From 2006 to 2013, the U.S. consistently experienced the highest healthcare expenditure (due to inflation and an imbalanced federal budget) as a percent of GDP compared to the world's top ten economies based on nominal GDP. Therefore, for the U.S., reducing healthcare cost was long overdue. In addition, with a steadily increasing number of uninsured people (from 46.3 million in 2008 to 49.9 million in 2010), the U.S. needed to expand its insured population pool. What is more, with the population aged 65 and above projected to reach 83.7 million in 2050 (from 43.1 million in 2012), the U.S. had to improve the quality of its advanced care needs.

To address all these problems, the Patient Protection and Affordable Care Act (PPACA), generally called the Affordable Care Act (ACA) or informally Obamacare, was enacted in March 2010. The federal statute is meant to provide affordable private and public health care insurance to more and more Americans by introducing new subsidies and taxes on citizens. The ACA expands Medicaid3 to persons and families earning lower than 138 percent of the Federal Poverty Level, expands the benefits of Medicare4 at no additional cost and introduces insurance exchanges to enable procurement of subsidized insurance without the intervention of a broker.

Exhibit 1 depicts the inter- relationship between various stakeholders in the U.S. healthcare eco-system prior to the ACA. The insured population had access to an entire body of providers, whereas the uninsured had access to hospitals only in case of emergencies. The emergency departments of hospitals were mandated by Federal law to treat and stabilize all treatment-seeking individuals. Healthcare providers could choose not to treat the uninsured patients in non-emergency situations. If they did treat the uninsured in a non-emergency situation and the patients were unable to pay for the treatment received, the bills got registered as bad medical debts. The U.S. hospitals recorded uncompensated care costs (bad debts and charity care) to the extent of about $50 billion in 2013 as per the reported statistics by American Hospital Association (the AHA)ii.

Insurers' Prospect

The Affordable Care Act disallows premium differentiation on the basis of gender or pre-existing medical conditions and mandates the provision of providing affordable healthcare. With this, health insurance companies could run the risk of declining margins if they fail to adhere to the directives or prevent such a situation, by adopting several mitigation measures to minimize the impact arising from the directives. However, the ACA also offers opportunities to tap into the market of approximately 41 million uninsured Americans, which would have diverse implications on pricing and markets served. WNS DecisionPoint™ analyzed several such opportunities and risks arising due to the ACA and suggests mitigations measures respectively to deal with the revised health insurance landscape in the U.S. (Exhibit 3).

Risks

Inability to Meet MLR Guidelines Due to Operating Inefficiencies

With the advent of ACA, if the MLR is less than 80 percent (individual and small group market) or 85 percent (large group market), insurers would have to refund the deficit to their customers. In 2015, insurers paid $469 million to about 5.5 millioni people in MLR rebates. Insurers have to spend the stipulated amount on improving "quality of healthcare", which might include ways to prevent hospital readmission; improve patient safety and wellness; keep track of utilization of drugs; and introduce fraud and abuse prevention programmes. The U.S. Department of Health and Human Services (HHS) has also allowed insurers to compute a certain proportion of ICD - 108 implementation costs towards improvement of quality of healthcare. However, the insurers cannot use premium dollars for collecting clinical data without conducting analysis or covering marketing and management expenses or broker commissions. Those expenses have to be accounted for in the remaining 15-20 percent of the premium dollars.

An easy bail out of this situation would be to raise premium prices. But such an approach would contradict the idea of providing affordable healthcare. Plus, the U.S. health insurance industry is not oligopolistic in nature and the Government has introduced levers (such as the marketplace/ exchange) to prevent a rise in premium cost. Hence, the insurers need to optimize 15-20 percent of their premium dollars to the maximum to earn profits. Keeping premiums constant, insurers can only increase profits by reducing their administrative overheads. Even if they have to refund the deficit to customers, the insurer will have a higher profit pool to pay the rebate from.

WNS DDecisionPoint™ conducted a DuPont Analysis9 of top 10 U.S. health insurers over 2009-15. It was observed that Return on Equity (RoE) declined in 2015 compared to 2009, primarily driven by operating inefficiency (Exhibit 4).

Also, insurers maintaining a higher RoE levels have been able to generate better shareholder value (correlation co-efficient (r) of 0.8 with p10 < .05 (alpha = .05)) (Exhibit 5)

According to analysis by WNS DecisionPoint™, a one percent reduction in operations costs (underwriting and claim processing costs) would improve RoE by 220 basis points and Return on Assets (RoA) by 74 basis points.

