The digital adoption scores of the selected utilities were derived using seven parameters as mentioned below. Each parameter was assigned a relative degree of importance based on a survey conducted by WNS and across 50 utilities located in US, Australia, and the UK. These attributes are further sub-divided into various predetermined parameters.

Examining the change in customer complaints received by utilities in 2015 over 2014, it was observed that the Forerunners fared well compared to their peer group and reported a fall in number of complaints during the period.

Followers reported 41% rise in complaints whereas complaints eceived by the Laggards doubled.

For complaints related to billing, 80% of Forerunners reported a fall whereas Followers and Laggards saw an average increase of 60%. A similar situation is observed for metering and customer service related complaints as well, where at least 60% of the Forerunners have experienced a fall in complaints and have outperformed Followers and Laggards.

Forerunners also performed well, compared to Followers and Laggards, in terms of customer acquisition, SG&A12 Margin and Cost-to-Serve per customer as depicted in the following figure.

The channel shift is a clear signal that utilities wanting to engage with an increasingly tech-savvy customer base must move customer interactions away from traditional and assisted channels and into the digital medium. Once digital interfaces are developed, utilities should maintain continuity of communication by constantly updating digital content in line with changing consumer needs and preferences.

Roadmap To Digital Excellence

The digital maturity roadmap will enable utilities to assess their overall digital readiness across four dimensions by evaluating their core capability and competencies in providing digitally enabled customer experience. The roadmap also explains how utilities can enhance digital functionalities in each phase of digital adoption to strengthen customer relationships. The transition between different dimensions of digital maturity is a continuous journey and each incremental advancement through the stages results in improved customer satisfaction.

Although many energy utilities in the UK have increased their focus on embracing and deploying digitization initiatives, they still need to significantly enhance the scope and reach of digital service offerings.

Measuring Digital Maturity Gap

Considering the current adoption rate of digital channels, as shown in the chart below, it can be said that UK energy utilities have a long way to go to be Transformers where they consistently provide seamless and best-in-class user experience and fully integrate digital initiatives into their customer engagement strategy.

The development cycles of digital

technologies are extremely rapid and utilities need to build up their digital capabilities sooner and refine them based on customer feedback. Rather than an all-at- once approach, utilities stand to gain more if they roll out prototypes at the outset to minimize sunk cost, scale up successful initiatives, and sustain change through a structured transformation methodology.

The chart below provides a holistic view of digital maturity levels among utilities, which help them understand where they stand and how they can measure gaps between them and their competitors.

Bridging The Digital Divide

To enable utilities to effectively bridge the digital maturity gap, WNS DecisionPoint™ suggests two strategic approaches

