After bouncing back from a global downturn, airlines now have the formidable task of protecting their bottom lines in the face of tough headwinds such as labor costs and maintenance of old fleet. Airlines will need to curb the erosion of revenue and increase it via ancillary products through direct (airlines' websites) and indirect channels (travel agencies). With booking volumes through travel agencies predicted to drop from 67 percent in 2016 to 55 percent by 2021, it's imperative for airlines to find ways to maximize the ancillary revenue through this channel.

The introduction of New Distribution Capability (NDC), a new XML-based data transmission standard, will help airlines in this direction by enhancing the communication between airlines, travel agents and travelers and allow airlines to:

To push customized ancillary offers through travel agents, it's now more critical than ever for airlines to leverage the power of analytics. With analytics, they can assess customers' overall purchase and spend patterns around ancillary products/services by drawing insights from the booking data extracted from their websites and travel agencies.

By 2020, the potential for ancillary revenue growth in the airline industry is expected to touch USD 130 billion. But to maximize ancillary revenue, airlines will need a better understanding of customer behavior. In this effort, analytics can help airlines draw insights from customer data which in turn can be used in conjunction with the New Distribution Capability data transmission standard ("NDC standard") to improve impact of ancillary offerings on customer engagement, choice, and satisfaction and on total revenue.

Redefining Interactions With Traveler

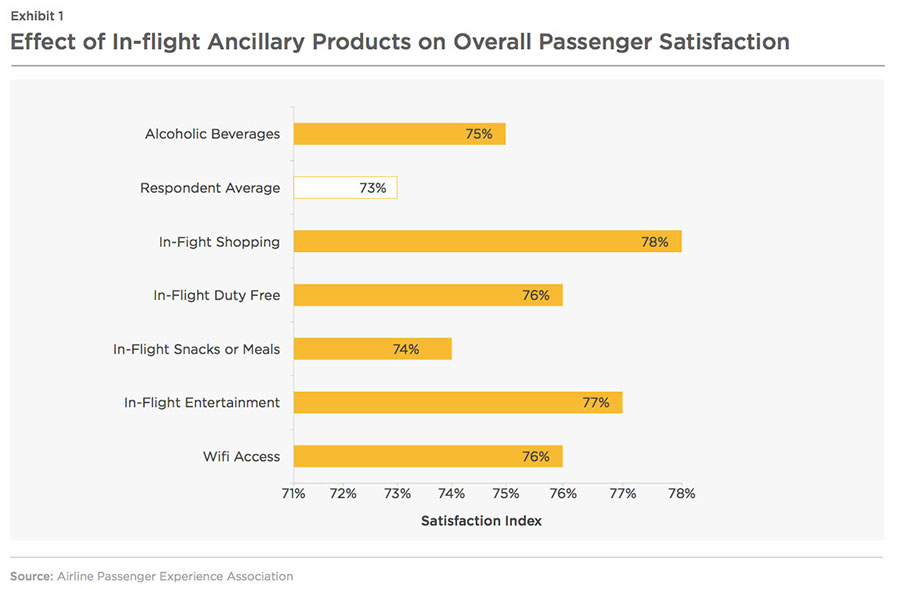

Accelarated growth in aviation fuel prices in 2008 resulted in high operating cost for airlines which was compensated by increase in ticket prices. Meeting resistance from price - sensitive customers, airlines sought solace from ancillary revenue - a means to maintain steady top line without intimidating customers. This shift in airlines' business model is making customers focus more on 'value' as against 'price' and which positively affects their satisfaction as well. Passengers engaging in shopping in-flight had 3% to 5% higher passenger experience scores than the overall average of 73%, according to Airline Passenger Experience Association's passenger insights study in 2014i (Exhibit 1). Success of this model is supported by the fact that ancillary revenues worldwide grew by more than 160%ii from 2010 to 2015.

What if airlines could create more opportunities with ancillary products/services to take customer satisfaction a notch up? What if airlines could offer a wider range of ancillary products/services to customers directly at the time of 'booking' tickets? This would not only aid customers' decision making and trip planning but turn away the spotlight from 'lowest fare'iii option while choosing an airline. Since limited ancillary products can be offered for purchase 'in-flight', offering ancillary products at the 'booking' stage increases chances of sales conversion. But for this to happen, airlines need to move away from offering 'same for all' ancillary products and start personalizing offers. However, in order to succeed in such an attempt, the very first step for airlines would be to understand customer behavior and segment them into various groups that can be then targeted for effective allocation of marketing spend.

Amadeus predicts that by 2020, revenue from ancillary products and services is expected to reach USD 130 billioniv . In 2015, 67 global players accounted for USD 40.5 billion in revenue from ancillary servicesv. Considering the same break-up of ancillary revenue between these 67 airlines and other airlines in the future, there lies a growth opportunity of ~USD 48 billion for these 67 airlines by 2020 (Exhibit 2).

