROWTH IN A RISING INTEREST RATE ENVIRONMENT

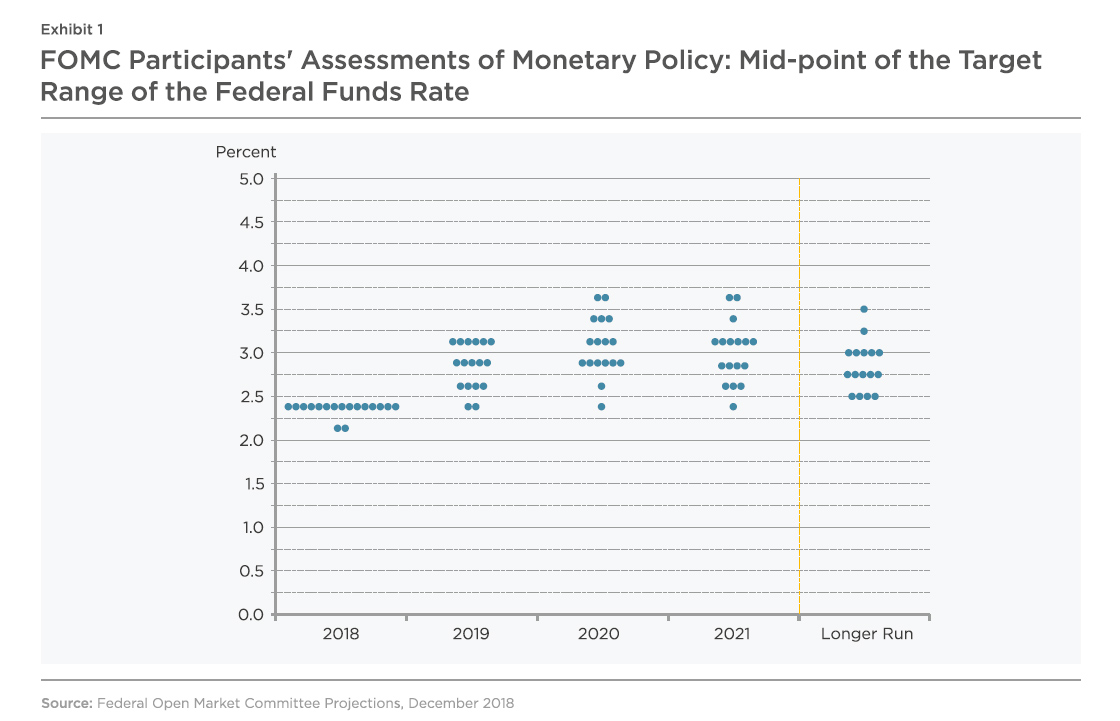

In its latest policy review, the

United States (U.S.) Federal

Reserve (Fed) continued on its

trajectory of rate hikes by raising

the target range of the federal

funds rate to 2.25-2.5 percent. This

is the fourth rate hike in a series of

three consistent rate hikes in 2018.

Economic data monitored by the

Fed indicates that the labor market

has continued to strengthen amid

strong job gains and a low

unemployment rate. The Fed has

indicated two rate rises ahead for

2019 in the wake of softening economic data and anticipated

global growth slowdown.

A look at financing conditions in

the consumer credit markets

presents a mixed picture. While

nurturing of growth in household

spending, interest rates on

consumer loans continued to rise.

In the residential mortgage market,

tight financing conditions persisted

for borrowers with low credit

scores. There was a slowdown in

the growth of home-purchase

mortgage originations as mortgage rates reached their highest level

since 2011, and refinancing activity remained muted.1

Consumer lending is likely to

experience further slowdown in

2019. The path of U.S. rate rises

over the course of next year will

determine the lending strategies of

credit unions and their subsequent

growth. In the coming sections, we

will assess the forecasts for U.S.

interest rate rises and how these

will impact credit unions and their

lending portfolios.

FORECAST OF U.S. INTEREST RATE TRAJECTORY

In its press conference held on

December 19, 2018, the U.S. Fed

singled out two important points

that will differentiate the trajectory

of U.S. interest rates in 2019 from

that of 2018. Firstly, 2019 will

witness moderate growth

compared to the rising pace of

growth in 2018. The additional tightening of financial conditions

seen over the last couple of months

combined with signs of weaker

growth seen outside of the U.S.,

have led the Fed to mark down its growth and inflation projections.2

Secondly, the U.S. economy

continued to strengthen in 2018.

Given the four rate hikes, the Fed signaled that it will be providing a

smaller boost to the economy in

2019 and put the target rate for the

Fed between 2.25 to 2.5 percent, at

the lower end of the range of

estimates provided by the Federal Open Market Committee (FOMC).3

The chart describes the

policymakers' assessments of the

future path of monetary policy.

