Of late, airlines offer customers the option of transferring points to family members, although sale or trading of points is prohibited. Some loyalty programs also provide innovative redemption options. For example, Aeroplan, Air Canada's loyalty program, lets loyalty card holders pay their college fees with loyalty pointsiii. Air New Zealand's loyal customers can exchange their loyalty points for Hobbit-themed knick-knacks, such as a replica of Gandalf's silver scarfiv. These souvenirs are made by the same weavers who created the textiles used in the Lord of the Rings trilogy. Cathay Pacific enables their loyal customers to swap 15,000 miles for a 'Made in Hong Kong tour' which includes lunch, a trip to a local market and a visit to a tailor, a boot maker and a wood etcheriv.

Nowadays, most airlines offer 'coalition' loyalty programs, allowing passengers to earn and redeem points from multiple sources such as hotels, car rentals and e-commerce websites. Airlines sell points/miles to coalition partners and generate additional revenues at a very high margin. This way, loyalty programs have transformed from being 'cost' centers to 'income' generating centers (Exhibit 2).

Over the years, airlines have forged partnerships and alliances to extend seamless customer service, offer benefits to frequent flyers and enable airlines to hedge risk. For example, airlines have partnered

with banks to come up with co- branded credit cards. Airlines sell miles/points to the credit card partners and make money in the process. Typically, the partner pays a certain sum to the airline for each

new member with a loyalty card. The airline might also be paid on the basis of the revenue generated from interest and fees by the card issuing bank.

The bank, in turn, presents those miles to the customer as an incentive for doing business with them. Since banks which provide co-branded credit cards (with an airline) consider expenses incurred by loyal customers as good debt, they willingly pay to buy miles/points from airlines. In the process, banks benefit every time the card is used in a transaction and customers benefit from earning more loyalty points.

Sometimes, airlines also charge an annual fee from the customer for

these co-branded credit cards. Since air travel is expensive, airlines assume that people flying frequently would be affluent and willing to spend additional dollars for extra benefits. Cathay Pacific, for example, charges HKD 1800 and HKD 980 for American Express Cathay Pacific Elite Credit Card v and American Express Cathay Pacific Credit Cardv respectively.

Delta Air Lines recently renegotiated a deal with American Express. The deal is expected to double Delta's benefits over the

next five yearsvi. United Airlines realized more than half of its ancillary revenue of USD 5.7 Billion through the sale of miles to partners in 2013vii . For major U.S. airlines, most of the ancillary revenue is generated by the sale of frequent flyer milesviii and mostly to co-branded credit cards (Exhibit 3). However, a significant percentage of mile accumulation still happens from flight accruals which are not sold to coalition programs.

By partnering with other channels, airlines are extending the sources, opportunities and frequencies of earning and redeeming miles/points to customers. This

increase in customer touch points across multiple channels, such as car rentals and restaurants, expedite the process of earning points by members. All of this

should make loyalty programs more appealing to customers while also providing impetus to aviation traffic and revenue.

Effects Of Airline Loyalty Programs

Urbanization delivers opportunities to people in search of a higher income and better standard of living. Cities are the main drivers of economic growth and globalization. They attract large multinational corporations and are the hub of international trade, media, transport and foreign tourism. Increase in urbanization has led to increase in GDP per capita (Exhibit 4) - a key driver for growth in aviation traffic.

In 2014, 0.9 million ix long haul passengers flew daily from/to/via 47 cities which constituted 90 percent of the world's long haul1 traffic. Sixty-six percent of these cities were from developed economies ('mature markets'). Demand for medium and long haul travel is usually low with subsistence level income but intensifies as income levels grow.

During the past 10 years, global air traffic demand grew at an average annual rate of 5.3 percent, while global GDP, a proxy for global income growth, grew by an average annual rate of 3.4 percent. This points to an average income elasticity of 1.54, implying economic growth to be another key driver of air travel.