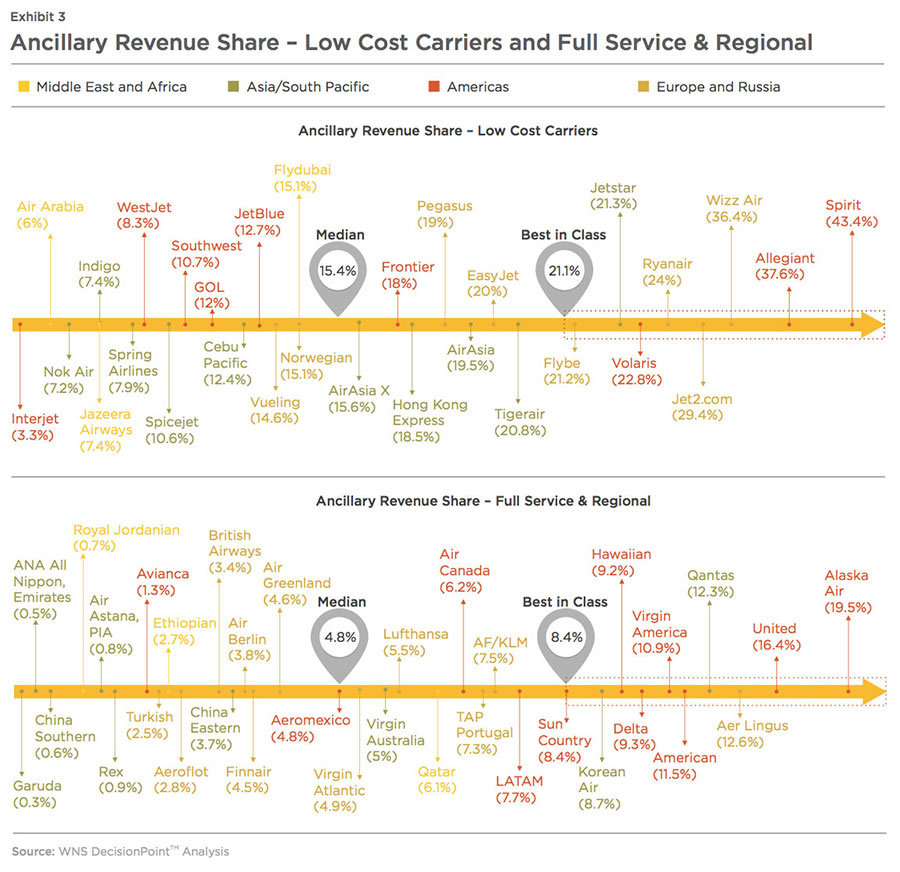

Ancillary revenue data for 2015 was divided into two segments, low cost carriers and full service & regional carriers; and analyzed to understand the industry trend. Exhibits 3 and 4 show the relative position of 67 airlines as far as ancillary revenue share is concerned.

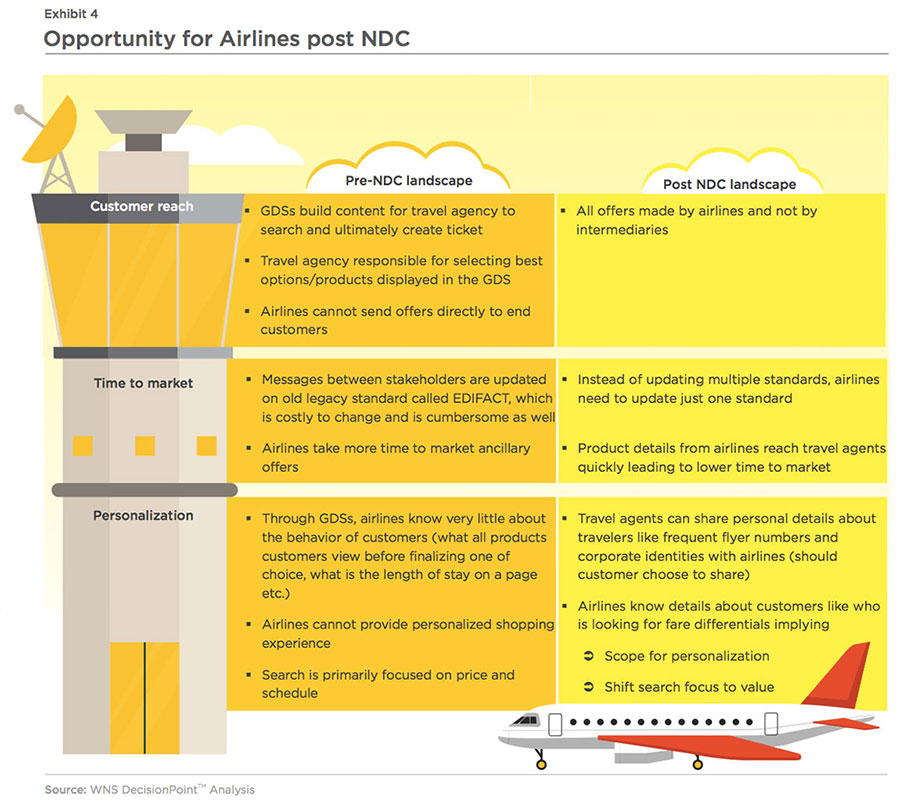

Airline tickets can be booked directly through airline websites or through travel agencies like Online Travel Agents (OTA) or Travel Management Companies (TMC). In the wake of a predicted decrease in booking volumes through travel agencies from 67% in 2016 to 55% by 2021vi, airlines need to maximize ancillary revenue through this channel. Airlines need to leverage the New Distribution Capability (NDC) program launched by International Air Transport Association (IATA). The new XML-based data transmission standard will enhance communication between airlines, travel agents and travelers, which will allow airlines to construct a comprehensive offer themselves, even through indirect channels (Exhibit 4). The program will provide opportunity to revolutionize end-to-end airline distribution functions, namely shopping, booking and servicing, payment and ticketing, airline profile, interlining and reporting, settlement and accounting.