This would not only help insurers optimize 15-20 percent of their premium dollars and create additional profit but also maximize the wealth of its shareholders.

Failure to Write Profitable but Affordable Products

With the mandate of making premiums gender and pre-existing conditions independent, a game theory condition may arise, whereby, healthy customers might choose not to buy health insurance (and pay a nominal penalty annually, which is much less than the cost of premiums) until the time they get sick. Thus, the ratio of people with an expensive illness will rise and the cost per insured person will increase. This would force insurers to increase premium prices. The average health care premium price for plans bought on the Federal Exchange is expected to increase by 7.5 percentiii in 2016. The average price of a standard Silver11 plan in major cities across 10 states and District of Columbia is expected to increase by 4.4 percent in 2016 as compared to 2015iv.

Failure to Correctly Predict Premium Prices

Predicting premium costs becomes challenging for products sold in individual markets since they depend on numerous variables such as household age, income and size and medical history and there is a lack of availability of systematic nationwide data about premiums in the individual market prior to the ACA. Insurers, therefore, run the risk of losing out on enrolling new and repeat customers if the premium is too high or lose out on margin if it is too low.

Concentrated Competition in Marketplace

In "marketplace/exchange", customers can compare and choose policies depending upon their requirement, budget and subsidy they are eligible for. It also leads to the power of premium pricing being taken away from health insurers and put into the hands of consumers in a competitive marketplace. Even with insurers being barred by regulators, acquisitions by other insurers and their withdrawal from the exchange markets, customers can choose plans from about 290 exchange-participating insures in 2016. In addition, with the evolution of private exchanges, where employers can purchase health insurance plans and then the employees choose one from among the options provided by the participating insurers, being flexible in designing relevant products for unsubsidized consumers is the key to thrive in the concentrated competitive environment.

Competition From DPC Models

An alternative payment structure called the Direct Primary Care (DPC) model typically charges patients either a flat monthly, quarterly or annual fee covering most of their primary care needs such as clinical, laboratory or other comprehensive care management needs. DPC model follows retainer billings and is different from fee-for-service insurance billing. It is a lucrative option for customers as well since companies with the DPC billing model charge lower fees (median fees of $80) with no hassles related to claims. Plus, DPC companies provide quicker access to doctors/ physicians and ensure greater share of their attention. DPC model covers 80 percent of frequent diseases and primary care services. However, for the rest 20 percent of expensive illnesses, patients are recommended to purchase wraparound policies from insurance companies. Thus, insurers would be left to cover only high risk diseases , which would have adverse effect on their margins.

Failure to Contain Rising Healthcare Costs

From 2014 to 2024, healthcare spend in the U.S. is expected to grow at an average rate of 5.8 percent per yearv. To contain rising medical costs, insurers could team up with ACOs and medical homes12 and can analyze data on the latest treatment measures. Evaluation of remedy effectiveness can help in adoption of beneficial treatment methods and, therefore, reduce readmission rates. Plus, insurers, together with providers, can provide patients extended access to a bigger network of doctors/physicians. However, even after these collaborative arrangements, if improvement in treatment is not achieved, healthcare costs would only escalate.

Opportunities

Affordable Care Act opens up a range of opportunities for insurers. Though the risks are high, the opportunity to generate business is significant, if risks are tackled well and resources are used wisely.

Increase Business Prospects

First and foremost, there is business opportunity from about 41 million uninsured Americans. Assume 10 percent get insured in the first year. If an insurer could tap even one percent of the population, who decided to get insured in the first year and insure ~3500 people every month for 12 months; considering $235vi as the average monthly premium per person in the individual market, the company can gain an additional ~$63 million in that year. Insurers must conduct market deep dives to assess the underlying area-specific risks and trace higher-profitability markets that can be served efficiently.

Broaden the Reach of Healthcare

With the introduction of the marketplace, there is an opportunity for insurers to sell insurance by tapping customers the retailer way i.e., segmenting, targeting and then positioning. A pre-requisite for this would be to estimate demand, demographically and geographically; understand competitors and their products in various segments; determine which markets to cater to; and then write profitable and competitive products and communicate product details through various channels(as preferred by customers). This would help mitigate direct competition in public and private exchanges and otherwise.

But in order to hold on to the opportunities, insurers must leverage the presence of huge data sets effectively.

To start with, insurers must start analyzing data they already possess. Demography and transactional history through claims; psychographics through emails and chat transcripts, past history of attending preventive care programs; past health records through website logins; and usage of prescription drugs can be analyzed to not only identify the profitable markets but to identify target customer segments and design outreach campaigns, accordingly to increase participation in wellness programmes. Greater involvement of customers in self-management of care will lead to improved health outcomes, lower claims and improved margins.

