Overview

As COVID-19 continues to slam the brakes on several industries, the travel and tourism industry is looking at unprecedented levels of disruption. Restrictions on international travel and cancellations of major events have put airlines, hotels and cruise operations in a state of quandary.

A complete shutdown of operations across most parts of the globe is compelling the travel sector to seek interim relief from governments. In line with this, the U.S. government has earmarked USD 60 Billion from the USD 2 Trilion aid package for the airline industry. It remains to be seen if other players in the travel ecosystem will get the benefits they ask for from their governments.

WNS DecisionPointTM analyzed the current scenario in airline, hotel and cruise industries across the globe. Job losses will continue to climb, if the situation does not ease quickly. In this report, we forecast the scope and period of impact for these three segments.

Introduction

The spread of the Covid-19 disease globally, caused by the coronavirus, has halted travel industry operations across the globe. Demand for the three major segments of the global travel industry — airlines, hotels and cruises — has slumped to its lowest point in several years. As the virus continues to spread unabated leading to widespread sealing of international borders and closure of flight routes, organizations across airline, hotel and cruise segments face some of the toughest challenges — grappling with low customer demand, grounded fleet, employment cuts and declining revenues.

We analyze the impact of the virus outbreak across the airline, hotel and cruise segments, and forecast the extent and duration of the impact and essential steps that companies in these sectors can take to limit, if not stop, the damage incurred.

AIRLINES – HARDEST HIT SECTOR

Passenger demand dropped drastically in the first week of March 2020, forcing carriers to freeze hiring and reduce the number of flights, including on profitable transatlantic routes. According to Ascend – an aviation data consultancy – data for the first half of March 2020 show a 2.8 percent fall in global aircraft capacity.1