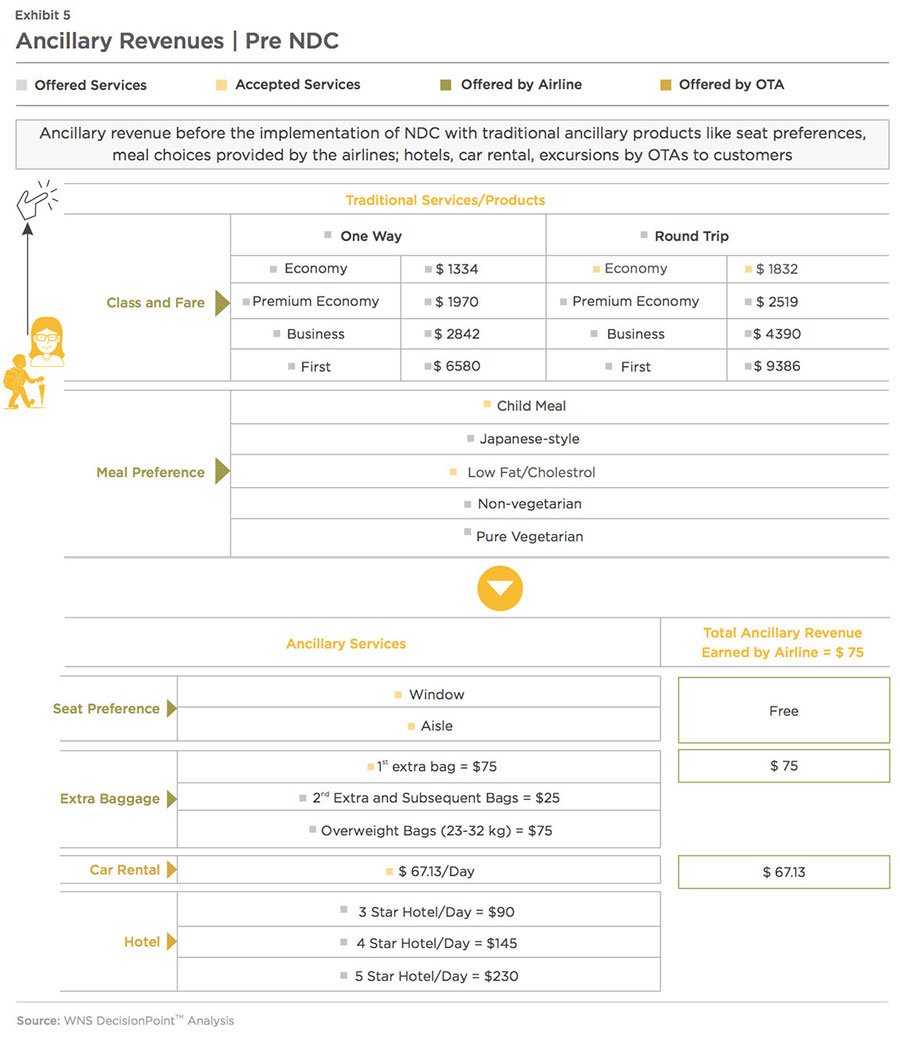

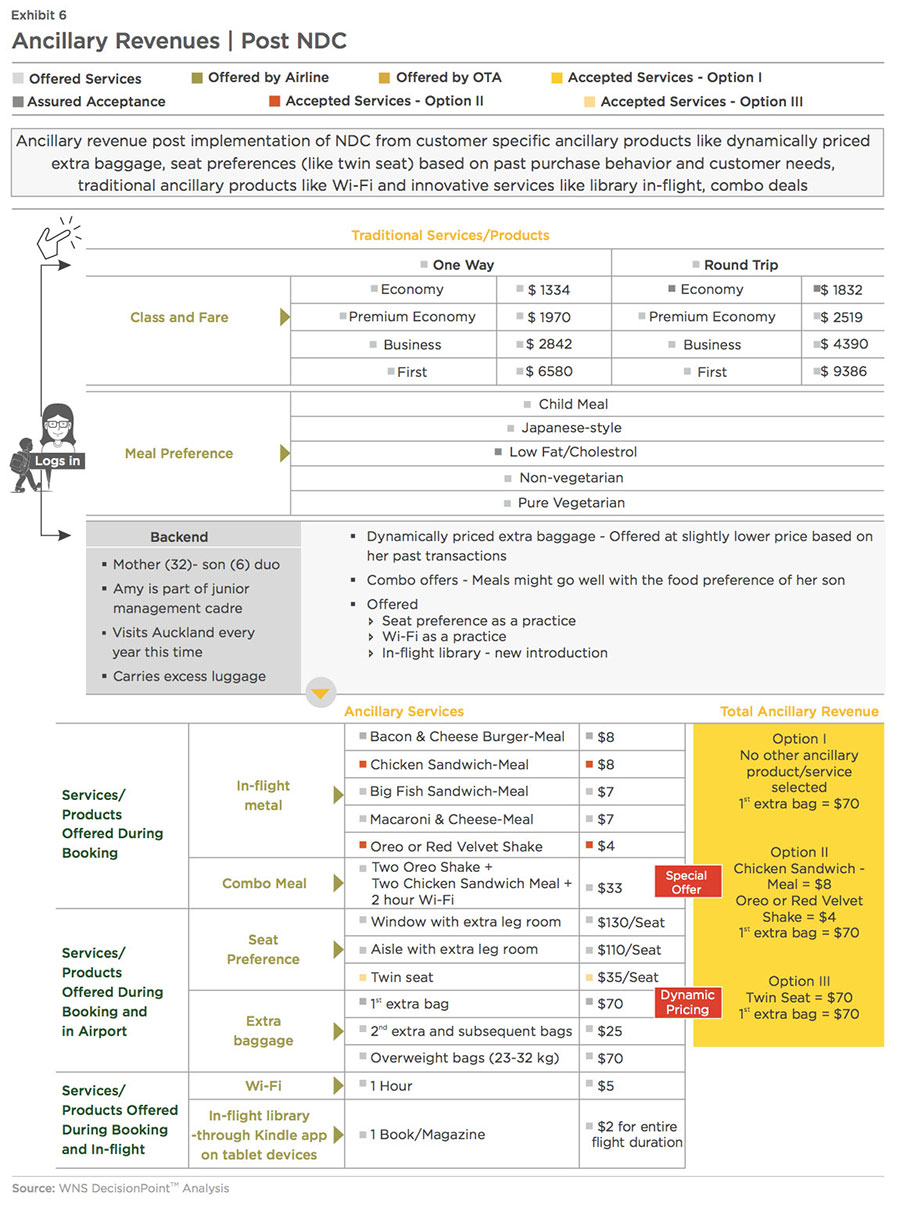

In a perfect world, with NDC, airlines would have data about their customers even when bookings are made through travel agents. This will provide airlines ample opportunities to personalize ancillary products. As an example, take Amy (32) and her son, Sam (6). Amy is at a supervisory level in a health insurance company, visits Auckland every year this time and carries excess luggage. They are flying from London to Auckland in June 2017. Pre NDC, airlines would have taken a cookie cutter approach and provided traditional ancillary products and services like seat preference and extra baggage to Amy when she books her tickets through an Online Travel Agent (OTA) (Exhibit 5). Taking a liberal estimate, the airline might have earned USD 95 from this duo through this channel.

Using information about Amy-Sam post NDC, airlines can simulate three scenarios (Exhibit 6) ranging from conservative (Option I) to aggressive (Option III) which could potentially affect their revenues from ancillary products and services by ~7% (Option I) to ~9% (option II) to ~40% (Option III). With the implementation of NDC, airlines can offer innovative ancillary products through OTAs depending upon the need of customers like providing an option to book a vegetarian meal by a star chef by paying a small premium, offering an in-flight library to rent or buy books from or providing the facility to shop online in-flight.

However, in case of partial onboarding of stakeholders in NDC, airlines will have exposure to limited customer data on bookings made through travel agents. Nevertheless, insights from customer data obtained from bookings made directly from airline websites and restricted data available from bookings made through travel agents, together, can help airlines ascertain customers' overall purchase and spend pattern of ancillary products/services. Airlines can accordingly push customized ancillary products/ services when a search is made through travel agents. For products searched directly on airline websites, enough and more data is available to identify customer purchase and spend trends and serve "identified" and "non- identified" customers distinctly with personalized offers.