The mitigation tactics and implications raise a separate set of questions to ponder over, across the entire health insurance value chain spanning product development and pricing, sales and marketing, care management, strategic alliances and risk management.

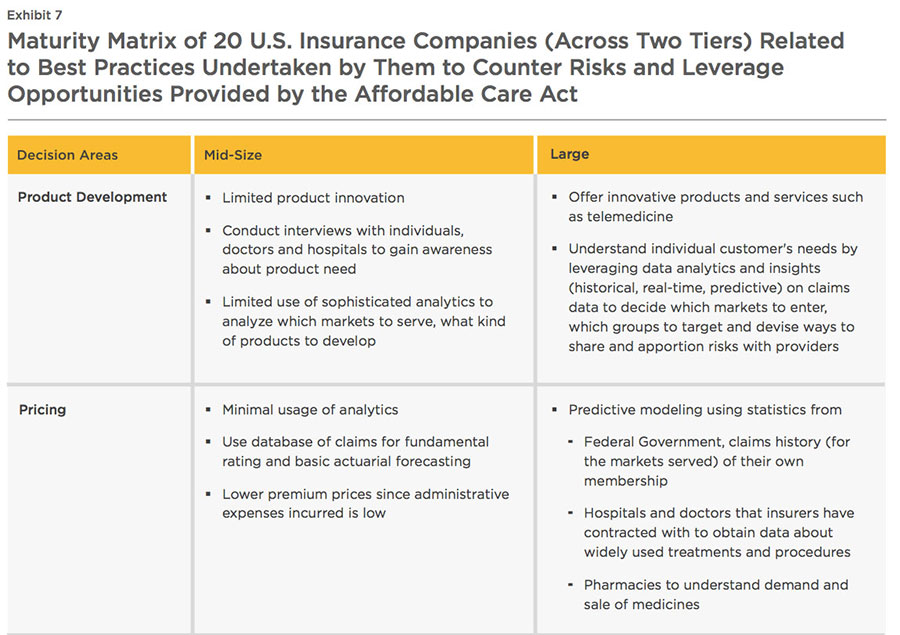

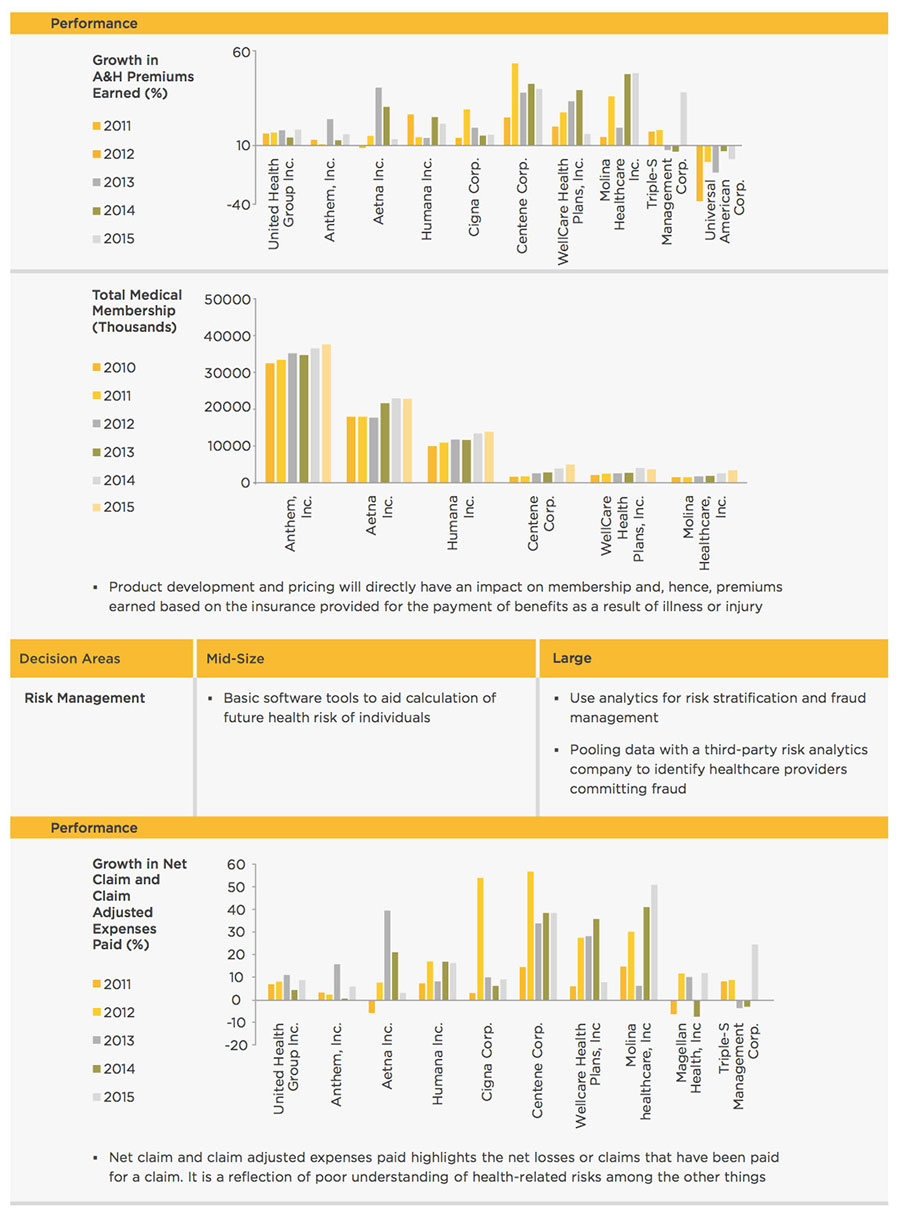

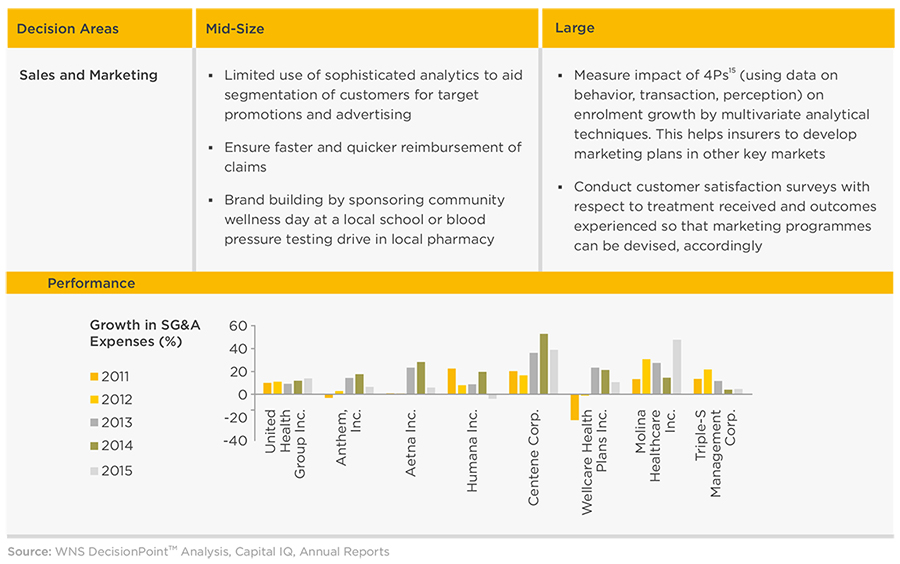

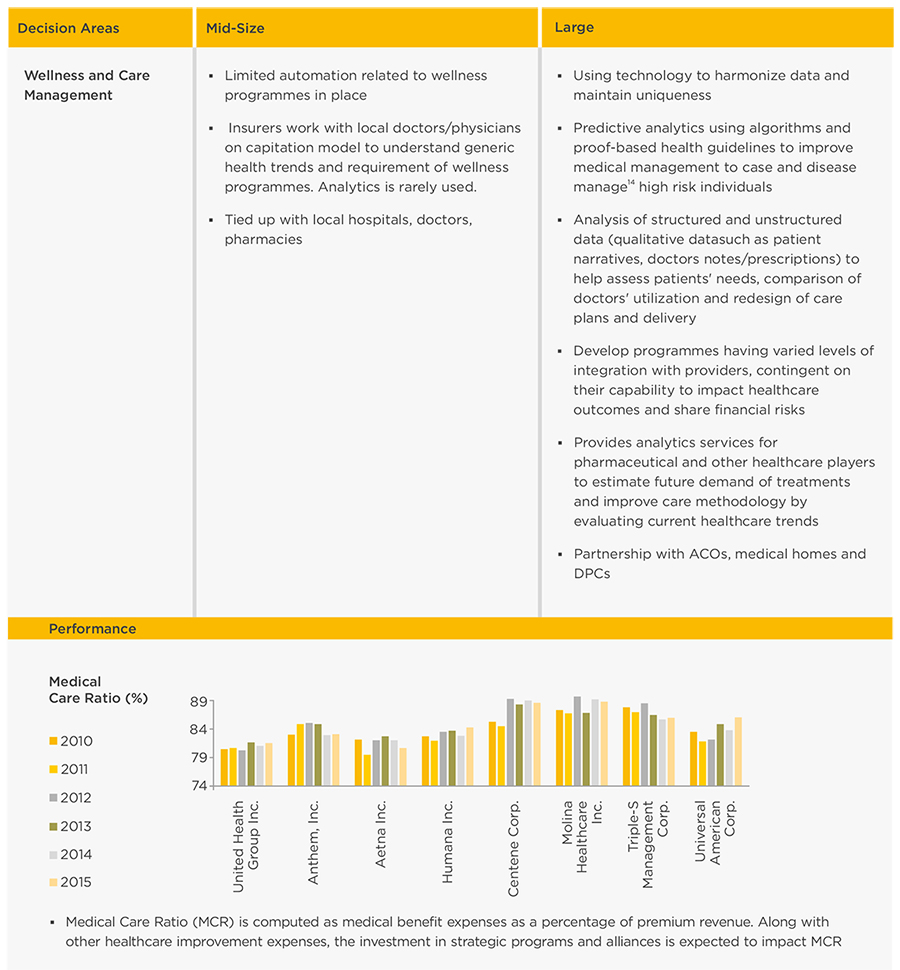

Insurers' Maturity In Light Of ACA

WNS DecisionPoint™ conducted a detailed study of 20 Insurance companies in the U.S. across various revenue tiers to understand the initiatives undertaken to counter the impact of the Affordable Care Act (Exhibit 7). Companies with latest annual revenues greater than $1 billion were classified as "large" companies, while those with revenues less than $1 billion were classified as mid-size ones. A sample of 10 companies was studied across each tier.

Maturity Of "Large" Players

To refine understanding of various marketing levers such as product, price, promotions and distribution based upon the markets served, one of the large insurers has tied up with a specialist analytics company and has also developed a platform to capture and analyze both structured (economic and demographic variables) and unstructured data (such as doctors' notes and prescriptions, laboratory reports and procedure data). The insights regarding health trends, best practices and patients' response to treatment types are then used by the insurer to help their partner ACOs redesign patients' care delivery.