Consequently, developed economies have experienced a high demand for air travel for a long time now, and are currently operating in a mature phase. Growth rates are thus lower compared to developing economies ('emerging markets'), making loyalty programs an important marketing tool in a limited growth market.

WNS DecisionPoint™ measured the degree of potential customer appeal of loyalty programs offered by 75 airlines across the developed and developing economies by grading them on the following value parameters:

- Ease of earning and redeeming points/miles by comparing the number of direct to indirect 2 channels deployed - more channels implying a greater opportunity to earn and redeem points

- Validity of points/miles the higher the period of validity, the greater the chances for customers to earn and redeem more points

- Loyalty tiers more loyalty tiers provide differentiated benefits for varying levels of loyalty

- Points earning structure based on mileage, zone, spend and direct reward ? hybrid model provides greater opportunity to earn points

Based on the data across each of the four parameters, the aggregate score of the airline was calculated. This score was then mapped to one of the categories of potential customer appeal of loyalty programs - Low, Medium or High - on the basis of predetermined classification rules. The impact of loyalty programs was then analyzed across airlines' passenger traffic, revenue enhancement and trends in sales and marketing margins in developed and developing markets.

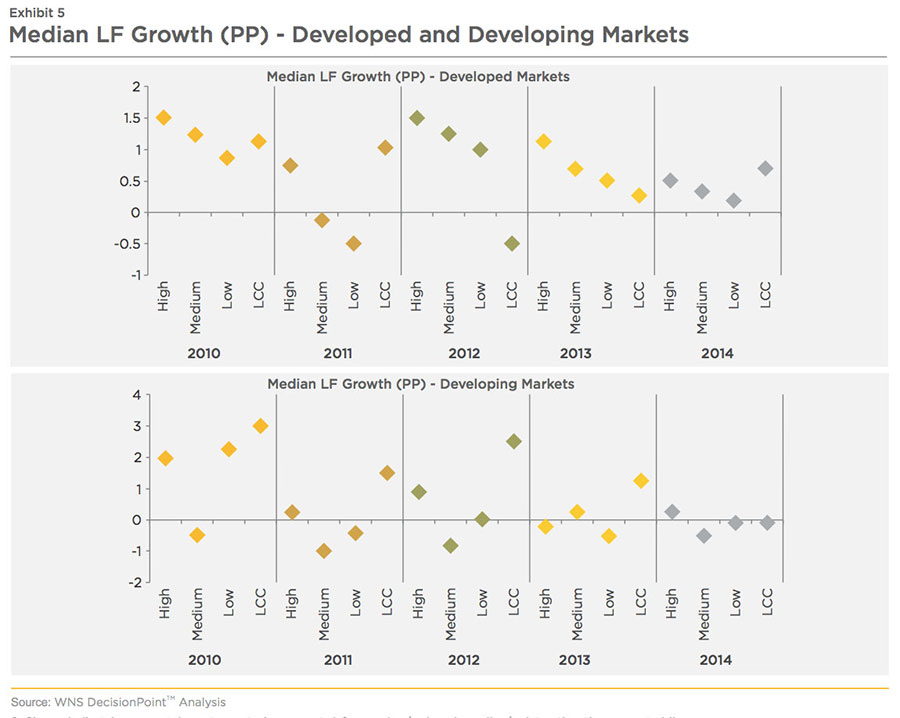

A critical measure of traffic for airlines is Load Factor (LF), which measures capacity utilization. Growth in capacity utilization is dependent on demand for air travel. In 2014, the average load factor (of airlines within the purview of our study) in mature markets was about 80 percent owing to stronger demand, whereas the average load factor in emerging markets was around 76 percent. In developed economies, airlines with a high potential customer appeal of loyalty programs performed better, and consistently experienced high growth (0.45 percentage points (pp) in 2014) in load factor compared to medium (0.30 pp in 2014) and low (0.12 pp in 2014) potential customer appeal of loyalty programs.