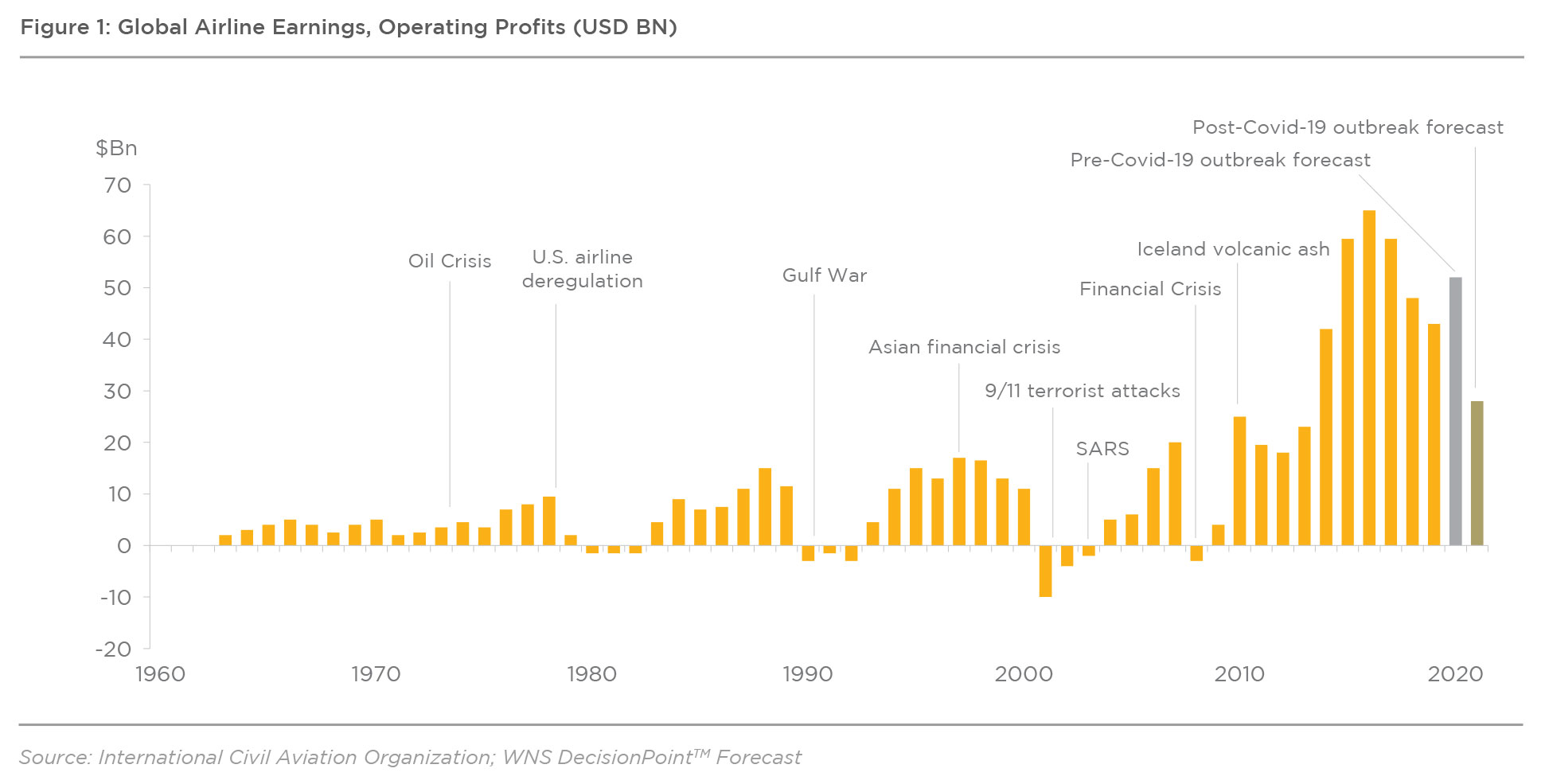

The graph illustrates global airline operating profits in the last six decades, with upheavals seen during major global macro events, from the oil crisis of the 1970s to the SARS epidemic of 2002-03. Global airlines suffered operating losses worth USD 5 Billion during the SARS epidemic. Analysis and forecasts from the International Civil Aviation Organization (ICAO) before the COVID-19 outbreak suggest that global airline operating profits for 2020 would have hit USD 57 Billion. As of March 2020, wherein the outbreak has spread beyond 100 countries, WNS DecisionPointTM forecasts operating profits to reduce by 50 percent of the ICAO forecast, to approximately USD 28 Billion.

As per the International Air Travel Association (IATA) estimates, the ‘extensive spread’ of the virus (spread beyond 100 countries) will reduce global passenger revenues by USD 113 Billion.

WNS DecisionPointTM calculations indicate that countries with more than 100 confirmed cases will see a steep year-on-year plunge in flight booking rates in April 2020, signaling flight booking cancellations on a global scale in the coming months.

According to analyst estimates, the short-term and long-term consequences of COVID-19 would mean reduced travel, and many airlines currently struggling will face challenges in surviving. Those that continue to operate will reduce fleet size to maintain profitability.2 Fleet sizes determine the number of seats in the market, and reducing the number of seats will increase the price per seat in the market.3 However, the extent of fleet cuts will depend on the length and depth of the crisis.