A health insurance leader in this segment envisaged the risk of their customers developing metabolic syndrome, which helped the identified population set take precautionary measures. This reduced healthcare costs and resulted in lower claims. Similarly, another player in this segment leveraged clinical analytics capability to identify high-risk members and provide them with suitable care measures.

For pricing their products, the companies use forecasting techniques such as regression analysis on data obtained from Federal government (claims history), hospitals (treatments widely offered) and pharmacies (in-demand drugs) to gauge future health risks of customer pool and determine medical requirements in terms of physician interventions and medicines.

These companies are also focused on digital health technologies, such as portable diagnostic technologies, wearable sensors, and health/fitness apps, which could empower customers to take more ownership of their wellness and, therefore, revolutionize care delivery. They also can help health care providers, insurers, and others analyze a growing body of data to customize recommendation by taking into account personal context and situational data and measure treatment outcomes to better tailor patient interventions. Not only insurers, but providers could use data generated by these personal wearable devices to better manage care and control healthcare costs. With these data, pharmaceutical companies could also run clinical tests and based on trial outcomes, favour reimbursement. Technology has also enabled insurers to elevate care performance (through better assessment of risk, better product design) by knowing their customers better - for example, initially if a person moved from a group to an individual plan, the insurers would consider them as two different members and not leverage information already available. This partnership also helps insurers with quick, safe and appropriate ways to manage the health coverage of individuals, obtain information about physicians and claims anytime, anywhere using smartphones and tablets. For example, Electronic Health Records (EHRs) accessible to both providers and payors enable them to have a better understanding of the health and medical conditions of patients. Some of the insurers offer innovative services such as telemedicine, where hospitals provide care to patients through video conferencing, broadcasting of still images, remote monitoring and imparting basic medical education in remote areas.

Most of the payors provide robust programmes to meet MLR guidelines such as providing hospitals with ways to improve patient care and decrease healthcare costs. One of the top ten insurers is proactively coming up with better-designed care management programmes by leveraging best and successful practices of partner hospitals/ACOs and by comparing prescriptions of doctors with respect to similar medical cases. Most of the other insurance companies are conducting various wellness and disease management13 programmes, vision care for children and adults and providing health coaching.