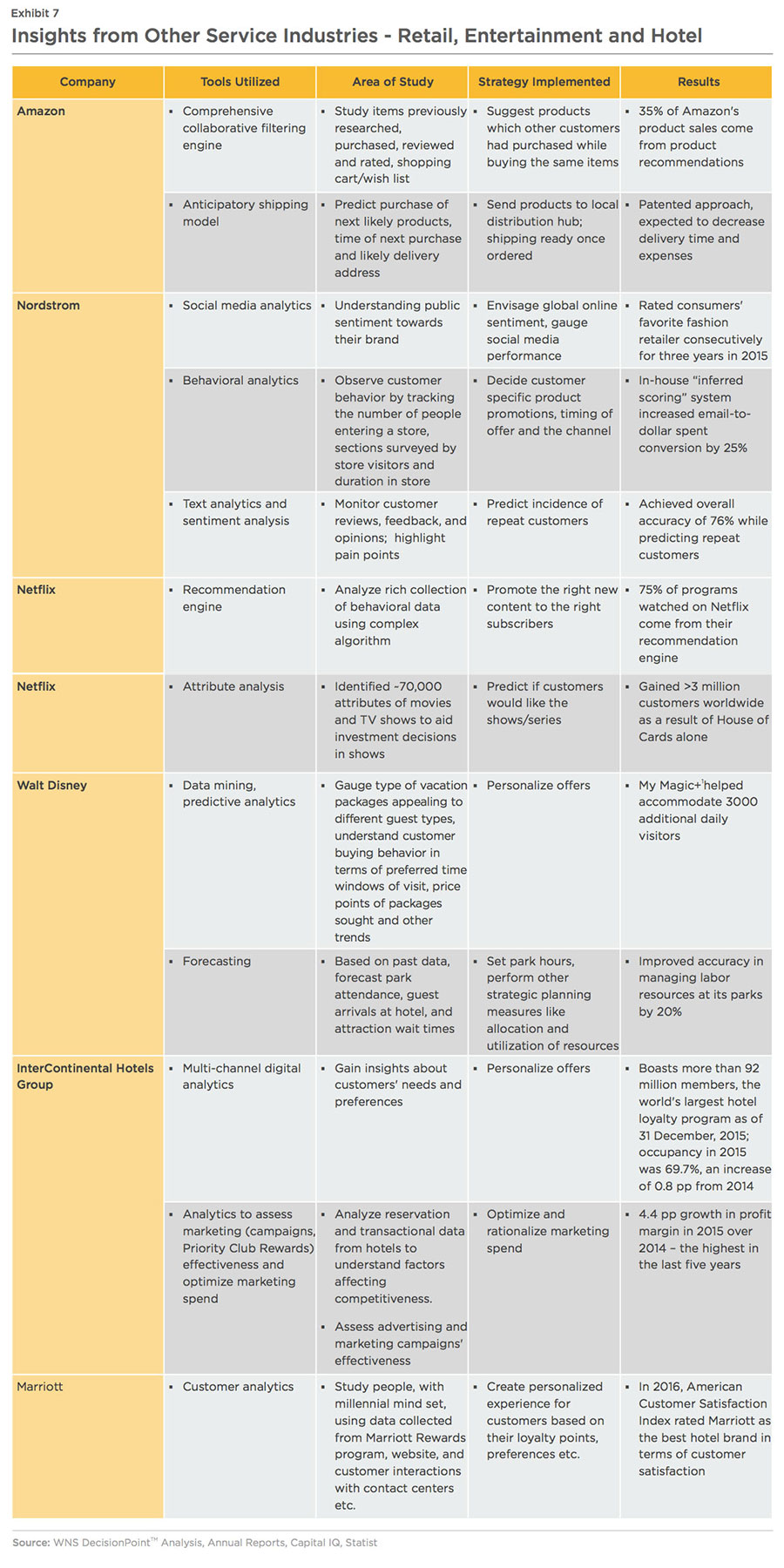

Insights From Other Service Industries

The hotel, retail and entertainment industries have broad similarity with the airline industry in more ways than one. Firstly, they all provide services directly to consumers. Secondly, with consumers' expectations related to the service industry growing, the presence of substitutes vying for attention and loyalty and technology companies catalyzing development, these sectors are under tremendous pressure to reinvent their service potential and surpass customer expectations or perish. Therefore, the ways and means adopted to reach, acquire, develop, retain, and inspire (known as the customer life cycle) customers by these industries will generally be similar and insights can be cross-leveraged, albeit with some industry specific modifications. Considering industry leaders in retail, entertainment, and hotel and capturing their ways of maintaining customer life cycle reiterates the importance of:

- Gauging customer behavior

- Understanding customer needs

- Leveraging analytics

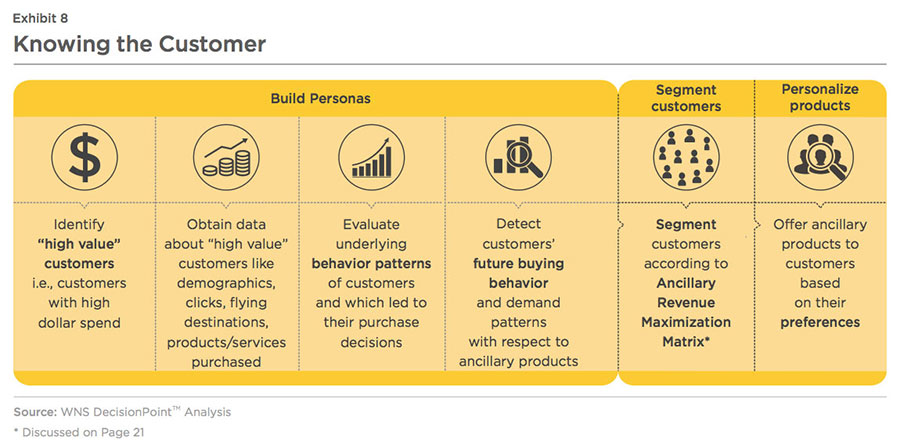

In the case of airlines, they can collect an initial, basic level of user data about customers booking through their websites. For example, which products and services did Martha, a new hypothetical flyer, consider while booking a return ticket from Chicago to Detroit and what did she end up purchasing? What was the price difference between products and services considered and bought, and were any offers leveraged in the process? Aided with information about flying destinations, frequency of travel, dollars spent on booking tickets and ancillary products, preferred hotels and car agencies, airlines should evaluate the underlying behavior and spend patterns of their high2 valued customers that lead to purchase decisions. Airlines can study Martha's propensity to leverage offers and tendency to shop in relation to the kind of travel she has undertaken. Once there is an understanding of current behavior and spend patterns, airlines should try to figure out travelers' likely future buying behavior and forecast demand for ancillary products and services. Equipped with future travel patterns of customer personas, airlines can create personalized, 'made-just-for-me' travel experiences (Exhibit 8).