Another critical factor for determining the demand of airline traffic is Revenue Passenger Kilometers (RPK). In 2014, median

RPK growth of airlines in mature markets with a high potential customer appeal of loyalty programs was 5.5 percent

compared to 2.7 percent and -0.02 percent for those with medium and low potential customer appeal respectively.

Key performance indicators of airlines such as capacity utilization and demand have close association with macroeconomic factors. The last few years have seen limited progress in these uncontrollable

factors. As a result, developing economies around the globe have experienced decline in both capacity utilization and demand growth. Low-Cost Carriers (LCCs) in these developing markets have

been doing better because a large portion of the market is extremely price-sensitive and a significant percentage are first-time flyers.

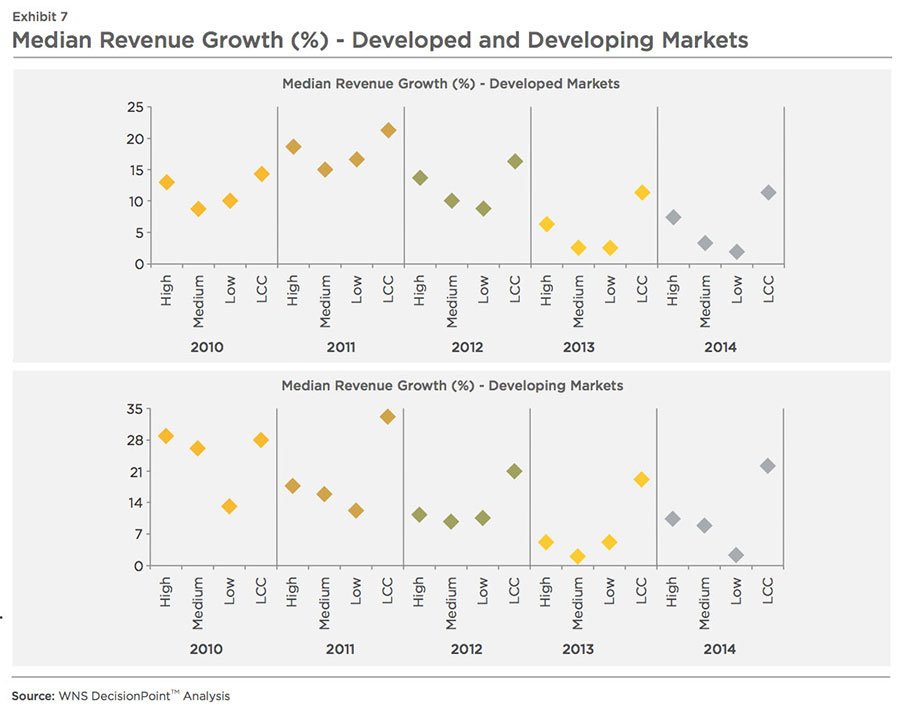

Turbulent economies have affected airlines' revenues in both the developed and developing markets. However, in the mature markets, airlines with a high potential customer appeal of loyalty programs have consistently fared better from 2010 to 2014, with the highest median revenue growth among legacy carriers. In emerging markets, even though revenue growth of LCCs has dipped from 2012 to 2014, they have consistently performed better and maintained a high revenue growth rate compared to the legacy.