Developing Customer Facing Digital Features

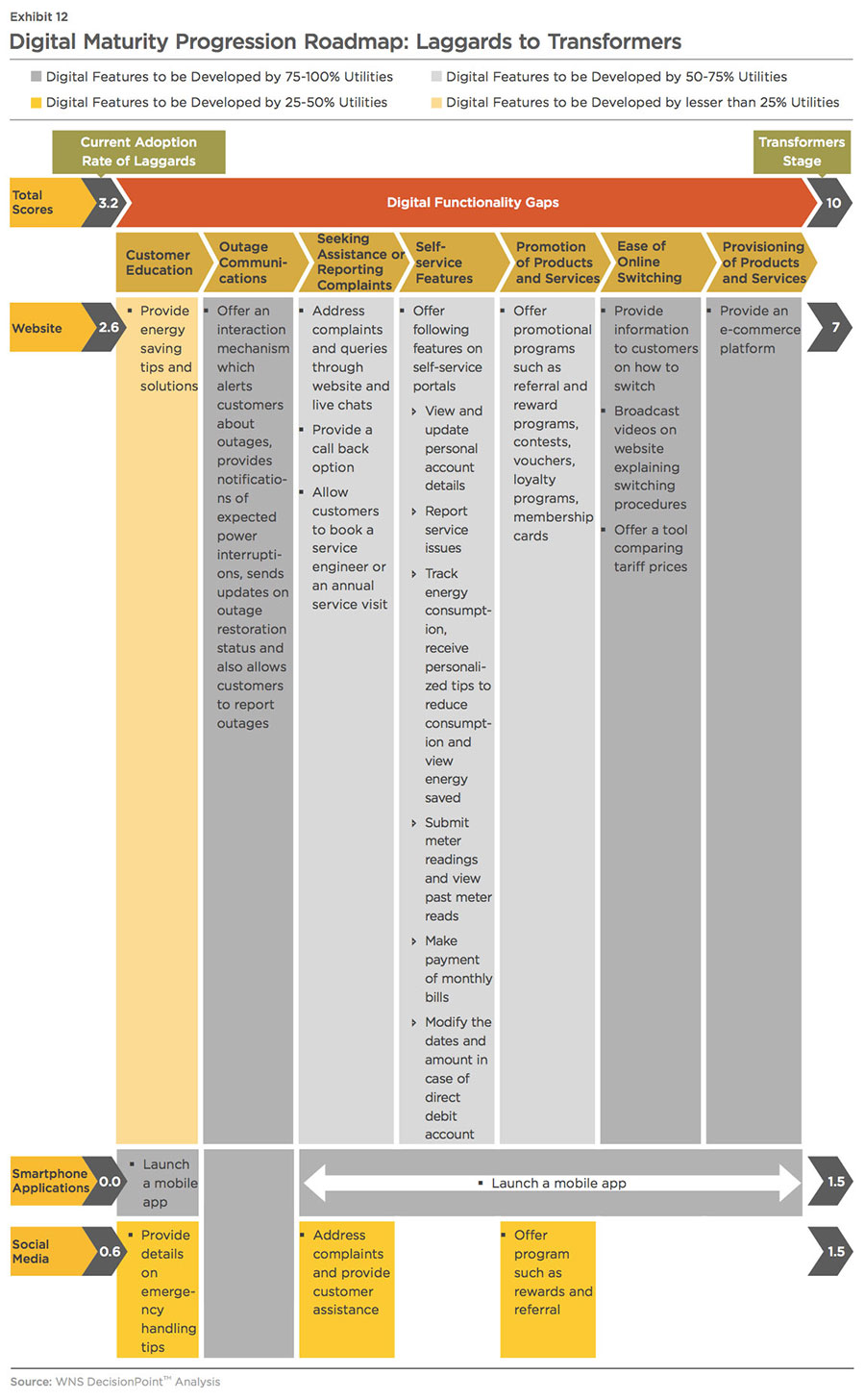

Laggards, Followers as well as Forerunners should consider developing and enhancing features of each digital channel by discovering the attributes to which customers are most likely to respond positively. The below exhibits (12, 14 and 16) pinpoint specific areas where each category needs to build and/or expand the functionality of their customer facing digital features to move up the digital maturity level.

Capability Enhancement Needed for Laggards to Become Transformers

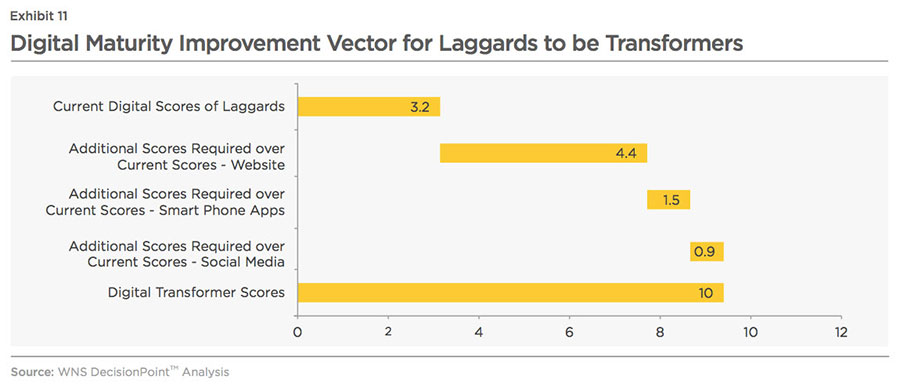

Laggards need to significantly increase their digital penetration rate across selected channels as shown in Exhibit 11. Traditional product-centric approaches have acted as deterrents to Laggards from investing in customer- centric digital channels.