This would also help airlines create and share offers with customers during their probable time of travel. For example, another traveler, Michael traveled economy class to places like Kauai, Sedona for the past two years. Without analyzing his travel, offering him a deal consisting of transfer by Porsche Cayenne while he is booking flights for his next visit is bound to be a failure. While he is booking flights for his next visit is bound to be a failure. Instead, looking at his spend patterns on flight tickets and ancillary services, flying destinations and time of travel, it can be inferred that he probably likes hiking travel tours in the U.S. but on a lower budget and might continue doing the same this year as well. Therefore, offering him a deal at a time when he usually plans his vacation with return air tickets to Yosemite National Park, a hatchback car transfer and a four-day stay in a budget hotel near the park would be more appealing to him. According to a report by Amadeusvii, it is more likely that every one in four travelers would respond to customized messages and one in five would respond to promotional offers pertaining to their location.

Determining Future Offerings For Customers

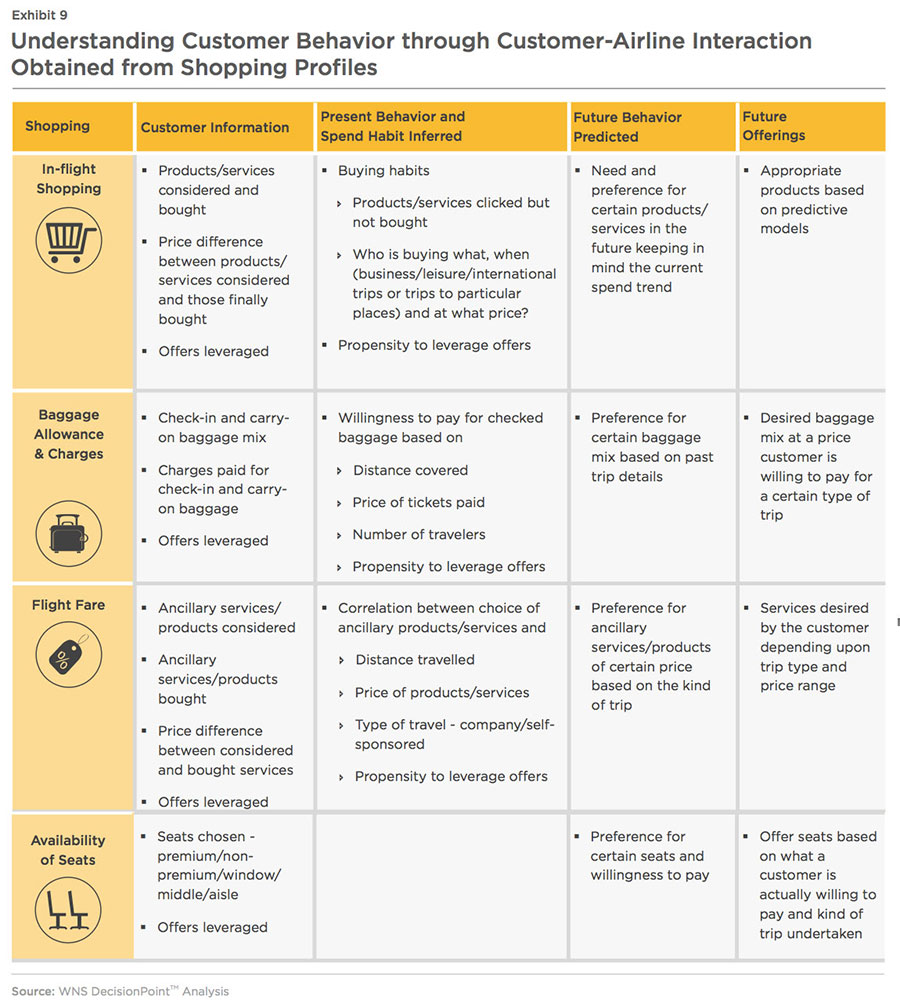

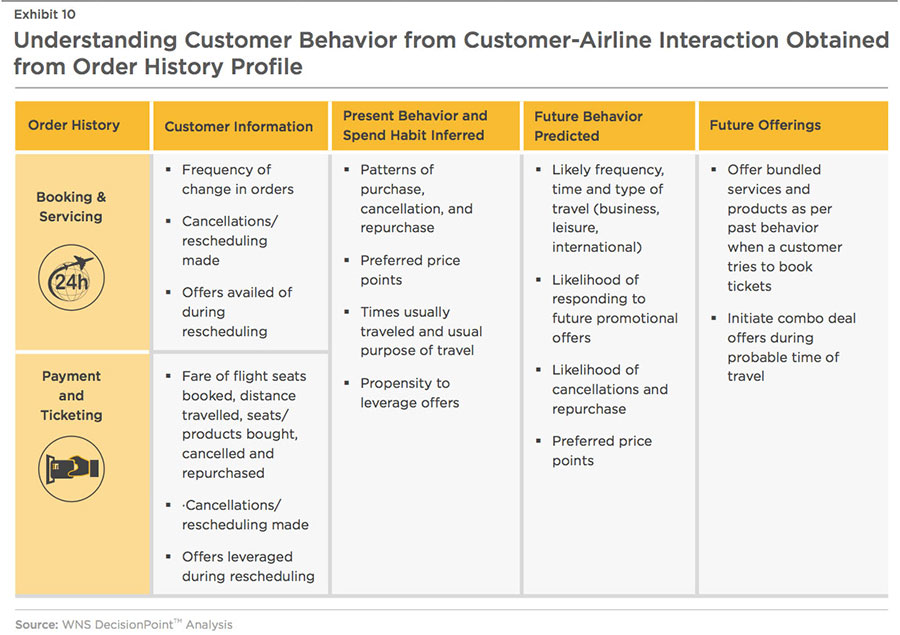

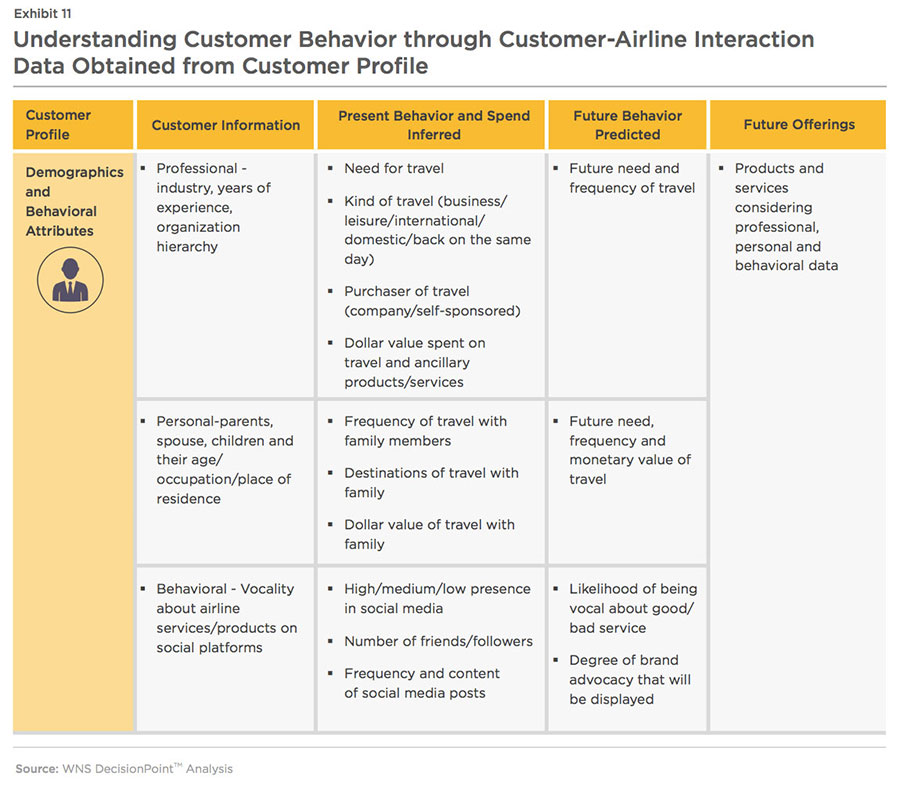

Airlines can extrapolate behavior and spend patterns of "high valued customers" from their interactions through airlines' website by looking at their shopping, order history and customer profiles as depicted in Exhibit 9, 10 and 11. Utilizing these data trends relating to customers' spend on ancillary products, airlines can:

- segment customers

- personalize offers to customers booking tickets through the airline's website

- mail personalized offers to customers closer to their probable time of travel

- Make custom offers based on "unidentified" customers' search requests through travel agents when they act as Offer Responsible Airline (ORA) or Participating Offer Airline (POA).