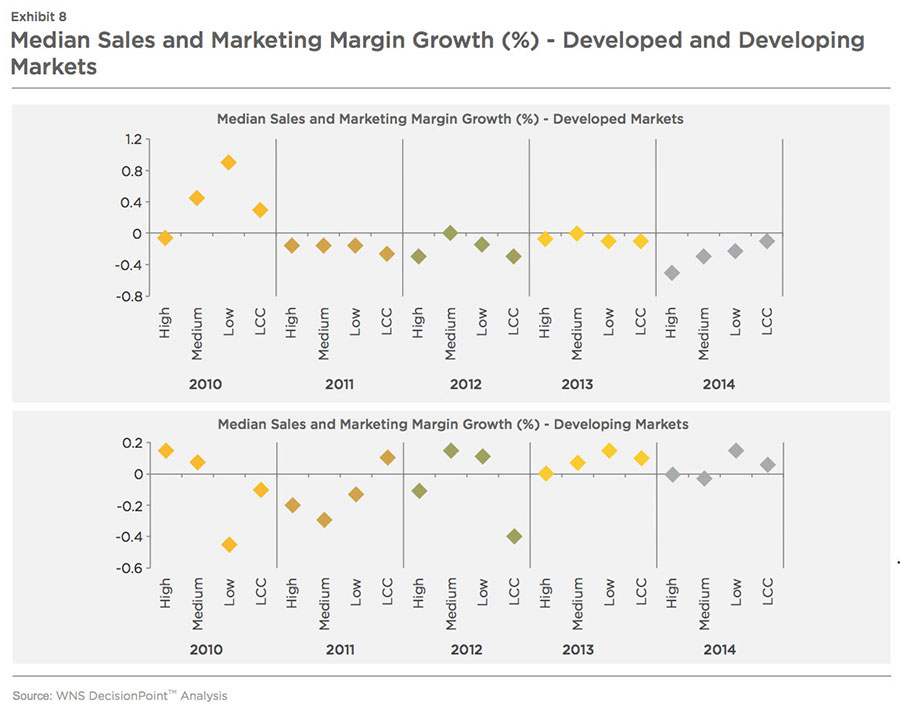

In the presence of robust and

mature loyalty programs, expenditure in sales and marketing is supposed to come down since loyal customers imply repeat business and lower cost to serve. In 2014, when the global economy was showing signs of recovery from its slump, airlines with a high potential customer appeal of loyalty programs in the developed world were the ones who saw the maximum decline in sales and marketing expense as percentage of revenue (median ~ -0.41 pp) compared to those with medium (median ~ -0.28 pp) and low (median ~ -0.18 pp) potential customer appeal of loyalty programs. However, there are airlines which choose to focus heavily on marketing in spite of having robust loyalty programs. United Airlines has consistently maintained the sales and marketing expense at the same level and continued with advertisements on television, radio, print and social media using their quintessential tagline 'Fly the Friendly Skies'. This was inspired by customer feedback that 'userfriendly', in today's day and age, implies an amalgamation of service, product and technology.

In the developed or mature markets, LCCs have maintained a low sales and marketing margin growth. On the other hand, in the developing or emerging markets, where the income elasticity of demand is quite high (Exhibit 9), LCCs, by virtue of their value proposition, create an automatic pull whenever there is a need for travel. Improved economic conditions lead to higher disposable income for consumers, which then leads to a surge in travel demand for legacy carriers. Plus, income elasticity declines (Exhibit 9) as countries become more developed.

Passengers from the developed economies, having moved up the 'hierarchy of needs', demonstrate greater willingness to leverage incremental benefits provided by the loyalty programs. Passengers in emerging markets still base their flight preferences on price and, hence, there is a strong inclination to travel with low-cost airlines. High income elasticity deters these passengers from flying, let alone taking advantage of loyalty programs.

As wealth and economic well-being gives impetus to passenger traffic in the developing countries in Asia, Middle-East, Africa and Latin America, another 29ix long haul traffic hubs are expected to come up. Eighty-seven cities around the globe are expected to surpass the 10,000 daily passenger threshold by 2030ix, from the current list of 47 cities. As the aviation market in developing economies matures further, loyalty programs will become more and more relevant.

A survey by Googlex in 2014 showed that 67 percent of business travelers were keen to try out new and unique loyalty programs. The survey indicates that airlines have to engage more robustly with customers, understand what they need and meet their reward expectation.

Before embarking on the journey to capture markets in emerging countries, it is imperative for airlines to conduct a health-check of their current loyalty programs and take note of their customers' views on the programs' benefits and drawbacks. This would help airlines re-engineer their programs to suit future customers, enabling not only customer retention but also customer lifetime value and profitability. Feedback from current loyalty program users would help airlines identify and associate with appropriate partners. This would simultaneously increase profit share of partners as well, giving them a reason to stay in the partnership.