Laggards need to enhance their websites and build many customer- centric interfaces across selected parameters such as self-service features enabling customers to change their account details, track energy usage, and view historical bills, among others. Their website interfaces are simplistic from a design standpoint and provide basic functionalities only such as self-service information like frequently asked questions (FAQs) and emergency handling tips. Moreover, since Laggards lack a mobile footprint, they should also start thinking about planning for a mobile application launch while deciding to develop new marketing and customer engagement strategies. In order to define the mobile strategy, it is critical for Laggards to understand where the company wants to be, the dynamics of the industry operating environment, competitor strategies, alignment with customer needs, as well as how mobile as a touch point can become an asset to the company. Different elements of the mobile interface could be important to different stakeholders, but a clear strategy is needed to prioritize the needs and solutions and deliver an actionable plan with a specific sequence of activities to drive the necessary improvements.

Adoption of social media channels by Laggards is also very low and at a nascent stage, requiring them to expand their capabilities as shown in the diagram below.

Capability Enhancement Needed for Followers to Become Transformers

Followers demonstrate a similar trend to that of Laggards and need multiple and high-quality digital interfaces across selected digital channels. Although customer experience remains the prime focus of Followers, they lag behind Forerunners in terms of the priority they assign to the digital channels.

Followers fared equal to Forerunners in social media penetration but lag behind in terms of core functionalities or features available to users on their websites and smartphone applications, such as the presence of a web tool that compares tariff prices of various energy suppliers and highlights potential savings to customers if they switch. Their mobile footprint is varied, with many utilities struggling to deliver and maintain reliable apps with basic features. Their websites also lack many customer-centric features as shown in the diagram below.

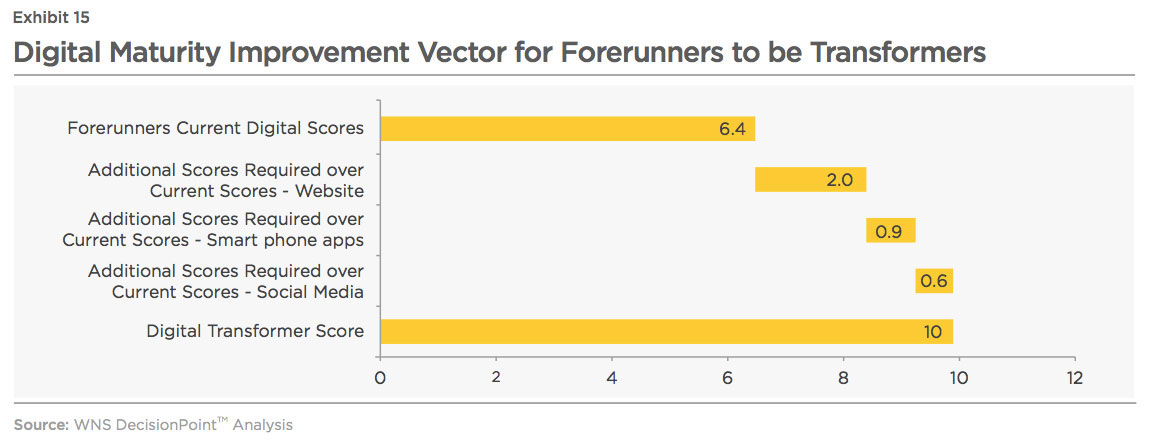

Capability Enhancement Needed for Forerunners to Become Transformers

Although Forerunners score better in terms of customer-focused features like a self-service portal, innovative features such as a tariff comparison feature on website and mobile application that also displays potential savings for switching energy providers, outage alerts with estimated restoration time, personalized advice on reducing consumption, such as making house more energy efficient and using different types of thermostats etc., are missing. Forerunners also have to increase their digital customer experience mainly around promotions and outage communications, to reach the next stage.