Prior to NDC, ORAs and POAs had admittance to basic details about actual bookings. With the adoption of NDC, airlines could invest in systems focusing not only on tracking bookings but studying search and buying behavior as well. To be in control of their sales process, airlines need to act like retailers and draw insights from the sales funnel and conversion ratio. The volume of overall search funnel is likely to be huge compared to booking volume since all ancillary products/flights options investigated are not bought. By emulating the approach of retailers, airlines could convert these leads into sales. WNS DecisionPoint™ presents Comprehend Your Customer Framework (CYC Framework) by which airlines can generate offers by linking data fields from their order history, shopping and customer profiles to create a single view of customer (Exhibit 12).

Based on present behavior and spend habit (obtained from 1 and 2), likely future behavior of customers can be predicted so that:

- Customers can be segmented on the basis of their future profitability

- Bundled products/services, based on their past and predicted behavior, can be offered when they try to book tickets

- Customized/personalized offers can be initiated during their probable time of travel

- Insights can be extrapolated and offers accordingly created for unidentifiable customers booking through travel agents

The algorithms airline use to frame offers (ancillary products/services it wishes to offer, and at what price), is based on the airline's commercial appetite and the availability of supporting data analytics infrastructure in terms of hardware, software, and data scientists.

Usage Of Analytics - Predicting Travelers' Future Buying Behavior

A number of airlines gather data internally but struggle to transform unstructured data like chat logs, call center transcripts, and social network feeds into insights. According to a report by the International Institute for Analytics viii in 2016, airlines were seventh in terms of analytics maturity behind the likes of Amazon, Google and Netflix, together called "Digital Native" (Exhibit 13).

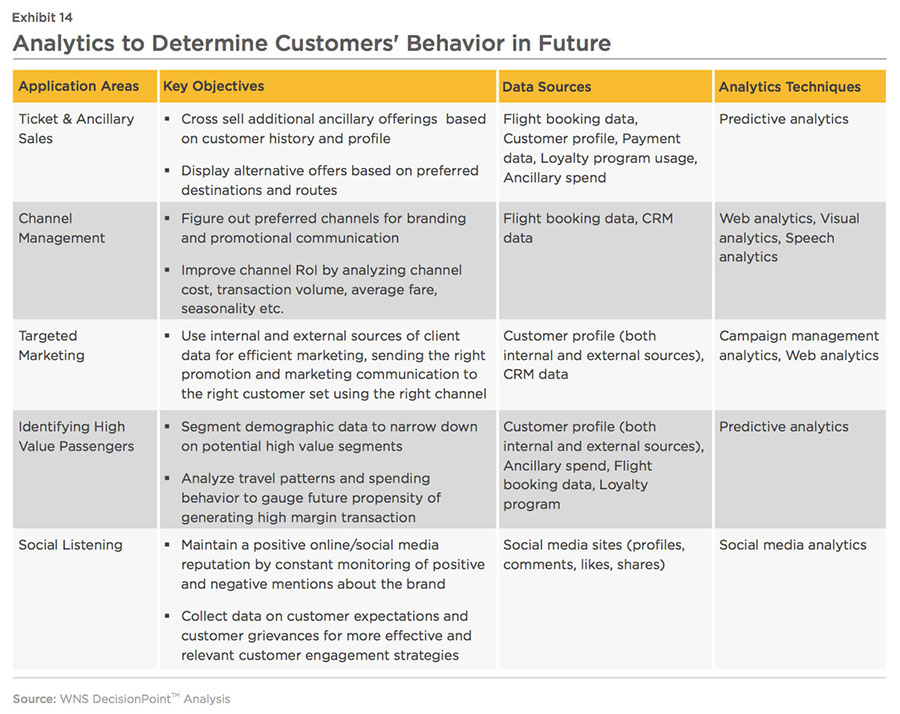

Albeit difficult, leveraging data sets like transactional data and customer feedback effectively is possible and can help airlines discover their customers' future behavior. To succeed in that endeavor, airlines should invest in sophisticated analytics, as depicted in Exhibit 14.