Travelers' Views On Airline Loyalty Programs

WNS DecisionPoint™ administered a worldwide survey among airline loyalty card holders to obtain their feedback about prevailing loyalty programs and uncover the challenges they face with respect to the programs they are enrolled in. Interviews with senior executives in the airline industry were also conducted to understand the shortcomings of these programs.

Loyalty Programs Lack Customer- Friendly Point Accumulation And Reward Structure

59 percent of survey respondents criticized the insignificant number of points that travel costs and miles convert into. Another 43 percent complained about points translating into meager rewards. Approximately 26 percent of our survey respondents say that the choice of rewards provided by airlines is not lucrative enough. Of them, 22 percent reveal that, from the designated choices, the reward they want to select is scarcely/never available. Lufthansa's customers need 35,000 miles within one calendar year to reach the frequent flyer level and 100,000 miles to qualify for the next level. Since miles cannot be carried forward to the next year, a failure to attain all the miles in one year would mean failure to upgrade to the higher tier.

Loyalty Programs Are Difficult To Redeem

Twenty-five percent of the respondents have not been able to redeem loyalty points as of yet. Of them, almost 20 percent have been holding loyalty cards for more than ten years, 26 percent for five to ten years and another 26 percent for three to five years. Approximately 12 percent of respondents mentioned that the process of redeeming points is not convenient - websites crash and calls with customer care relating to loyalty programs cost them money since the call rates to those numbers are very high. Another 22 percent shared the feedback that restrictive terms and conditions make redeeming points very difficult. Delta's loyalty card holders - 26 percentxi - find the airline's rewards website tough to use; 17 percentxi of frequent flyers of U.S. Airways mention that getting an award from the airline is next to impossible. Failure to redeem loyalty points because of limited seats, blackout dates, quick expiration of points and low redemption value are among the most common issues. Airlines make customers sink significant amounts of time, money and effort before they reach the stage of getting rewarded. But if the customer fails at any one stage, airlines are quick not to reward them.

Loyalty Programs Between Partners Lack Synergy

During our discussions with senior executives of global airlines, it became evident that points earned by a traveler with a partner airline are not always automatically updated. This was pointed out by 14 percent of the survey respondents. It is clear that, in spite of the coalition agreement in place, accumulation of loyalty points is not seamless and that there is a lack of synergy between the airlines and their partners. Earning and burning miles for services availed with partner airlines is a sore point for travelers and this ends up devaluing the loyalty program.

Loyalty Program Benefits Are Diluted

The airline industry in the U.S. came to a virtual standstill after 9/11. Though the number of business travelers has increased over the years, the benefits have remained the same for both the frequent flyers and the less loyal ones. Twenty-eight percent of the survey respondents, of which 84 percent have held a loyalty card for more than 5 years, said that the benefits of loyalty programs are diluted. There are no separate benefits for customers who have been loyal for a longer duration.

Loyalty Programs Do Not Reward Leisure Travelers

The interviews revealed that leisure travelers find it tough to earn and redeem points since they travel infrequently through the year. It takes them a long time to collect enough points to be redeemed. In some cases, the points expire long before becoming redeemable. Worse, even if a passenger comes close to redeeming loyalty points, award seats might be scarce and therefore unavailable.