Each shaded circle (rounded to the

nearest 1/8 percentage point) indicates an individual participant's

perception of the mid-point of the

target range of the federal funds

rate toward the end of the year.

With at least two more rate rises anticipated in 2019, U.S. interest

rates are set to follow a rising

course in the medium-term, with

far reaching implications for the

credit union industry.

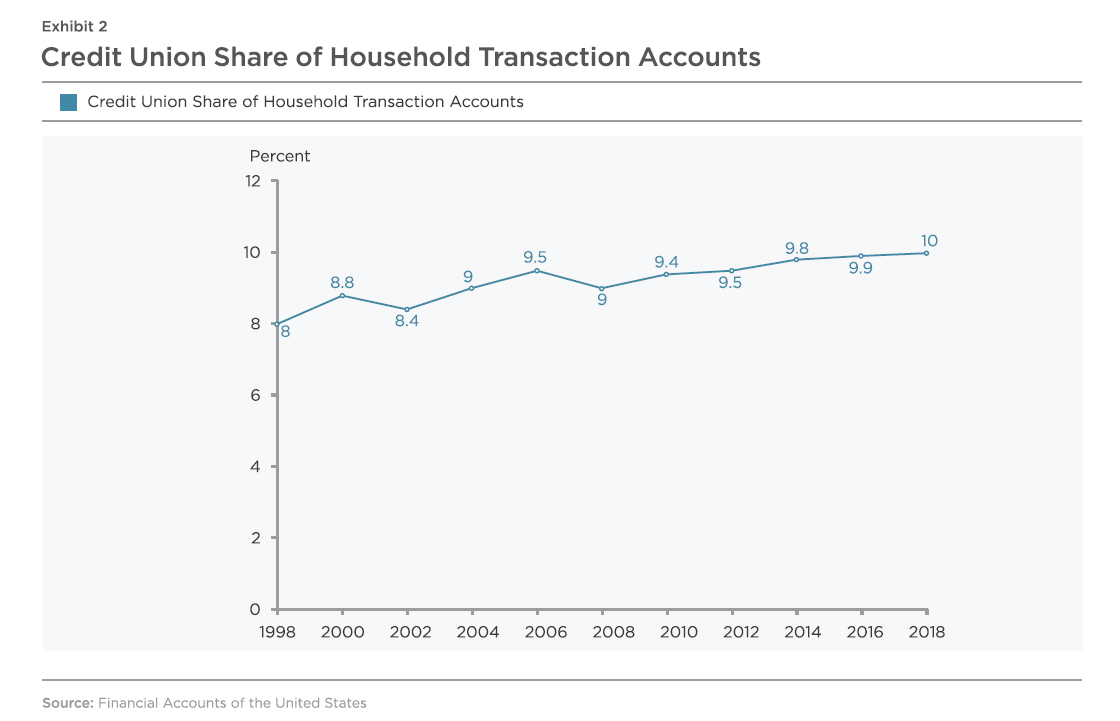

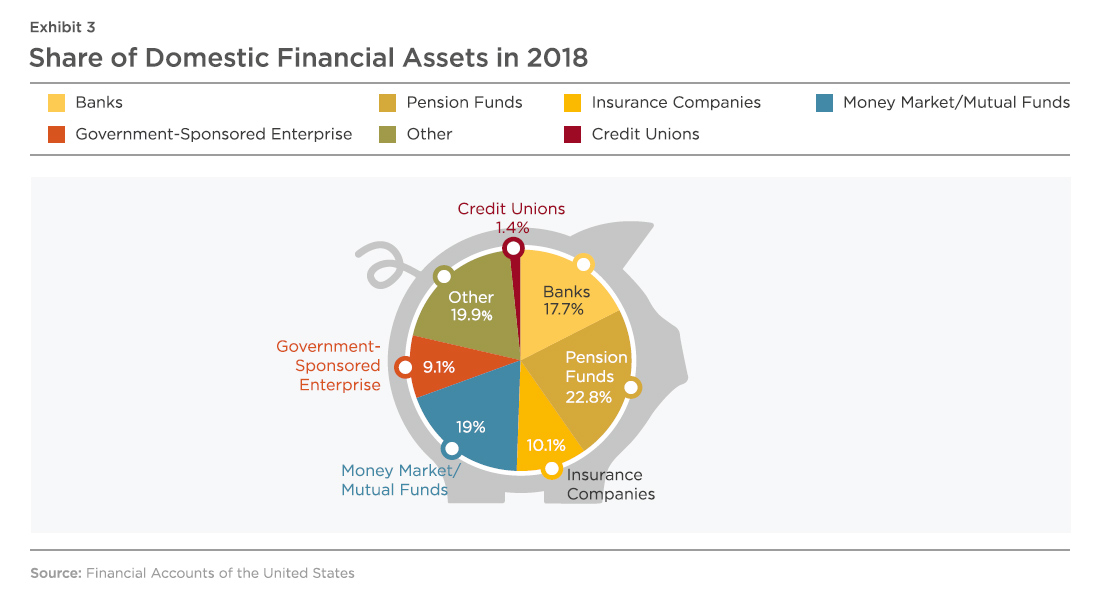

CREDIT UNIONS: INDUSTRY TRENDS

Credit unions are member-owned,

non-commercial cooperative

financial institutions. They are run

autonomously, led by directors

who offer their services for free

and function to serve their field of

membership. In terms of size,

they occupy a tiny proportion of

the U.S. financial services industry,

and yet they are of paramount

importance to their members. The vast majority of credit unions

are small financial institutions

trying to gain a footing in the

highly competitive financial

services industry. The median

credit union manages a meagre

USD 33 Million in assets and has 8 full-time employees.4 By

comparison, the median bank

has more than USD 210 Million in

assets and 45 full-time employees. In addition, the credit union

industry is less top-heavy than

the banking industry. The top

100 banks represent 81 percent

of total bank assets, whereas the

top 100 credit unions only account

for 44 percent of industry assets.

Each of the three largest banks

accounts for more assets than all

5480 credit unions combined.

Year-over-year growth in credit union membership was 4.3 percent in June 2018, its highest level in three decades.5