Forerunners are flexing their digital muscle while designing customer support strategies; however, a few traditional utility players continue to consider digital strategy as secondary to competitive differentiation. Also, they tend to focus more on physical channels as the primary medium of communication with customers. Similar to Followers, most Forerunners (60-80%) offer only basic functionalities on websites, smartphone applications, and social media and only 10-20% provide important customer- centric features, such as outage communications, tariff comparison tools, videos explaining switching procedures, among others. Lack of in-house expertise in user experience design, fast-changing digital technologies, and complex systems integration requirements delays adoption of digital channels. The following chart depicts the interfaces required to be developed by Forerunners to bridge the gap and reach Transformers stage.

Developing Operations Focused Back End Strategies

Apart from building customer facing digital capabilities, utilities are also required to develop or rethink their back- office strategies to bridge the digital maturity gap. They should embed digital capabilities within their customer service operations to ensure seamless customer experience across channels.

Adopt a Well-defined Strategy for a Digital Customer Engagement Program

Utilities that fail to establish a link between digital customer engagement and organizational customer service strategies will be unable to produce anticipated results from digital channels.

A clear understanding of which interface will be a part of the online presence is very important in framing digital strategy. For instance, before having an interface on a self-service channel that allows customers to change the date of direct debit, utilities should ensure that their back-office processes such as billing, energy consumption, metering, among others are well integrated and the change in the date is reflected across processes. With numerous options available in digital landscape today, the utility company may fail at integrating the digital strategy with the company's strategy and/or underinvest in digital resources.

Create a Dedicated Digital and Analytics Team Focussing on Customer Engagement

Building a dedicated, cross- functional team headed by a Chief Digital Officer tasked with the overall success of digital channels is vital for ensuring the program's focus and accountability. The digital team should be tasked with responsibilities including managing digital requirements, supervising interface development, and ensuring best practices in usability and design. The team should also effectively deal with any customer concerns pertaining to any of the digital channels and should harmonize integration with enterprise applications.

Utilities should also build an analytics team who continuously track and analyze the smart meter data to understand customers' behavior and needs. Moreover, with the increasing investments in advanced metering infrastructure (AMI) and meter data management (MDM) software, utilities are now in the position to deliver crucial insights beyond meter-to-cash functionalities. Meter data analytics enables utilities to gather unique customer insights, promptly manage and even prevent outages, and develop new tariffs and personalized services for the customer.

Acquire In-depth Understanding of the Interfaces and Customers

Creation of a new feature or service requires a deep understanding of target customers and user experience. For instance, the meter reading feature tends to have higher adoption rate owing to its recurring nature in relation to a personal account modification feature which is seldom operated by customers. The utilitycompany should also acquire knowledge of target customers and their probability to engage with the new interface. For instance, a customer who is active on an existing digital channel is more likely to use new services compared to inactive customers.

Roll out Focused Interfaces that Target Specific Usage Scenarios

Bundling multiple features into one common interface may lead to user fatigue in turn leading to an unfavorable user experience. User interface design must focus on anticipating user behavior and identifying the most important

features or a collection of closely related features that are essential to garner and hold user's attention.

Ensure Back-end Integration for a Flexible and Scalable Architecture

Back-end integration is one of the main hurdles for a utility service provider undertaking digital interface development. Many utilities have extensive investments in customer information systems that may predate the mobile app and social media era. They are also increasingly investing in outage management systems that are focused on internal operational processes, but not targeted to provide outage communications to customers. These systems typically lack mobile-friendly application programming interfaces (APIs)13 or web applications that can facilitate reusable and scalable interface development. Utilities should consider deploying mobile backend as a service (MBaaS) model which is focused on streamlining the mobile apps development processes that run on multiple devices, without compromising developer flexibility.

Create a Sustained Awareness Campaign

Higher adoption of digital tools and interfaces is greatly influenced by the ability to continuously remind target audience about the presence of the tool/service and the associated consumer benefits. Utilities can run various promotional campaigns using methods such as bill inserts, social media, direct mail, and customer call to build interest in digital channels.