Nineteen percent of travelers who say that the choice of rewards is not lucrative enough indicated that they are not likely to fly with that airline again. Likewise, 18 percent of the passengers who could not redeem loyalty points for rewards felt that they are less likely to choose that airline the next time they fly. Of the respondents who have not been able to redeem

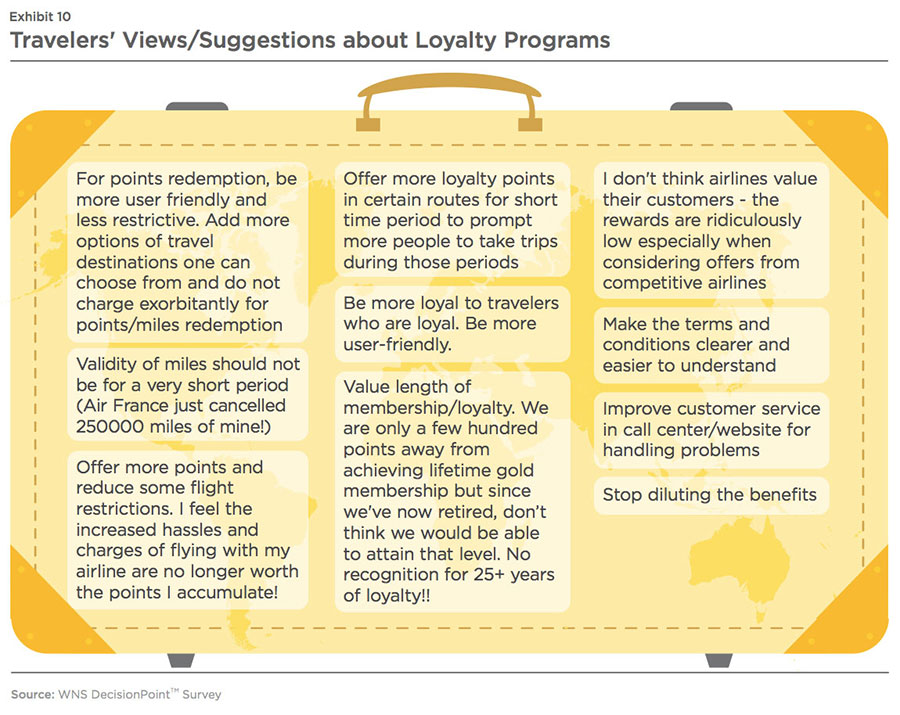

loyalty points, 58 percent say that they are not likely to speak positively of this airline's loyalty program to friends/family/ colleagues. Changing rules overnight, altering programs abruptly and not delivering promised rewards to customers frustrates them (Exhibit 10).

Most of the airlines still provide loyalty points on the basis of miles flown. A first or business class flyer paying five times more than the economy class passenger has no way to avail the benefits of a differentiated loyalty program. Delta Airlines is one of the very few airlines which has recently started assigning points based on fare instead of the distance flown. But then what happens to a customer who covers a small distance, pays a small fare, but flies frequently throughout the year?

Critical Considerations In

Designing A Successful

Loyalty Program

With customers being unhappy about the kind of benefits offered and rating loyalty programs far down in their list of most important

attributes that commonly stimulate brand loyalty, it is time airlines started making their loyalty programs dynamic and rewarding.

WNS DecisionPoint™ recommends a three-pronged approach (Exhibit 11) to transform the current state of loyalty programs.

Improved Segmentation Model

A key element in the strategic design of loyalty programs is segmentation because airlines need to treat their profitable customers differently. Airlines have access to customer data sets including earning and spending history, redemption and length of membership, to name a few. Complete understanding of the current customer data sets and utilization of newer means of obtaining data about customers is necessary to build a robust segmentation model.

One of the ways to dynamically segment customers is by forecasting their probable future revenue and future participation frequency in loyalty programs.

Probable Future Revenue (PFR) can be obtained by considering the revenue generated historically, probable future travel frequency and fare inflation. Probable future travel frequency can be determined based on income, cost of travel, occupation, age, hometown, route convenience and other personal attributes or identifiers. Future Participation Frequency (FPF) can be obtained from historical participation frequency and probability of similar or better future participation frequency. Probability of similar or better future participation frequency is tied to industry attrition rate of loyalty program participants, length of membership in loyalty program, inactivity period, points awarded that participants cannot redeem due to expiration, inadequate balance, and other factors. Participation frequency is the ratio of total loyalty points redeemed to total loyalty points earned in a year.