But payors in this tier are doing much less to counter competition from DPC providers. With the introduction of an insurance marketplace, it is now important for payors to come up with new ways to reach out and market their products to customers to create a higher recall instead of the prevalent traditional direct customer marketing, telemarketing and direct mailing outreach strategy.

Maturity Of "Mid-Size" Players

Insurers in this segment deal with a smaller population set. Hence, interactions with individuals, hospitals and doctors are considered to be sufficient for comprehending product needs. Armed with the database of claims used for basic actuarial forecasting and an understanding about individuals' affordability and estimation of health risk, insurance companies can effectively design their product offerings.

The Insurance companies in this category focus on direct and targeted marketing. For instance, they might sponsor community wellness day at a local school or a blood pressure testing initiative at local pharmacy.

Leveraging Opportunities Head On - Course Ahead

Based on a study of 20 insurers and interviews with experts in the U.S. insurance industry, WNS DecisionPoint™ proposes two approaches (Exhibit 8) to not only comply with the mandates of Affordable Care Act but to tackle operating inefficiencies and outpace competition.

Quick Impact Solutions

Insurance companies may focus on implementing programmes at the very beginning which require:

- Low investments in capital and capability build-up

- Minimal new infrastructure set-up

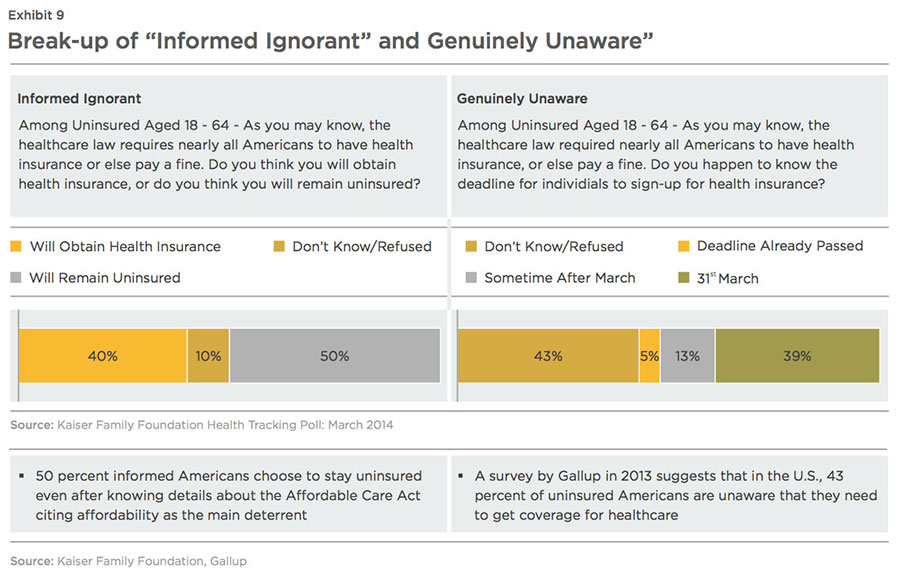

Since Affordable Care Act is prescriptive in nature, there is not much scope for differentiation on the basis of products. Typically, customers would choose products that would cover for expenses pertaining to the hospitals/ physicians they go to and medications they take. Before ACA, most of the insurers would reach out to companies to sell their products. But now, in order to bring more individuals under insurance cover, there is a shift to selling products to individuals. With the market undergoing a paradigm shift from being Business-to-Business (B2B) focused to selling directly to customers (B2C), providing exceptional customer service would become the key differentiator to retain policyholders in the long term. But the problem lies in the fact that the uninsured pool of the population is either not keen to buy insurance until the time they get sick (and willing to pay a nominal fine annually, which is far lower than the annual cost of insurance) and are difficult to engage; or they are completely unaware about insurance coverage options and benefits. While the former comprises the "informed ignorant" bracket, the latter are "genuinely unaware" (Exhibit 9).

While both groups need to be informed about the changes brought about by ACA, the information needs of both groups differ greatly.

Simplify Insurance for the "Informed Ignorant"

Fifty percent of Americans, who know about Obamacare, but choose to stay uninsured, quote affordability as the main constraint. With either the traditional insurance plan or high deductible plan, there is some or significant out of pocket expenses. But, even if they have to pay a small fine annually for not taking up an insurance plan, it would be a much cheaper option than paying for insurance annually. Plus, they can always get insured if they are sick.