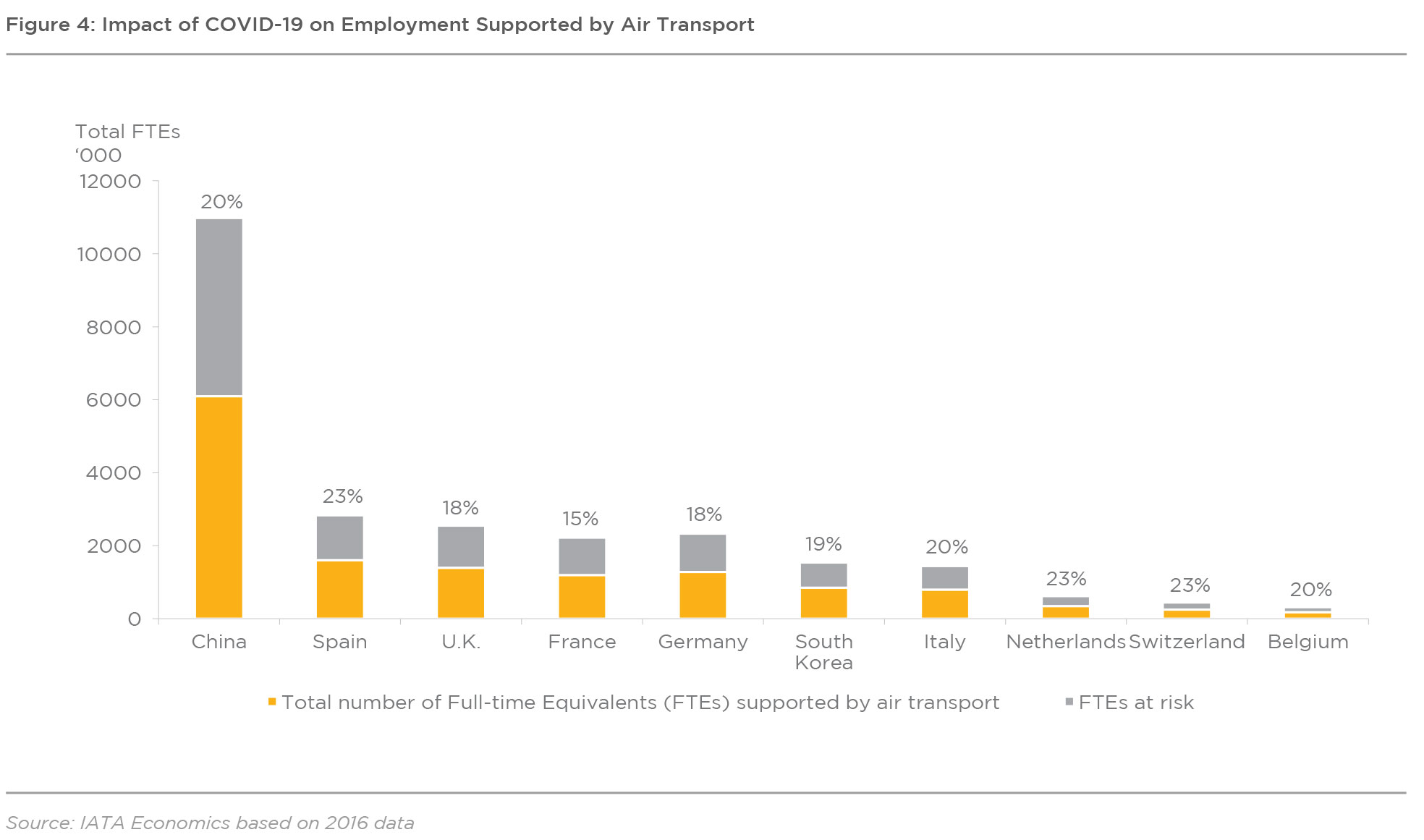

Air transport is a major constituent of global economic prosperity, accounting for 65.5 million jobs and USD 2.7 Trillion in economic activity.4 With increasing number of airlines facing cash flow pressures and fragile financial conditions, they are confronted with the prospect of cutting back air services and laying off employees by offering them unpaid leaves or reducing the number of hours worked.5

IATA estimates employment risk at 15-23 percent of the total number of jobs supported by air transport in the countries depicted in the graph. The medium-term employment scenario will depend on the future course of the spread, and curtailment efforts of governments and communities across the globe.

HOTEL INDUSTRY

Hotels and tour operators around the globe are facing complete meltdown after the disease was declared a pandemic by the World Health Organization (WHO). Several countries imposed lock-downs and the U.S. banned the entry of citizens from 26 countries. The World Travel and Tourism Council (WTTC) has estimated that up to 50 million jobs were at risk in the hotel and leisure industry and that the sector could shrink by 25 percent – equivalent to three months’ travel loss in financial terms.6

OCCUPANCY RATES REBOUNDED QUICKLY AFTER SARS

Seventeen months on, MiFID II is changing the investment banking business, with asset managers concentrating their negotiating power on a smaller list of the largest brokers. The regulation seems to have shrunk the research coverage, particularly among small and mid-sized companies.