Set Effective Measurement Criteria

Since digital channels have traditionally been considered the less preferred means for customer interaction, many utilities do not even consider measuring the progress of each digital channel. However, with rising customer preference for digital interactions, utilities will need to start identifying or creating measurement metrics which will enable them to understand the return on investment from each channel. For example, the progress on the digital channel can be expressed in terms of adoption rate, retention rate (% of customers who enroll that stayed connected), and usage rate (% of registered users who actively use the interface).

Offer Incentives for Greater Adoption

Utilities should aim to decrease the inbound flow on traditional channels and, at the same time, shift channel mix in favor of the digital medium. Possible ways to incentivize digital adoption include discounts for paperless bills or transacting through an online account and/or rewarding meter readings received through an online account.

Optimize Balance of the Functionality and Usability Aspects

While the old school of thought places premium on functional aspects, the currently prevalent design approach places equal importance on usability. This gains prominence when it comes to the design of mobile apps, where user experience is vital and can break down quickly with as little as one poorly designed screen or a counter-intuitive step. As an example, programs such as energy tracking and savings which require customers to enter details in a form may not achieve higher adoption if they are not intuitive and nimble enough.

Capture Engagement Metrics to Guide Future Planning and Resolve Issues

Tracking user activity through appropriate metrics beyond just tracking number of downloads of mobile apps will determine the efficacy of the platform. Applying digital analytics helps in estimating the effectiveness of the channel, depth of engagement, as well as ascertains the probability of a revisit. Such analytics is also critical for ensuring any interface related operational problems being detected and addressed in time before they spiral out of control - such as a breakdown in mobile bill payment gateways may lead to void transactions and refund issues.

Ensure Regular Rate of Feature Evolution and Upgrade

After launch, digital platforms require regular upgrades of features and design to retain and increase user engagement (refer to Exhibit 8 - Maturity Model for Digital Customer Service and Support). Customer behavioral analytics should be leveraged to generate insights that can be fed back into comprehensive experience-redesign efforts. These insights will help a design team to redefine the digital experience from the perspective of target users. This may also involve technology updates such as regularly upgrading mobile apps to ensure they are compatible with new versions of the mobile operating systems (iOS, Android, Windows Phone OS, and BlackBerry OS) and new devices (tablets, smart home devices, and smart watch).

Deliver a Seamless Multichannel Customer Support

Utilities should ensure smooth integration of all digital and offline channels to provide a robust anytime, anywhere and any channel experience which is increasingly demanded by Generation Y customers. To secure a multichannel user experience, utilities will have to make significant changes to their existing CRM systems and processes to make it adaptable to support these channels.

Digital technologies are being increasingly adopted by today's customers and have drastically impacted many industries, including the energy utility sector. Further, regulators are also pressurizing utilities to deliver better customer experience and uplift their declining trust on utilities. Utilities urgently need to fix these negative and damaging perceptions of customers. Also, the rollout of smart meters provides an opportunity for utilities to boost customer satisfaction by proactively providing them with prescriptive solutions. Early adopters, who have already ventured on this journey, are realizing the benefits of higher customer acquisition, improved customer satisfaction, and reduced cost-to-serve, among others. They have also witnessed increased operational efficiency across the meter-to-cash process. Nonetheless, every utility has to move up the digital maturity model to enhance their business operations and customer interactions. An effective digital strategy requires long-term vision and organizational rigor with a significant focus on front-office technology developments and operations focused back office processes. Utilities who fail to deliver an engaging customer experience that paves the way for customer loyalty will face the risk of being left behind in this digital era.

References:

i. Office for National Statistics, Labour ,Market Statistics Summary Data Tables 2015

ii. Dimension Data, Global Contact Centre Benchmarking Report, 2015

iii. Ofgem, Customer Engagement with the Energy Market - Tracking survey, 2015

iv. UK Customer Satisfaction Index, January 2016

v. Ofgem, Complaints to Energy Companies, 2014

vi. JD Power, Customer Impact Report - Utility Social Media Interaction, 2013

vii. Ofgem, Retail Energy Markets in 2015

viii. DECC, Smart Metering Implementation Programme, 2015

ix. Gartner, Survey Analysis - How Much Does It Cost to Serve Customers in the Utility Industry?, November 2013