The question of affordability can be countered by pairing insurance with credit card payments. The customer can be provided with an option to pay their insurance premiums with the help of credit cards at lower interest rates. This will distribute the insurance related expenses over a period of time and make buying insurance a more viable option.

The insurance companies can provide loyalty points for premiums paid by a customer. These loyalty points can then be redeemed through other channels such as drug stores, wellness programmes etc., depending upon the partnerships made by the insurance companies.

Reach Out to the "Genuinely Unaware"

There is a large number of the uninsured population, who are completely unaware of the Federal healthcare laws. Only a handful know if they qualify for Medicaid or other subsidies offered by the Federal government. In order to bring this vast population under the insurance coverage, they have to be educated about the benefits of insurance and ways to get enrolled. The most common means to reach out to them would be through community centres, churches or grocery stores (Exhibit 10). Insurers, in their markets, can spread the word about the features of various products, the provider coverage, subsidies etc., though these mediums. This would increase the awareness level of the uninsured and increase their chances of getting insured.

Customer Management for All - Customers and Providers Alike

With competitive stakes intensifying, quality customer service will drive differentiation between various health insurance brands. Insurers need to display greater customer-centricity towards repeat/long-tenured policyholders and provide them with dedicated relationship managers, while for all the other customers, specialized customer query and confusion management departments could be set up.

The same approach is applicable while managing collaborative relationships with providers. Providers have to exert a large amount of effort to get their costs reimbursed. In the presence of an effective customer management department, the providers can be updated about their payment dates. Alternatively, insurers can arrange for a pick-up of receipts and documents related to reimbursements to make the entire process easier and smoother. This ensures transparency and will lead to an increase in providers' faith in the insurer, which would further create a positive goodwill in the market.

Future Impact Solutions

Apart from implementing quick impact solutions, insurers need to embark upon long-term programmes, whose benefits may only be visible after five to seven years. Such programmes would require the employment of skilled and specialized resources and investments in technology infrastructure such as advanced analytical tools and technologies, but they would be indispensable for the success of a health insurance company. To start with, insurers need to:

- Reach out to the uninsured to determine health risk: Through a series of marketing efforts, which can include communicating to customers through community centres, churches, grocery/departmental stores, newspapers or television, insurance companies will be able to reach out to a wider set of customers. Insurers can run awareness programmes to educate this population about the benefits of healthcare coverage. Once, customers have provided their details as part of such programmes, insurers can use this information to determine their healthcare risks for the future and recommend suitable coverage products. Insurance companies can also forecast health trends, risks and customers' need from the data obtained with respect to age, gender, geography, smoking habits, assessment of episodic and chronic diseases and catastrophes. With these data sets, profitable products for the uninsured, for which no data currently exists, can be written.

-

Determine the mix of lifestyle and disease management programmes: Based on the risks studied and predicted, insurers can decide on the wellness programmes to be undertaken. According to an articlevii in a leading journal of health policy thought and research, return on investment(RoI) for lifestyle management16 was $0.48, whereas the RoI for disease management was $3.78 for every $ 1.0 of investment. However, percentage of programmes dedicated to lifestyle management and disease management would depend upon current and future healthcare trends in specific geographic areas. Since both these measures would demand significant time and effort from individuals, convincing them about the benefits of these programmes is crucial. Targeted communication through calls or community events would be the ideal way to reach out to individuals with personalized messages depending upon the preferences of various customer segments. Sharing results of such interventions regularly with the individuals would reinforce their belief in the programmes.

- Risk sharing with physicians and hospitals: Be it for wellness programmes or for treating the sick in general in hospitals, insurance companies need to be aware of the performance of physicians and hospitals they are associated with. Tracking performance of various physicians and doctors (for a particular set of diseases) would enable insurance companies not only to compare the medical outcomes but also understand the best practices that can be adopted to improve care management. Insurance companies could also link bonuses and penalties based on the effectiveness and outcome (utilization) of medical care and treatment. This way, not only the insurers, but also the providers/physicians, run the risk of losing dollars due to ineffectual treatment since the bonus and penalty would depend upon the achievement of health improvement and prevention of readmission. This policy has the ability to reward exceptional performers which would encourage improvement in diagnosis and treatment, reduce claims and add to an insurance company's margin

Higher enrolment along with premium rate inflation post the implementation of Affordable Care Act, has boosted the industry's top-line during the last few years (average revenue growth in 2009 was 3.7 percent compared to 16.5 percent in 2015). However, the insurers experienced decline in operating efficiency (refer to DuPont analysis, page 10)and as highlighted by the declining underwriting profits in 2015 compared to 2009 (Exhibit 10).