By identifying quartiles in terms of the PFR and FPF, each customer can then be mapped into a Customer Valuation Matrix (CVM). The CVM will clearly lay out the continuum of participants with high to low future profitability (PFR) and participation frequency (FPF). Since all participants are neither equally profitable for a loyalty program nor of equal priority from a marketing or promotion perspective, the CVM will allow airlines to identify and cater to their high priority segments.

Airlines' loyalty reward allocation should be based on the behavior trends of each segment. To understand behavioral characteristics and sentiments of customers, it is imperative for airlines to tap into real-time social media commentary. Currently, there is low adaptation of social media analytics to drive customer loyalty, as most airlines are using this new digital channel only to resolve queries, tone down negative experiences and promote offers.

But social media is more than just a mere customer service or public relations tool. While many airlines have begun utilizing social media to improve customer engagement rates, the ones who succeed in the future will go further to capture customer insights and tailor customer engagement programs in order to improve their odds of being successful in identifying loyal customers and rewarding them.

Social media analytics has the capability to take unstructured data from online platforms such as Facebook, Twitter, LinkedIn and e-commerce websites, and process it to gauge the behavior of travelers. Each customer segment can then be rewarded based on common features and preferences. Airlines can also calculate the Net Promoter Score3 and identify brand promoters and detractors by this method. This score is a key indicator of loyalty and, by extension, growth.

The vast customer data obtained can help improve not just airline loyalty programs, but other practices like promotions and campaign management as well. Buzz analytics can read signals from social media and identify and prioritize actions related to promotions and campaign management. This form of analytics mines copious data available from online conversations on social media platforms like Facebook and Twitter to derive consumer insights. Insights about customers' behavior and sentiments could be used to orchestrate personalized experiences by taking into consideration the value drivers of each segment. These insights can be used to differentiate the loyalty program from those of peers, and continually reevaluate tier requirements to ensure continued participation of members. With the physical and digital world getting blurred, airlines would need to have an omni-channel presence for conveying relevant information to travelers.

The Return on Investment (RoI) of promotional activities and customer profitability can be gauged by campaign management analytics. This would also establish data-validated best practices which would act as inputs for future campaign design.

Better Interline Partnership Management

The second program component focuses on airline partnerships. Partnerships make earning points complicated for loyalty card holders. Sometimes, partner airlines end up not crediting loyalty points to their travelers, leading to dissatisfaction. One of the ways to improve the current situation is by revamping interline and codeshare partnership management processes, specifically in relation to financial commitments and contractual agreements related to billing and invoicing.

Streamlining partnership management would enable integration of business units, systems and data formats and promote a simpler and effective operating environment for airlines, their partners and customers. With better partnership management, passengers flying with a partner airline would not have to take the effort to call up the airline and update their miles/points. It would be done automatically, accurately and instantly.

Catering To The Underserved

A key feature of any successful loyalty program rests in its ability to offer a broad set of rewards, based on consumers' choices of flying patterns. This essentially puts the focus on a segment that is often ignored - the leisure traveler. Loyalty programs could be designed to cater to this underserved segment. The infrequent travel pattern of this customer segment makes earning and redeeming points difficult.

Yet airlines continue to offer cookie-cutter loyalty programs for all their flyers.

After identifying high value customers and their flying behavior, they should be provided with discounted fare offers at times when their likelihood of travel is high. At the same time, target customers should be offered loyalty programs which have a wide window to earn and redeem points. While the former attracts passengers, the latter, by virtue of its reward structure, has the ability to reinforce a traveler's belief in the airline.