Speech analytics deployed on recorded calls will help identify, classify and arrange spoken words and phrases during calls into themes automatically and reveal upcoming trends, issues and opportunity areas. Consequently, airlines can quickly process terabytes of data, emanating from tens of thousands of calls, to determine areas of concern and plan corrective action. For example, Southwest Airlines leverages speech analytics on recorded communication between customers and customer care agents to extract information about customers' experiences and their needs.

To understand customers' current behavior even more accurately, airlines should try extracting customer perceptions and sentiments from social media commentary to gauge what customers like or dislike about the brand, services, and overall experience.

Social media analytics tools should be deployed to monitor an airline's reputation in real-time, seeing if users are posting positive or negative messages about their experiences. The approach would determine not only customers' sentiments but also seek insights around opinions, emotions, and behavior and evaluate the success of marketing campaigns. Grouping sentiments, opinions and behavior would provide an outlook about the overall brand sentiment. Over time, it would also give a sense of an airline's performance, the market and the competition and help the carrier build brand equity.

Social media platform is more than just a mere marketing, customer service or public relations tool. While many airlines have begun utilizing social media to improve customer engagement rates, the ones who succeed in the future will need to identify and offer what travelers' want and need without even prompting them. Predictive analytics and complex forecasting can enable airlines to actually know a customer's future behavior right down to an individual's need, preferences and buying habits. Plus, it will reduce airlines' overall operational and marketing costs to serve a customer by interpreting their needs accurately and offering products suited to their needs. If Martha agrees to share personal details and her social media profile, airlines can know that she is based out of Chicago, went to Tier II B-school, heads sales in Midwestern United States for a leading global beverage company and has a daughter about six to seven years old. To be responsible for heading sales in a particular region, Martha must have spent close of 15 to 20 years in the industry and is likely to be a part of the same industry in the future as well. So, the likelihood of her being a regular traveler would remain high. Analytics can help give Martha an experience perfectly suited to her needs, and in turn, help airlines be competitive, profitable, and preferred.

To estimate customers' future need for ancillary products/flight options, airlines need to act like retailers and monitor customers' movement on their websites. Since all options explored by customers are not bought, such offerings have the potential to be up-sold or cross-sold in future. By emulating the approach of retailers and leveraging visual analytics to track clicks, airlines could convert these "leads" into "sales". They should also use visitor recording to track the journey of a user through scroll, mouse movement, click and keypress on a website. Visual analytics is an excellent method to gauge options surveyed by a customer before deciding on a final product/service. Diagnostic analytics can be deployed to evaluate which promotions, campaigns and offers worked in the past and which did not. This form of analytics can also segment customers on the basis of spend and revenue generated.

Segmenting Travelers - Offering "Need Based" Ancillary Products/Services

Based on customers' likely future behavior - their propensity to spend on ancillary products/ services and the frequency of travel, airlines can segment customers into four distinct classes as depicted in Exhibit 15. Corresponding to each class or category, the airlines could offer ancillary products/services at the flight booking stage, at the airport or during the flight or after the flight, tailored to customers' needs. The products/services offered should also vary by flying class and involve personalization to suit a traveler's behavior and need.

Customers with a high potential future spend on ancillary products and services and a frequent travel schedule form the "most valued" segment. The idea is to retain these customers in this segment by continuously providing them with innovative products apart from regular ones like power banks, mobile, iPad chargers in flight.

The second rung consists of "valued" travelers with medium propensity to spend on ancillary products/services and frequent travel or high propensity to spend on ancillary products/services and infrequent travel. The former has a tendency to spend on need based products. By persistently providing different levels of "need based only" services/products to travelers in this segment, an airline will be able to help flyers gradually go up the hierarchical order of needs, making it more likely for the travelers to purchase a higher value need-based service/product in the future. For the latter, airlines should try to brand themselves as the preferred flying medium by offering fare discounts and various loyalty programs.

The third rung of customers, the "potentially valuable" segment, has travelers with medium propensity to spend on ancillary products and services and infrequent travel. The idea is to facilitate their evolution to the valued group by offering them need based discounted product bundles and slowly moving them up on their hierarchy of needs so that they purchase a higher need based product/service in the future or by offering them discounted fares and loyalty programs so that travel with the airline becomes a need.

Over and above the segment specific opportunities, airlines could provide an entirely new flying experience to customers by offering in-flight e-libraries with a well-thought assortment of books and an in-flight shopping experience by partnering with retail giants like Amazon or country specific online souvenir shops. This can be done by making available iPads/tablets in-flight loaded with entertainment packages free of charge, where passengers can have access to an e-library at a nominal charge and online retail stores.

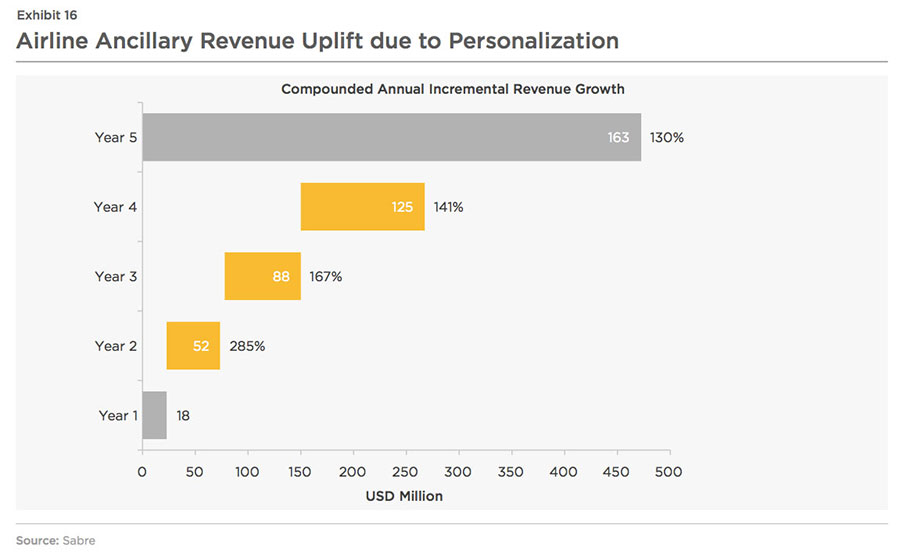

Airlines must outgrow their traditional role of being a transportation provider and personalize initiatives, like a retailer, to engage customers at various stages. According to Sabre, personalizing ancillary products/ services could increase incremental ancillary revenue by as much as 22%v. This could translate into a five-year revenue uplift of USD 163 million for a mid-size carrier(Exhibit 16).