Streamlining workflows and processes can help health insurers improve their operating efficiency. One of the ways to do the same could be by reducing the underwriting and claims processing costs. This would further help insurers decrease their premium prices. With the movement of consumers towards public and private health exchanges, insurers providing competitively priced premiums will gain an upper hand in winning customers.

According to a study by America's Health Insurance Plansviii, about 79 percent of claims in 2011 were settled automatically. The rest were manually processed at a cost of $1.36 per claim. In case a claim was not settled in the first round, it had to be re-settled, which increased the per unit processing cost to $3.99. The same study quotes that moving from manual (paper claims) to automated claims processing system can save up to 50 percent of the cost incurred while processing paper claims. According to the survey, the cycle time of processing claims can be reduced from 30-60 days (time taken for manual processing) to a week or two with automation. This helps in increasing the insurer's productivity, cost-effectiveness and solves issues related to budgeting, cash flow and allocation of resources. Costs can also be reduced through streamlining operations by means of document scanning, data capture, forms processing, indexing and categorization and data conversion.

Profitability can be influenced by positive underwriting income. While profiles with low-risk can run with automated quote generation, the high-risk profiles would require the intervention of experienced underwriters. Analytics tools and new data types such as doctors' notes and prescriptions, laboratory reports and procedure data can help underwriters assess risk decisions faster and with a high degree of accuracy. Technology, new tools for underwriting risk, data monitoring and outsourcing, if used effectively, can free underwriters from the task of reviewing all applications and would allow them to get involved with other activities such as strategic decision making and sales. This improvement in cost and speed would have a positive impact on not only the insurers and underwriters but customers as well. Insurers could well pass on the cost savings to the customer by decreasing the premium prices.

Conclusion

Due to tightened healthcare reforms by virtue of Affordable Care Act, the health insurance companies in the U.S. are exposed to a plethora of risks. Amidst poor profit margins and increase in cost structure post the launch of Affordable Care Act, insurers are not helping themselves by concentrating on point solutions in the health insurance value chain. The only way to thrive and survive is by adopting a well-rounded strategy concentrating on insuring more Americans, attaining cost- efficiency and thus, improving margins.

Improving customer service would be an important factor with the market moving from being B2B to becoming B2C focused - this initiative requiring low capital investment and capability augmentation in terms of specialized skill set and minimal new infrastructure set-up would display greater customer-centricity towards repeat/long-tenured policyholders. At the same time, insurers could try to attract customers whose primary concern is affordability by partnering with banks offering credit cards at low interest rates and loyalty points.

Similarly, insurers could reach out to the uninsured population, who are unaware of benefits of insurance.

Insurers should also think long- term and invest in skills and technology that will enable them to succeed. As insurers outgrow their traditional roles, they could devote more focus on ways to improve care management not just through providing a set of well- thought wellness programmes but also through devising ways to improve the performance and accountability of providers in general.

References:

i. Healthinsurance.org - Medical loss ratio returns $2.4 billion to consumers, 2016

ii. Marketrealist - A must-read overview of US hospital industry spending, 2014

iii. Centers for Medicare & Medicaid Services - 2016 Marketplace Affordability Snapshot, 2015

iv. Kaiser Family Foundation - Analysis of 2016 Premium Changes and Insurer Participation in the Affordable Care Act's Health Insurance Marketplaces, 2015

v. Centers for Medicare and Medicaid Services - National Health Expenditure Projections 2014

vi. Kaiser Family Foundation - Average Monthly Premiums Per Person in the Individual Market, 2013

vii. Managing manifest diseases, but not health risks, saved PepsiCo money over seven years by John P. Caloyeras, Hangsheng Liu, Ellen Exum, Megan Broderick and Soeren Mattke, 2014

viii.America's Health Insurance Plans (a national political advocacy and trade association which has approximately 1,300 member companies selling health insurance coverage to more than 200M Americans) - An Updated Survey of Health Insurance Claims Receipt and Processing Times, 2013

Other Sources Referred:

a) Gallup - In U.S., Uninsured Rate Dips to 11.9% in First Quarter, 2015

b) ObamaCare Facts - Facts on the Affordable Care Act

c) Kaiser Family Foundation - Kaiser Health Tracking Poll: March 2014

d) Gallup - In U.S., 43% of Uninsured Unaware They Must Get Coverage, 2013