To gauge the travel patterns of leisure travelers, airlines should utilize unstructured data like social intelligence, customer call transcripts, web-logs, emails and structured data like month-wise travel bookings, destinations frequented and ancillary products purchased. This data can bring out unique personality traits, interests and lifestyle patterns, resulting in improved behavior anticipation. Airlines can use this information to personalize fare discounts, hotel- airline combo packs, and other travel-oriented services. With this level of personalization, carriers can stay at the top of customers' mind whenever there is a travel need, increase their chances of getting a higher wallet share and pave the way for obtaining loyal leisure customers in the future.

This three-pronged approach (Exhibit 12) not only makes airline loyalty programs customer- centered but also exhaustive by taking into account the underserved segment of travelers.

Re-Evaluating Loyalty Programs

With a 43-fold growth in overall data volume from 2009 to 2020, the total data is expected to reach 43 zettabytesxiii. By 2017, half of analytics implementations will mine data real-time. It is an opportune moment for airlines to make their loyalty programs dynamic and segment specific to suit their customers' needs.

However, equally important is to maintain a close eye on a loyalty program's lifetime and track interactions between incremental revenue and incurred costs (Exhibit 13).

Loyalty program analytics can help airlines evaluate the relationship between the total number of loyalty points awarded versus the points redeemed and the cost of the loyalty program versus increase in revenue, increase in traffic and growth in social advocacy for each customer segment.

This will also help airlines with decisions pertaining to rewards structure and related promotional offers. This will also enable airlines to adjust their program levers till they hit a profitable relationship between incremental cost and revenue.

Stride Back To Leverage Opportunities Ahead

By 2034, China, the U.S., India, Indonesia and Brazil will be the fastest growing markets with respect to additional passengers flying every yearxiv owing to:

- Improved aviation demand due to better living standards

- Favorable population and demographic combinations (population decline or growth, percentage of working population and younger population)

- Increasing afford ability of air travel (since 1950, unit cost of air transport has declined by a factor of four)

As the aviation market in developed economies matures further, well-designed loyalty programs will become more relevant. The WNS DecisionPoint™ study revealed that loyalty programs are helping airlines improve load factor, generate higher RPM, and increase revenue while, at the same time, lowering sales and marketing expenses in mature markets. However, the WNS DecisionPoint™ survey unearthed numerous problems that travelers face with respect to loyalty programs.

In view of the survey results, we strongly advocate the need for airlines to design a well-structured, dynamic, and rewarding loyalty program. WNS DecisionPoint™recommends the three-pronged approach - Customer Valuation Matrix for segmentation, interline partnership management, and catering to the under served. WNS DecisionPoint™ also recommends a cost-benefit analysis of loyalty programs so that airlines can continuously monitor the performance and worthiness of their loyalty programs. A loyalty program can sustain only if it benefits both travelers and airlines.

References:

i. IBM - Airline Loyalty Program, Making it Much More than a Discount Card, 2013

ii. Colloquy - The 2015 COLLOQUY Loyalty Census, 2015

iii. Bloomberg - In Canada, You Can Pay for College with Frequent-Flyer Miles, 2015

iv. CNBC - Wine, weddings and Hobbits! Wacky flier rewards revealed, 2015

v. American Express - American Express® Cathay Pacific Elite Credit Card

vi. Bloomberg - American Express Renews Biggest Airline Card Deal with Delta, 2014

vii. SLoyalty Traveler - United Airlines Miles Purchase is Primary Ancillary Revenue Generator, 2014

viii. IdeaWorks Company - Airline Ancillary Revenue Projected to be USD 59.2 billion Worldwide in 2015, 2015

ix. Airbus - Global Market Forecast - 2015-2034

x. thinkwithGoogle - The 2014 Traveler's Road to Decision, 2014

xi. MileCards.com - 2014 Mile Satisfaction Survey, 2014

xii. Deloitte study - Rising above the Clouds Charting a course for renewed airline consumer loyalty, 2013

xiii. insideBIGDATA- 2016 Data Trends and 5 Reasons Companies Fail to Drive Value with Data, 2016

xiv. IATA - New IATA Passenger Forecast Reveals Fast- Growing Markets of the Future, 2014