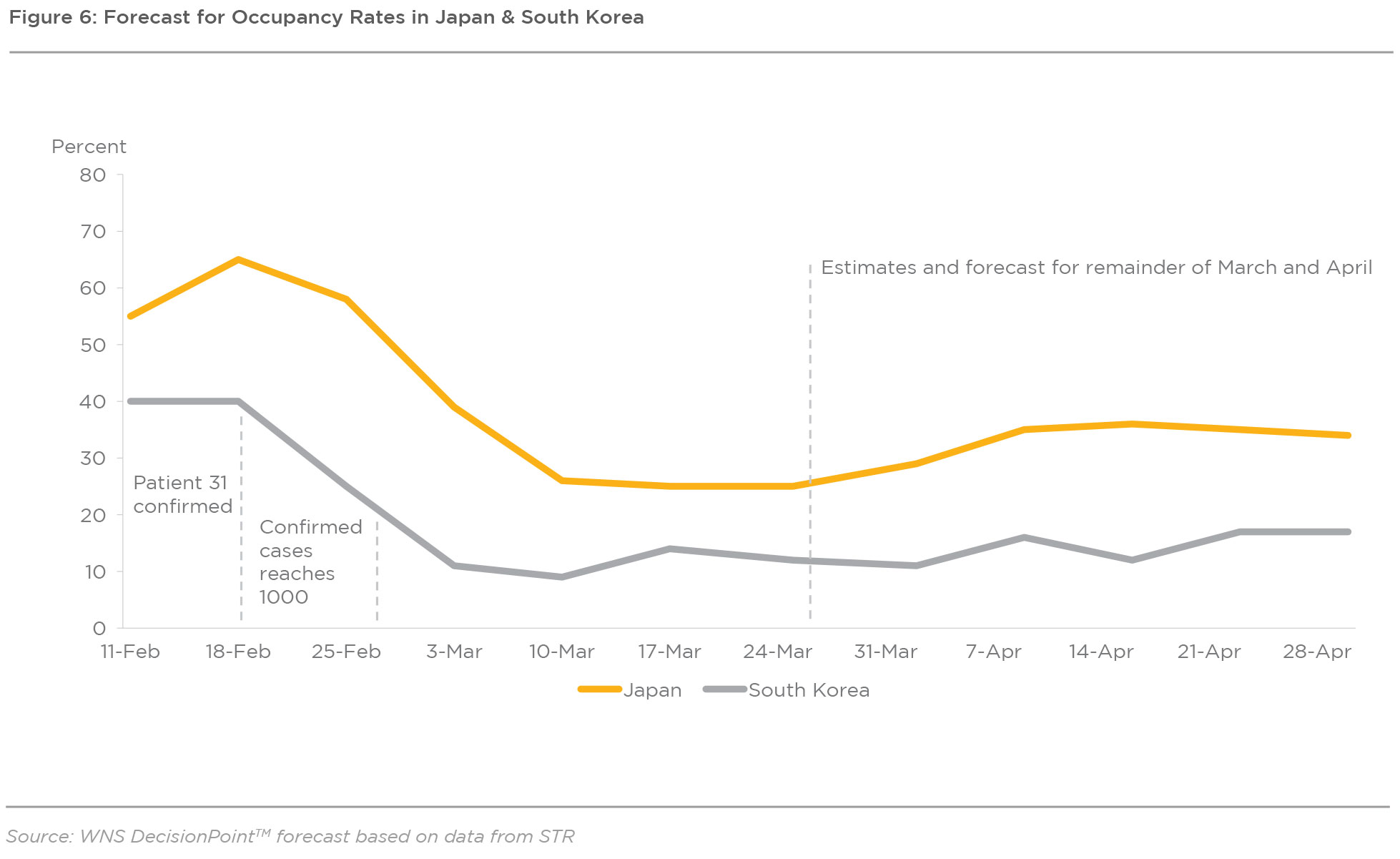

Occupancy rates in the Asian markets of Beijing and the Hong Kong Special Administrative Region recovered within three to six months after the SARS outbreak. However, the coronavirus outbreak has had a more serious and long-lasting impact on hotels in Mainland China. In February 2020, 2,600 temporarily closed properties constitute 40 percent of the total hotel revenues in Mainland China, and 56 percent of those properties are in the economy and midscale categories.7 More than 80 percent of hotels in Mainland China have closed their online bookings. Many hotel groups launched free cancellation policies and extended a one-year membership for guests.8