Utilize The Insights Redesign Loyalty, Campaign And Promotions Programs

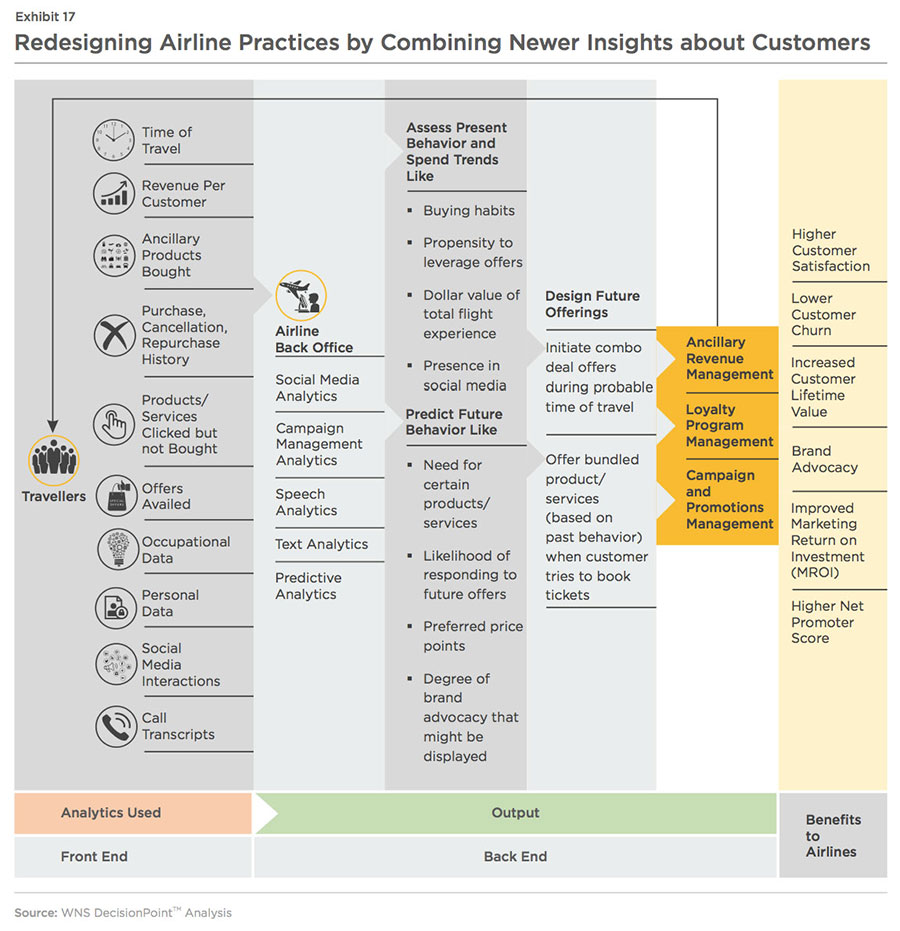

The vast customer data obtained can help not only capitalize on the airline ancillary revenue market opportunity but also be used to hone other practices within the marketing domain (Exhibit 17). First and foremost, airlines' loyalty programs can undergo a sea change from their current form of being complex and unrewarding for customers. Such a dichotomy exists because airlines follow a "one size fits all" approach which ends up defeating the purpose of loyalty programs.

The plethora of customer data airlines are exposed to, if mined thoroughly using an optimum combination of social media analytics, visual analytics and speech analytics, could provide valuable insights about customers' behavior and needs. Based on the insights from this data and calculations regarding the future profitability of customers, reward allocation should be done for different customer segments. With loyalty programs becoming actually rewarding and targeted towards specific customer sets, airlines will be successful in retaining their existing customers.

The Return on Investment (RoI) can be gauged by measuring the extent of repeat business and the rise in social advocacy by travelers.

Insights from customer data could also be used to design campaign and promotion strategies that create personalized experiences by taking into consideration the value drivers of each segment. Michael, for example, values hiking and is a price conscious traveler. Offering him deals conforming to his persona would have a higher chance of getting accepted as compared to a random promotional offer. The RoI of campaigns and promotions can be gauged by campaign management analytics which would read and analyze customers' responses and count sales linked to marketing campaigns. This would also establish data-validated best practices which would act as the input for future campaign design.

The Way Forward

WNS DecisionPoint™ identified ancillary revenue growth opportunities for 63 airlines across Europe and Russia, The Americas, Middle East and Africa, and Asia/ South Pacific. Ancillary revenue figures from 2014 exhibit underutilization of airlines' ability to maximize ancillary revenues.

To help airlines promote and sell ancillary products and services by addressing shortcomings of the industry's present distribution system, International Air Transport Association (IATA) has introduced New Distribution Capability (NDC) program . This will enable airlines to showcase their ancillary options and services better, thereby empowering travelers to be able to shop and compare the value of these propositions across airlines.

However, with airlines ranking lowviii in terms of analytics maturity, the road ahead seems arduous. First, there needs to be a marked shift in the way airlines derive and handle insights from data. To maximize USD 130 billion (by 2020) ancillary product/service market, airlines need to monitor and draw insights from their sales funnel and conversion ratio. Secondly, to showcase the right ancillary services to the right set of travelers at the right time, airlines have to be armed with personalized ancillary products.

WNS DecisionPoint™ recommends development of a detailed roadmap to recognize different behavior and spend extrapolations of customers from varied customer footprints leading to refined views about customers - the CYC Framework; precise ways of segmenting customers - the Ancillary Revenue Maximization Matrix and the selection of analytics to determine customers' future behavior.

Above all, these rich customer insights can also help airlines design well-rounded loyalty program strategies and targeted promotional campaigns thus taking customer centricity to a wholly different level.

References:

i. Airline Passenger Experience Association - APEX Survey Insights: Passenger Satisfaction In-flight, 2014

ii. Idea Works Company, Car Trawler - New CarTrawler Ancillary Revenue Yearbook Catalogs USD 40.5 Billion in Revenue Boosts for 67 Airlines, 2016

iii. IATA, 2015 - Annual Review 2015

iv. Amadeus - The Evolution of Airline Merchandising

v. Sabre - The Evolution of Customer Data

vi. Atmosphere Research Group - The Future of Airline Distribution, 2016 - 2021. Special Report Commissioned by IATA, 2016

vii. Amadeus - Thinking like a Retailer: Using Personalization to Drive Sales for Airlines, 2015

viii. International Institute for Analytics - Ranking Analytics Maturity by Industry, 2016