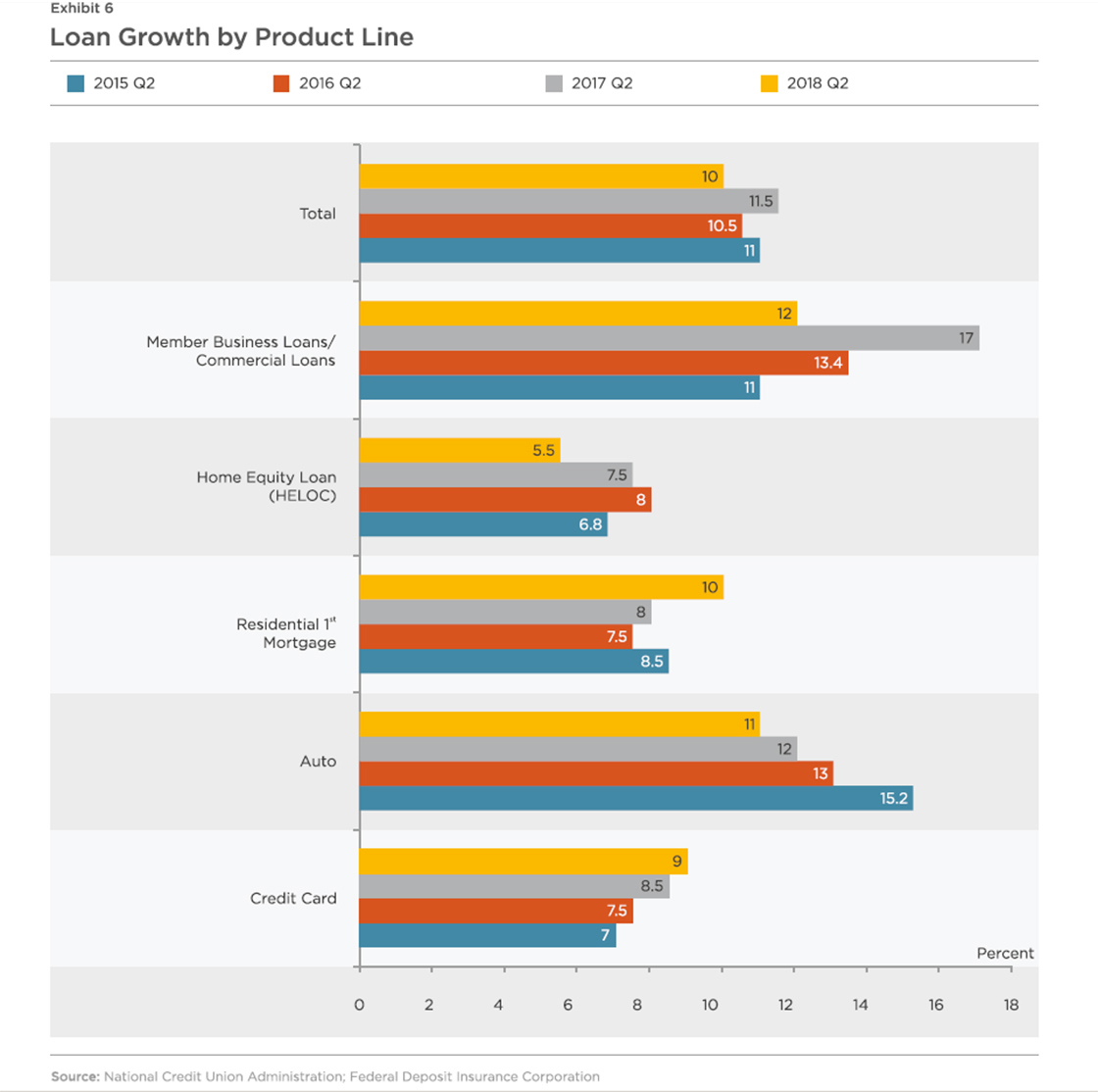

HOW HAVE RISING U.S. INTEREST RATES AFFECTED CREDIT UNION LENDING?

In recent policy briefs, the Fed has indicated more rate rises in the medium- term, thereby pushing credit unions

to reassess their lending and investment strategies.

An assessment of credit extension

by type of institution reveals a

pattern of credit unions maintaining

a flow of credit to the small businesses sector. As policymakers

grapple with the prospects of a

slowing economy in the near-term

and decline in business dynamism, they would do well to provide

credit unions with more

opportunities to partner with

small businesses.

Credit unions have maintained

strong loan growth over the years.

In the second quarter of 2018, total

industry loans outstanding

exceeded USD 1 Trillion. More than 70 percent of that comprises

first-lien residential mortgages and

auto loans (35 percent each). The

remainder of the loan portfolio

consists of junior-lien residential loans (8 percent), commercial loans

(7 percent), credit card loans

(6 percent) and unsecured

personal loans or lines of credit (4 percent).6

Auto lending has been a key

component of the industry

lending, propelling total loan

growth for years. However, auto

sales have declined sharply from a

year ago, primarily due to rising

interest rates which have led to a

fall in auto loans. As rates continue

to rise, auto companies enjoy

greater flexibility with regard to

offering low rates on vehicles,

thereby potentially gaining an

advantage over credit unions and

taking a small amount of business

away from them. Also, consumers

have been used to low interest

rates for a very long time. Hence,

even a slight increase in interest rates might steer consumers away

from loans.

So what strategies can credit

unions deploy to stay afloat in

the rising interest rate tide? One

of the best ways to combat the

challenge is to continue to loan

as much as they can, while

maintaining adequate liquidity

to service the members' financial needs.7 A proper contingency plan

must be in place should credit

needs change in the short-term.

Yields on loans have consistently

declined over the last several years,

but stayed flat quarter-on-quarter

in 2017 and 2018 - a clear indication that credit unions are

starting to feel the impact from

the re-pricing of newly originated