Occupancy rates reached an all-time low in South Korea after confirmation of 31 coronavirus cases in February and over a thousand confirmed cases towards the end of February. As the number of infected cases continue to rise in South Korea during March, WNS DecisionPointTM forecasts a steep decline in occupancy rates for the remainder of March and April. Hotels are facing cancellations and are forced to temporarily shut down properties across the country. Those that continue to stay afloat have had to reduce their workforce by more than half. The pace of recovery of the hotel industry in Mainland China and South Korea will be contingent upon how quickly the spread of infection is contained in these countries and steps taken by companies and institutions to provide stimulus to the ailing sector.

The U.S. is not very far behind either. According to data from the American Hotel and Lodging Association (AHLA), the hotel industry supports one in 25 American jobs, which denotes 2.3 million direct jobs and 8.3 million total jobs annually. The industry contributes USD 97 Billion in wages and salary and contributes nearly USD 660 Billion to the U.S. GDP.

The U.S. registered over 51,000 confirmed cases of the virus towards the last week of March. Based on the fast spread of the infection, WNS DecisionPointTM forecasts a steep drop of over 50 percent for occupancy rates in the U.S. for March and April, accounting for over two million lost jobs.

Europe is set for the biggest drop in a decade in occupancy rates for March and April 2020, with Italy taking the biggest hit as the epicenter of the virus outbreak in Europe. With confirmed cases rising to over 69,000 towards the end of March, WNS DecisionPointTM forecasts a steep negative change of up to 150 percent for occupancy rates in Italy. As no definite period has been stipulated for the lock-down across Italy, the drop in occupancy rates could be even more severe three to six months after April.

CRUISE INDUSTRY

The USD 45 Billion cruise industry has been in the eye of the storm ever since the infections were first detected in February 2020 on board one of the largest cruise liners in the world. More than 50 cruises were cancelled and seven ports closed.

The cruise industry is particularly vulnerable to the virus as the disease spread through the winter ‘wave season’ – the industry’s key quarter when ship owners vie for early bookings so that they can break even for the year’s forecasted sailings. Demand and capacity are often difficult to match, as ships are usually delivered up to five years after ordering and are priced at nine figures.9

The cruise industry attracted the largest number of customers from North America in 2019, while Asia-Pacific customers, more than half of whom were Chinese, accounted for the biggest year-on-year increase from 2018. Based on the current crisis levels, WNS DecisionPointTM estimates a 25 percent drop in customers from Asia-Pacific and a 50 percent drop in travelers from North America in 2020.

Customers are compensated for cancelled trips on cruises, but most major cruise lines do not have commercial insurance to cover pandemics, such as the coronavirus outbreak, because premiums are unreasonably high. Costs will have to be absorbed or compensated from a mutual liability insurance available through private shipowners’ clubs.10

CONCLUSION

The burgeoning spread of the coronavirus infection across the globe has brought the travel and leisure industry to its knees. To stop the spread of the virus, the travel industry has had to come to a complete standstill. Based on the state of the outbreak in March 2020, WNS DecisionPointTM estimates global airline profits to reduce by 50 percent from previous year and forecasts massive decline in booking cancellations across key destinations. Hotel occupancy rates and jobs in the employment sector will experience a worse fall than the SARS epidemic of 2002-03 and the 2008-09 financial crisis, with Italy suffering the biggest drop in occupancy rates from March to April 2020. The cruise industry is set to witness a decline in the number of customers in 2020 as potential customers tackle the long-term challenges brought on by the virus.

References:

1. Article by Financial Times, Coronavirus pushes aviation sector into ‘crisis zone’, March 2020.

2. Article by Financial Times, EasyJet founder Stelios says fleet must drop by quarter, March 2020.

3. Ibid.

4. IATA Economics, March 2020.

5. Ibid.

6. Article by Financial Times, Hotels and tour operators face ‘total meltdown’, March 2020.

7. STR, March 2020.

8. Ibid.

9. Article by Financial Times, Will Cruise ships survive and what will be left of them?, March 2020.

10. Article by Financial Times, Coronavirus: cruise industry caught in the eye of the storm, Feb 2020.