loans. Credit unions are facing

increasing pressure both from

consumers to increase deposit

rates and from internal business,

as loan growth has outpaced share

growth and created a need for

additional deposits to fund future

loan growth. One way to meet this

challenge and fight rising interest

rates would be to offer more

adjustable-rate products, enabling

an increase in expected income as and when rates rise.8

OUTLOOK FOR CREDIT UNIONS

Based on actual historical data

from the Credit Union National Association, WNS DecisionPointTM has created loan growth, asset

growth and membership growth

estimates and forecasts of credit

unions for the third and fourth quarter of 2018. Credit unions have

enjoyed a period of high growth

across the three categories through

2017 and the first two quarters of

2018. However, with spikes in

interest rates having taken a toll

on loans, assets and membership, WNS DecisionPointTM estimates a

downward trend for the remaining

two quarters of 2018 and an overall

decline from previous years across

the three categories.

Conclusion

Rising interest rates in the U.S. in

the last one year have had an

adverse impact on the credit union

industry as consumers steered

away from loans. Key components

of credit union loan growth, such

as auto loans, have witnessed a

slight decline as interest rates rose

and consumers started to postpone their auto purchases. In order to

maintain healthy levels of asset and

loan growth, credit unions will have

to adopt a host of strategies,

ranging from creating more diverse

rate-adjustable loan products in

their portfolio offerings to

maintaining adequate levels of

liquidity to satisfy consumers' credit needs. With the Fed

expected to go in for further rate

rises in 2019, it would be interesting

to see how credit unions balance

their asset and loan growth with

increasing pressures on liquidity

levels in the industry.

References:

1. Minutes of the Federal Open Market Committee, November 7-8, 2018

2. Transcript of Chairman Powell's Press Conference Opening Remarks, December 19, 2018

3. Ibid

4. 2018 NAFCU Report on Credit Unions, National Association of Federal Credit Unions

5. Ibid

6. 2018 NAFCU Report on Credit Unions, National Association of Federal Credit Unions

7. 'As interest rates climb, how should credit unions respond and strategize?', Credit Union Journal, March 2018

8. Ibid